View News

April-2025-Income-Tax-Updates-Detailed-Analysis-of-CBDT-Notifications-and-Circulars

April 2025 Income Tax Updates: Detailed Analysis of CBDT Notifications and Circulars

The Central Board of Direct Taxes (CBDT) issued a host of important updates in April 2025 that impact individuals, institutions, and corporate taxpayers. From PAN-Aadhaar compliance mandates to simplified return filing and changes in TCS on luxury items, the month was packed with regulatory activity aimed at increasing transparency and easing procedural bottlenecks.

Here’s a structured and detailed breakdown of the key tax updates issued through official notifications in April 2025.

1. PAN–Aadhaar Linking Becomes Mandatory

Notifications: 25/2025 & 26/2025

Date Issued: April 3, 2025

Relevant Provision: Section 139AA

Summary:

Individuals who received their PAN using only an Aadhaar Enrolment ID before October 1, 2024, must link their Aadhaar number to the PAN database by December 31, 2025, or any later date notified by the CBDT. Non-compliance could render the PAN inoperative.

Compliance:

The linking must be reported through systems authorized by the Principal Director General of Income-tax (Systems).

2. TDS Exemption for NSS Account Withdrawals

Notification: 27/2025

Date Issued: April 4, 2025

Relevant Provisions: Sections 80CCA & 194EE

Withdrawals made from accounts under the National Savings Scheme (NSS) will not attract TDS, giving a financial breather to small depositors and pensioners. This is a step toward making long-term savings more accessible.

3. Introduction of ITR-B for Search and Seizure Cases

Notification: 30/2025

Date Issued: April 7, 2025

Relevant Provision: Section 158BC(a)

CBDT rolled out a new income tax return form, ITR-B, specifically for entities subject to search and seizure actions under Sections 132 or 132A after September 1, 2024.

Key Features:

-

Covers income for the entire block period.

-

Requires digital signatures for certain categories like companies and political parties.

-

Supports provisional income declarations for ongoing assessment years.

4. Tax Exemptions for Select Public Institutions

Notifications: 28, 29, 37 & 39/2025

Date Range: April 7–24, 2025

Relevant Provision: Section 10(46A)

The following government-related institutions have been granted income tax exemptions:

-

Greater Mohali Area Development Authority

-

Prayagraj Mela Pradhikaran

-

National Mission for Clean Ganga

-

Mysore Palace Board

Nature of Exemption:

Income arising from grants, rental income, user charges, or bank interest will be exempt, subject to specified conditions and reporting standards.

5. Recognition of KIMS Research Foundation

Notification: 33/2025

Date Issued: April 17, 2025

Relevant Provision: Section 35(1)(ii)

The KIMS Foundation and Research Centre (Hyderabad) has been notified as a recognized scientific research institution. Donations made to this institution are now eligible for weighted tax deductions from AY 2026–27 through AY 2030–31.

6. Capital Gains Exemption via HUDCO Bonds

A. Five-Year Redeemable Bonds

Notification: 31/2025

Date: April 7, 2025

Section: 54EC

Investments made in HUDCO bonds (issued after April 1, 2025) within six months of a capital asset transfer can qualify for exemption from capital gains tax under Section 54EC.

B. Zero Coupon Bonds

Notification: 34/2025

Date: April 17, 2025

Section: 2(48)

HUDCO’s Ten-Year Zero Coupon Bonds (total issue: ?5,000 crore) are officially classified as zero coupon bonds, with maturity after 10 years and 1 month. These are targeted at infrastructure development without state subsidies.

7. TCS on High-Value Luxury Goods

Notifications: 35 & 36/2025

Date Issued: April 22, 2025

Relevant Provision: Section 206C

The CBDT has widened the net of Tax Collection at Source (TCS) by mandating 1% TCS on luxury and high-end goods where the transaction value exceeds ?10 lakh.

Covered Goods Include:

-

Premium wristwatches, handbags, sunglasses

-

Yachts, helicopters, racing horses

-

Artworks, collectibles (e.g., coins, stamps)

-

Sports equipment (e.g., golf kits, skiing gear), home theatres

TCS must be reported through Form 27EQ.

8. Deadline for Vivad se Vishwas Scheme

Notification: 32/2025

Date Issued: April 8, 2025

Relevant Provision: Section 90

The final date to file under the Direct Tax Vivad se Vishwas Scheme, 2024, has been set as April 30, 2025. The scheme aims to resolve pending tax disputes by offering reduced penalties and interest.

9. Expenditure on Legal Violations Disallowed

Notification: 38/2025

Date Issued: April 23, 2025

Relevant Provision: Section 37

CBDT has disallowed deductions for expenses incurred to pay fines, penalties, or settlements under the following acts:

-

SEBI Act, 1992

-

Securities Contracts (Regulation) Act, 1956

-

Depositories Act, 1996

-

Competition Act, 2002

This applies from the date of notification and emphasizes non-deductibility of non-compliant expenses.

10. Simplification of Return Filing Rules

Notification: 40/2025

Date Issued: April 29, 2025

Relevant Provisions: Sections 112A, 44AD, 44ADA, 44AE

Major Changes:

-

Assessees with only LTCG under Section 112A up to ?1.25 lakh, and no losses to carry forward, can now file ITR-1 (Sahaj).

-

Rule 12 updated to allow such taxpayers with presumptive income under Sections 44AD, 44ADA, and 44AE to file ITR-4 (Sugam).

-

Rule 11B now mandates Form 10BA for rent-based deduction claims.

-

A new version of ITR-1 has been notified under Appendix II.

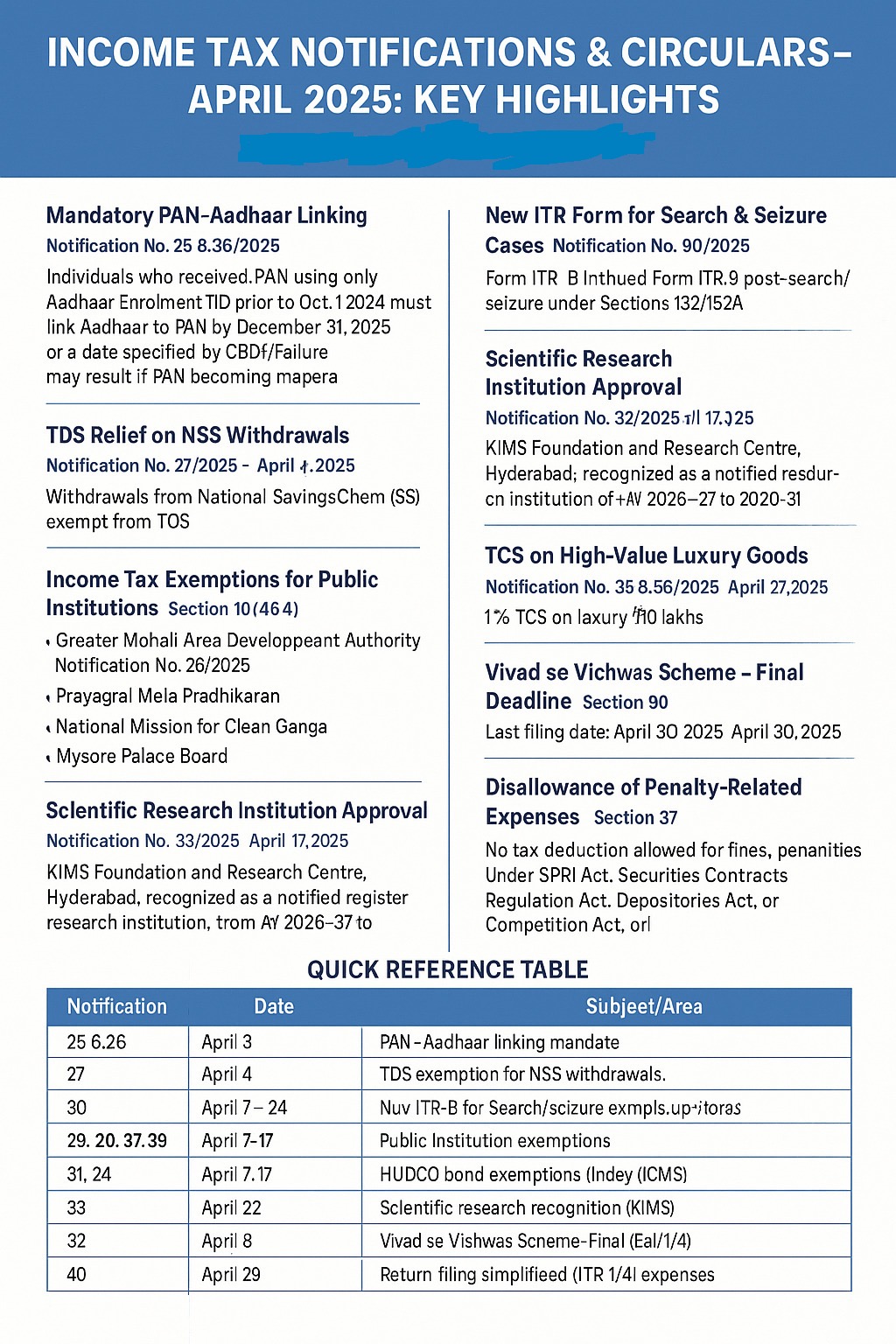

Quick Summary Table

| Notification | Date | Subject/Area | Relevant Sections |

|---|---|---|---|

| 25, 26 | Apr 3 | PAN–Aadhaar linking mandate | 139AA |

| 27 | Apr 4 | TDS exemption for NSS withdrawals | 80CCA, 194EE |

| 30 | Apr 7 | New ITR-B for search/seizure cases | 158BC(a) |

| 28, 29, 37, 39 | Apr 7–24 | Tax exemption to public authorities | 10(46A) |

| 31, 34 | Apr 7, 17 | HUDCO bond exemptions | 54EC, 2(48) |

| 33 | Apr 17 | Scientific research recognition (KIMS) | 35(1)(ii) |

| 32 | Apr 8 | Vivad se Vishwas final date | 90 |

| 35, 36 | Apr 22 | TCS on luxury goods over ?10 lakh | 206C |

| 38 | Apr 23 | Disallowance of penalty-related expenses | 37 |

| 40 | Apr 29 | Return filing simplified (ITR-1/4) | 112A, 44AD, 44ADA, etc. |

Final Thoughts

The income tax circulars and notifications of April 2025 reflect CBDT's continued focus on:

-

Promoting digital compliance,

-

Supporting scientific innovation and public welfare institutions,

-

Enhancing revenue from luxury segments, and

-

Making tax compliance more accessible for small taxpayers.

Taxpayers, advisors, and organizations are advised to review their compliance procedures in light of these updates and make necessary adjustments before filing returns or making investment decisions.

Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc.