View News

Demystifying-the-Record-Breaking-APA-Surge-by-CBDT-A-Milestone-in-India-Transfer-Pricing-Landscape

Demystifying the Record-Breaking APA Surge by CBDT: A Milestone in India’s Transfer Pricing Landscape

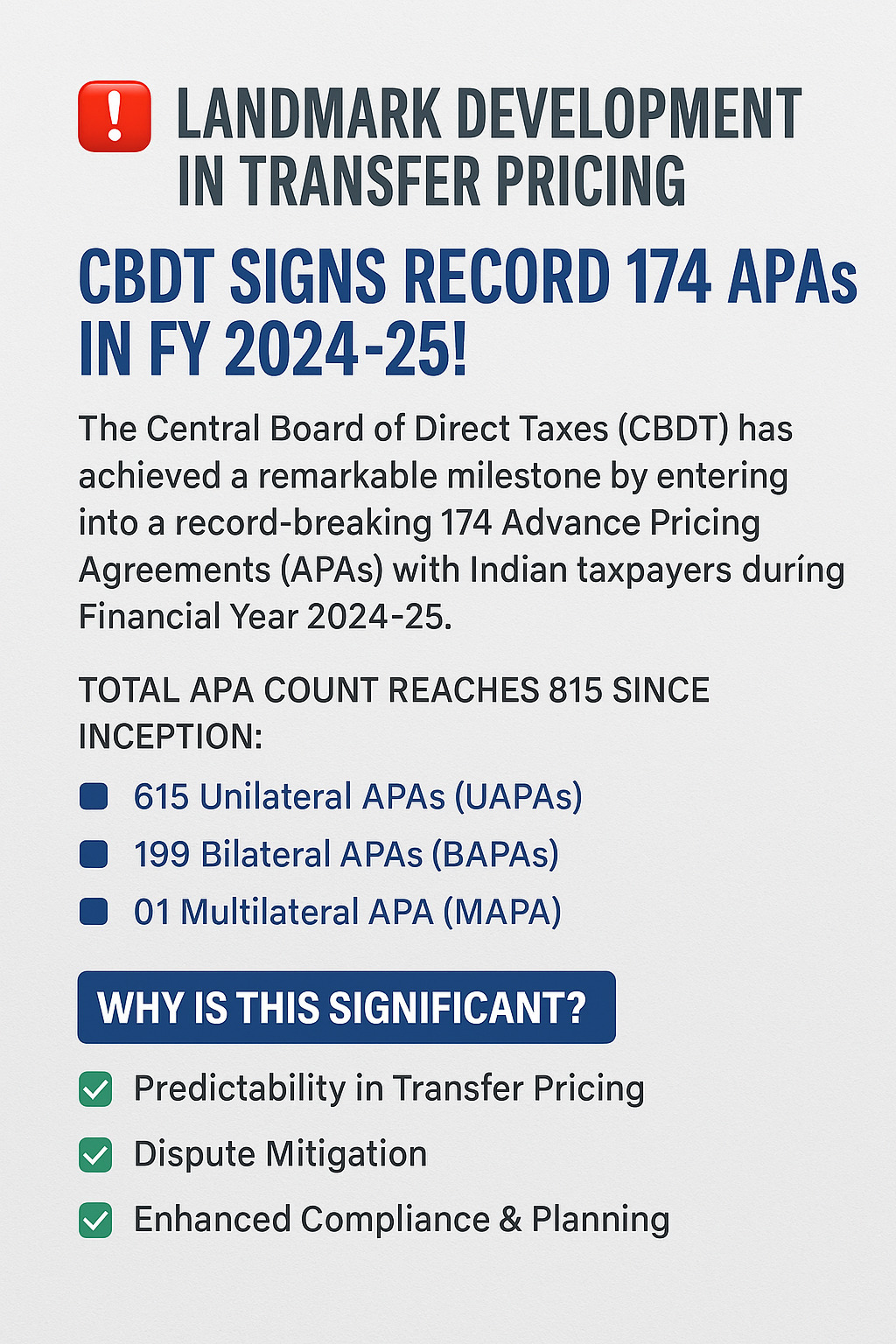

In a monumental move for India’s international tax regime, the Central Board of Direct Taxes (CBDT) has successfully entered into 174 Advance Pricing Agreements (APAs) with Indian taxpayers during FY 2024-25, marking the highest number of agreements inked in a single financial year since the inception of the APA programme.

This landmark achievement pushes the cumulative tally of APAs signed by the CBDT to a robust 815 agreements, comprising:

-

615 Unilateral APAs (UAPAs)

-

199 Bilateral APAs (BAPAs)

-

01 Multilateral APA (MAPA)

This surge not only underscores the Government’s commitment to creating a predictable and transparent tax environment but also reaffirms India's position as a preferred destination for multinational businesses navigating complex cross-border transactions.

What Are Advance Pricing Agreements (APAs)?

Advance Pricing Agreements are arrangements between a taxpayer and the tax authority (CBDT, in India’s case) that predetermine the transfer pricing methodology (TPM) for specified international transactions for a certain period.

These agreements aim to mitigate prolonged litigation and provide certainty by setting agreed-upon pricing norms in advance for intercompany transactions.

There are three types of APAs:

-

Unilateral APA (UAPA) – between the taxpayer and Indian tax authority

-

Bilateral APA (BAPA) – involving the Indian tax authority and its counterpart in another country

-

Multilateral APA (MAPA) – involving tax authorities of multiple jurisdictions

Historical Context & Growth Trajectory

The APA programme was introduced in India in 2012 as part of a broader initiative under the Finance Act, 2012, to reduce transfer pricing litigation, which was one of the most litigious areas in Indian taxation.

Here’s a snapshot of its progressive growth:

| Financial Year | Number of APAs Signed |

|---|---|

| FY 2013-14 | 5 |

| FY 2016-17 | 88 |

| FY 2020-21 | 62 |

| FY 2024-25 | 174 (record high) |

The exponential growth observed in FY 2024-25 is indicative of the maturity of the program and the Government’s resolve to expand the scope of certainty and tax governance.

Importance in the Global Business Environment

As India continues to integrate with global supply chains and hosts a growing number of multinational enterprises (MNEs), having a robust APA mechanism is essential. Here’s why:

Reduces Transfer Pricing Disputes

India has witnessed years of high-pitched transfer pricing litigation, with adjustments running into thousands of crores. APAs reduce this risk and promote mutual trust between businesses and the administration.

Ensures Long-Term Tax Certainty

By locking in the methodology for a period of 5 years (extendable up to 9 years with rollback provisions), APAs help MNEs in planning long-term investment strategies with clarity.

Boosts Investor Confidence

Clear pricing and dispute-free assessment cycles create a stable business environment, attracting foreign direct investment (FDI) and enhancing India’s Ease of Doing Business ranking.

Supports BEPS Compliance

Bilateral and multilateral APAs foster international tax cooperation and reflect alignment with the OECD’s Base Erosion and Profit Shifting (BEPS) Action Plans, particularly Action 14 (Dispute Resolution) and Action 13 (Transfer Pricing Documentation).

The Role of CBDT & Indian APA Teams

The APA programme in India is administered by a dedicated APA team within the CBDT, consisting of specialized officers from both income tax and legal backgrounds. The team is entrusted with:

-

Evaluating APA applications

-

Conducting detailed functional and economic analyses

-

Engaging in competent authority negotiations in case of BAPAs

-

Drafting agreements and ensuring periodic compliance

Their structured approach and transparent functioning have been instrumental in boosting stakeholder confidence and expediting APA closures.

Key Industries & Sectors Benefiting from APAs

The APA framework has found considerable traction across diverse sectors, including:

-

Pharmaceuticals & Life Sciences

-

Automotive & Engineering

-

IT & IT-Enabled Services (ITES)

-

Logistics & Supply Chain

-

Research & Development Units

-

Retail & Consumer Goods

With India's increasing push toward Make in India, Digital India, and global R&D hubs, the APA model acts as a stabilizing instrument for tax compliance and international collaboration.

The Road Ahead

While the FY 2024-25 performance is commendable, further improvements can be expected with:

-

Faster closure timelines for APA applications

-

Expansion of APA eligibility to more transactions

-

Stronger integration with Mutual Agreement Procedure (MAP) processes

-

More multilateral APAs, given India’s global tax treaty network

Continued focus on capacity building, technological enablement, and bilateral negotiation capabilities will be key to sustaining momentum.

Conclusion

The record number of APAs signed in FY 2024-25 is not just a statistical feat — it is a strategic leap toward enhancing tax certainty, reducing litigation, and making India a preferred destination for compliant and forward-looking multinational enterprises.

This development should be welcomed by both industry stakeholders and international tax professionals as a signal of India's growing maturity and responsiveness in complex cross-border tax matters.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc.