View News

Income-from-Compulsory-Land-Acquisition-Taxed-as-Capital-Gains

Income from Compulsory Land Acquisition: Taxed as Capital Gains

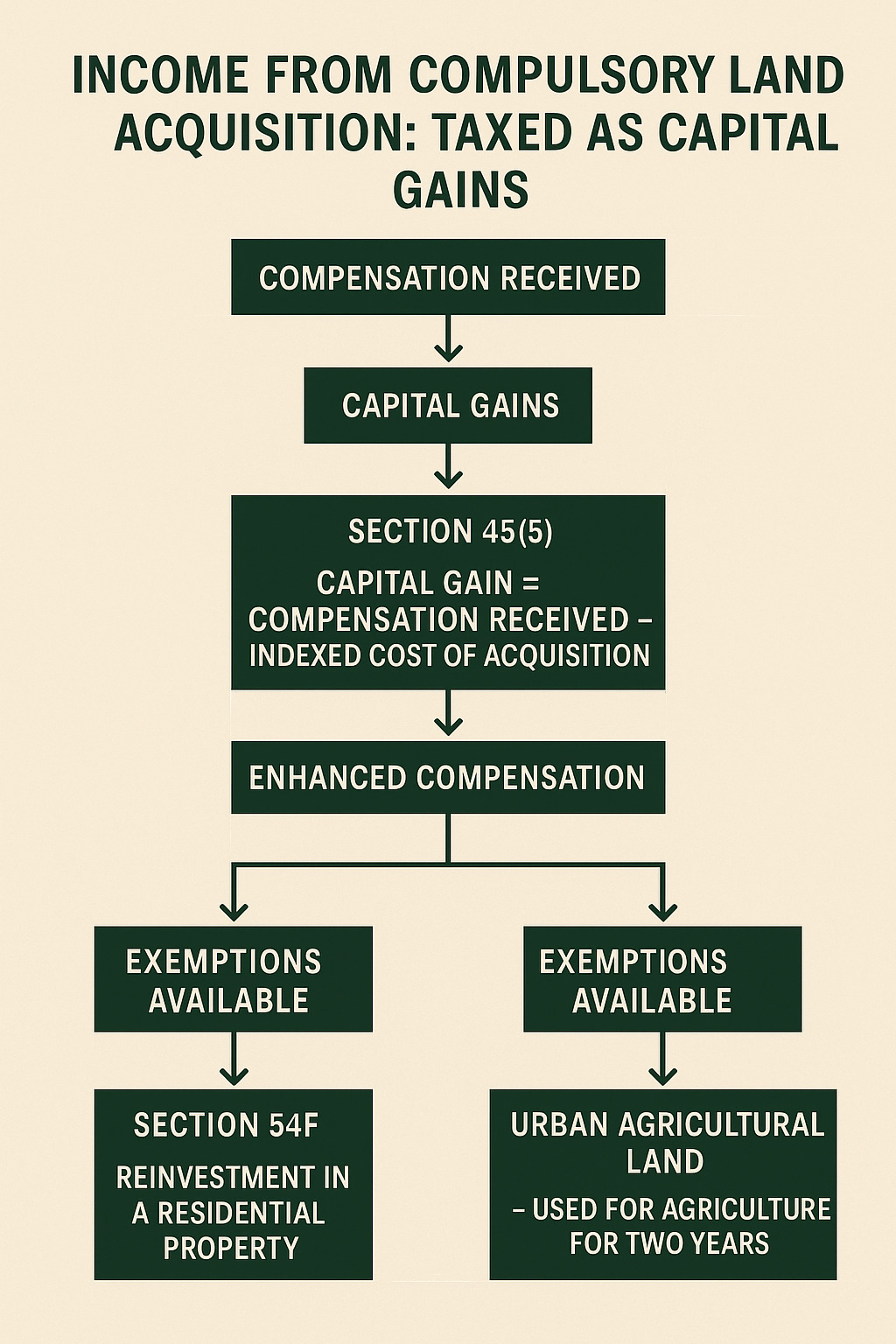

When the government acquires private land for public purposes, such as infrastructure or development projects, it often does so through a process known as compulsory acquisition. The compensation paid to landowners in such cases may appear to be a form of reimbursement or damage recovery. However, under Indian tax law, such compensation is treated as taxable income—specifically under the head "Capital Gains." This classification is based on the principle embedded in the Income Tax Act, 1961, which recognizes that even involuntary transfers of capital assets result in a taxable event.

Legal Framework: Section 45(5) of the Income Tax Act

The cornerstone provision for taxing compensation from compulsory acquisition is Section 45(5) of the Income Tax Act, 1961. Originally, capital gains taxation applied only to voluntary transfers of capital assets. However, to address the gap in cases of involuntary transfers, Section 45(5) was introduced. It stipulates that any compensation—initial, enhanced, or additional—received as a result of compulsory acquisition is taxable as capital gains in the year of receipt, not in the year of the transfer or acquisition.

Example: If a landowner’s property was compulsorily acquired in 2018, but the court awarded enhanced compensation in 2024 after litigation, that additional compensation is taxed as capital gains in FY 2024-25, not in FY 2018-19.

Definition of Capital Asset

For the compensation to be taxable, the acquired property must qualify as a capital asset under Section 2(14) of the Income Tax Act. A capital asset includes property of any kind held by a person, whether connected to business or not. However, the law excludes certain categories such as stock-in-trade, personal effects, and rural agricultural land. Thus, urban land, residential buildings, and commercial plots fall under the definition of capital assets, and their forced acquisition gives rise to capital gains liability.

Example: If Mr. Rao owns a plot in urban Bangalore and the government acquires it for a metro project, the compensation he receives is taxable under capital gains. If the same land were classified as rural agricultural land used for farming, it might be exempt.

Computation and Taxation

For taxation purposes, the capital gain is calculated as:

Capital Gain = Compensation Received – Indexed Cost of Acquisition

If the property was held for more than 24 months, it qualifies as a long-term capital asset and is eligible for indexation benefits—which adjust the cost of acquisition for inflation. The resulting long-term capital gains (LTCG) are taxed at a flat rate of 20%.

In cases of enhanced compensation, only the additional amount received is taxed in the year of receipt, and no separate cost of acquisition is allowed for the enhanced portion.

Example: Suppose Mrs. Sharma bought a plot in 2001 for Rs. 2 lakhs, and it was compulsorily acquired in 2023 for Rs. 50 lakhs. After indexation, the cost becomes Rs. 6 lakhs. The capital gain is Rs. 44 lakhs, taxed at 20%. If she receives another Rs. 10 lakhs in 2025 as enhanced compensation, that amount is again taxed as LTCG in 2025, without further indexation or acquisition cost deduction.

Available Exemptions

The Income Tax Act provides certain exemptions to reduce the tax burden in specific scenarios:

-

Section 54F: If the capital gains are reinvested in constructing or purchasing a residential property within the stipulated time frame (one year before or two years after transfer, or three years for construction), the gains may be exempt.

-

Section 10(37): Exempts compensation received by individuals or HUFs from the compulsory acquisition of urban agricultural land, provided:

-

The land was used for agricultural purposes for at least two years prior to acquisition, and

-

The acquisition was under a law such as the Land Acquisition Act.

-

These exemptions aim to provide relief, particularly to small farmers and individual landowners.

Example: A farmer whose agricultural land on the outskirts of Pune is compulsorily acquired for a highway, and who meets the above criteria, would not have to pay capital gains tax on the compensation.

Judicial Precedents

Indian courts have consistently supported the view that compensation from compulsory acquisition constitutes taxable capital gains:

-

In CIT v. Ghanshyam (HUF) [2009] 315 ITR 1 (SC), the Supreme Court ruled that compensation, including enhanced amounts, is taxable as capital gains in the year it is received, even if litigation is pending.

-

The Privy Council in Raja Mohammad Amir Ahmad Khan v. CIT (1932) 6 ITR 619 held that compulsory acquisition constitutes a "transfer" for tax purposes, thus giving rise to capital gains liability.

These judgments affirm that the involuntary nature of a transfer does not exempt the recipient from taxation under capital gains.

Conclusion

While compulsory acquisition may feel like a forced loss, the compensation received is treated as taxable capital gainsunder the Indian tax regime. This treatment ensures uniform taxation of gains from asset transfers, regardless of whether they are voluntary or forced. Taxpayers should maintain meticulous records, understand applicable exemptions, and consult professionals to ensure compliance and optimal tax planning when faced with such scenarios.