View News

Industry-Standards-for-Review-and-Approval-of-Related-Party-Transactions-by-Audit-Committee-and-Shareholders

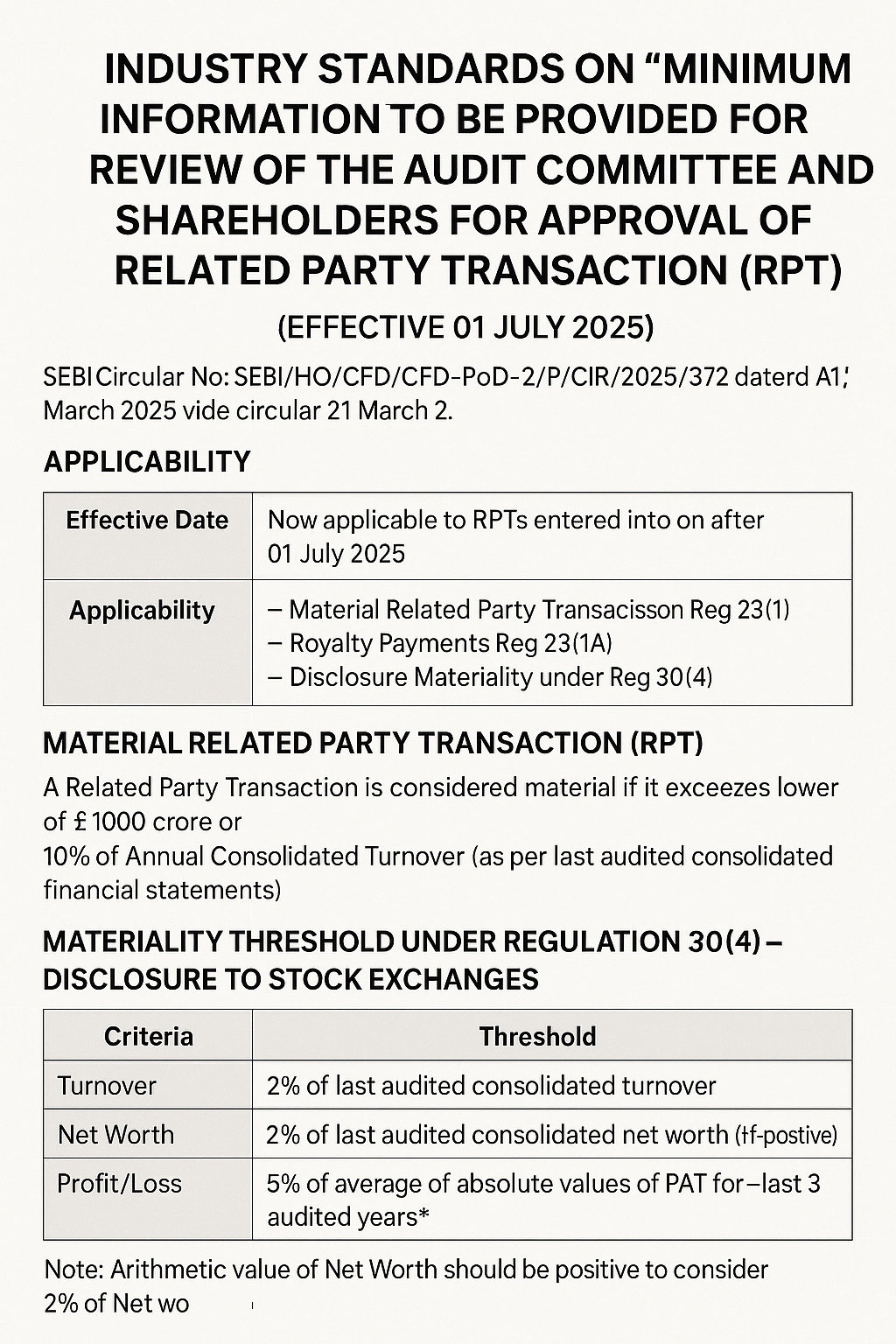

Industry Standards for Review and Approval of Related Party Transactions (RPTs) by Audit Committee and Shareholders (Effective 01 July 2025)

1. Introduction

To enhance transparency and governance, SEBI mandated minimum information requirements for the review of Related Party Transactions (RPTs) by the Audit Committee and shareholders. These requirements, originally applicable from 01 April 2025, have now been deferred to 01 July 2025 via SEBI Circular No. SEBI/HO/CFD/CFD-PoD-2/P/CIR/2025/372 dated March 21, 2025.

2. Applicability of Industry Standards

| Parameter | Description |

|---|---|

| Effective Date | Now applicable to RPTs entered into on or after 01 July 2025 |

| Applicability | Listed Entities entering into Material Related Party Transactions under: - Regulation 23(1) of SEBI (LODR), 2015 - Regulation 23(1A) (for Royalty Payments) - Regulation 30(4) (for Disclosure Materiality) |

3. Definition of Material Related Party Transaction (RPT)

Under Regulation 23(1):

A Related Party Transaction is considered material if it exceeds the lower of:

-

?1000 crore, or

-

10% of the Annual Consolidated Turnover (as per last audited consolidated financial statements).

For Royalty Payments [Reg 23(1A)]:

A transaction involving royalty is material if it exceeds:

-

5% of the Annual Consolidated Turnover (as per last audited consolidated financial statements).

4. Materiality Threshold under Regulation 30(4) – Disclosure to Stock Exchanges

When assessing whether a transaction qualifies for disclosure under Regulation 30(4), compare the value of the transaction with the lower of the following three thresholds:

| Criteria | Threshold |

|---|---|

| Turnover | 2% of the last audited consolidated turnover |

| Net Worth | 2% of the last audited consolidated net worth (if positive) |

| Profit/Loss | 5% of the average of absolute values of PAT for the last 3 audited years |

Note: Arithmetic value of Net Worth should be positive to consider 2% of Net Worth.

5. Classification of Transactions – Balance Sheet & P&L Based

A. Balance Sheet Items

| Nature of Transaction | Examples |

|---|---|

| Loans, Inter-corporate deposits, Advances | Granted to or received from Related Parties |

| Investments | Equity, Debentures, Mutual Funds, etc. |

| Guarantees, Surety, Indemnity, Comfort Letters | Other than performance guarantees |

| Borrowings | Loans from Related Parties |

| Asset Transfers | Sale/lease/disposal of units, divisions, shares, or undertaking |

B. Profit & Loss (P&L) Items

| Nature of Transaction | Examples |

|---|---|

| Sale/Purchase/Supply | Goods, services, or any business transaction |

| Royalty Payments | License fee, trademark/brand usage fee, technical know-how, etc. |

6. Minimum Information to be Provided to Audit Committee & Shareholders

As per the Industry Standards, the following minimum disclosures are required in the agenda/notice for approval:

| Particulars | Details Required |

|---|---|

| Name of Related Party | Relationship with the listed entity |

| Nature of Relationship | Whether promoter, director, KMP, subsidiary, associate, etc. |

| Nature, Duration & Particulars of Transaction | Precise description, recurring or one-time |

| Material Terms | Including value, tenure, payment terms |

| Valuation/Justification | Independent valuation if any; pricing rationale |

| Percentage of Entity’s Turnover/Net Worth/PAT | Relative impact |

| If Arm’s Length & Ordinary Course of Business | Supporting basis |

| Details of Approval from Audit Committee/Board/Shareholders | Date and nature of approvals taken |

| Justification for Entering into Transaction | Business rationale, synergy, necessity |

| Any Other Relevant Information | Risk factors, conflicts of interest |

7. Extended Timeline by SEBI

| Circular Reference | SEBI/HO/CFD/CFD-PoD-2/P/CIR/2025/372 |

|---|---|

| Issued On | March 21, 2025 |

| Key Decision | Extension of implementation of Industry Standards from 01 April 2025 to 01 July 2025 |

8. Compliance Requirements

Listed Entities must:

-

Ensure Audit Committee is presented with comprehensive, detailed documentation for all material RPTs.

-

Disclose all material RPTs in the quarterly compliance report and annual corporate governance report.

-

Provide justification and impact analysis for shareholder approval under Reg 23(4).

9. Summary of Key Thresholds

| Regulation | Type of Transaction | Materiality Threshold |

|---|---|---|

| Reg. 23(1) | General RPT | Lower of ?1000 Cr or 10% of annual consolidated turnover |

| Reg. 23(1A) | Royalty Payment | 5% of annual consolidated turnover |

| Reg. 30(4) | Disclosure Materiality | Lower of: 2% turnover, 2% net worth, or 5% avg. PAT (3 yrs) |

10. Conclusion

The implementation of Industry Standards on RPTs aims to curb undue influence, promote transparency, and safeguard shareholder interests. With the extended timeline to 01 July 2025, listed entities must strengthen their internal review mechanisms and ensure full compliance with the revised disclosure framework.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc.