View News

Nazara-Technologies-Acquires-Smaaash-Entertainment-for-Crore-A-Landmark-in-IBC-Resolution

Nazara Technologies Acquires Smaaash Entertainment for ?126 Crore: A Landmark in IBC Resolution

1. Introduction

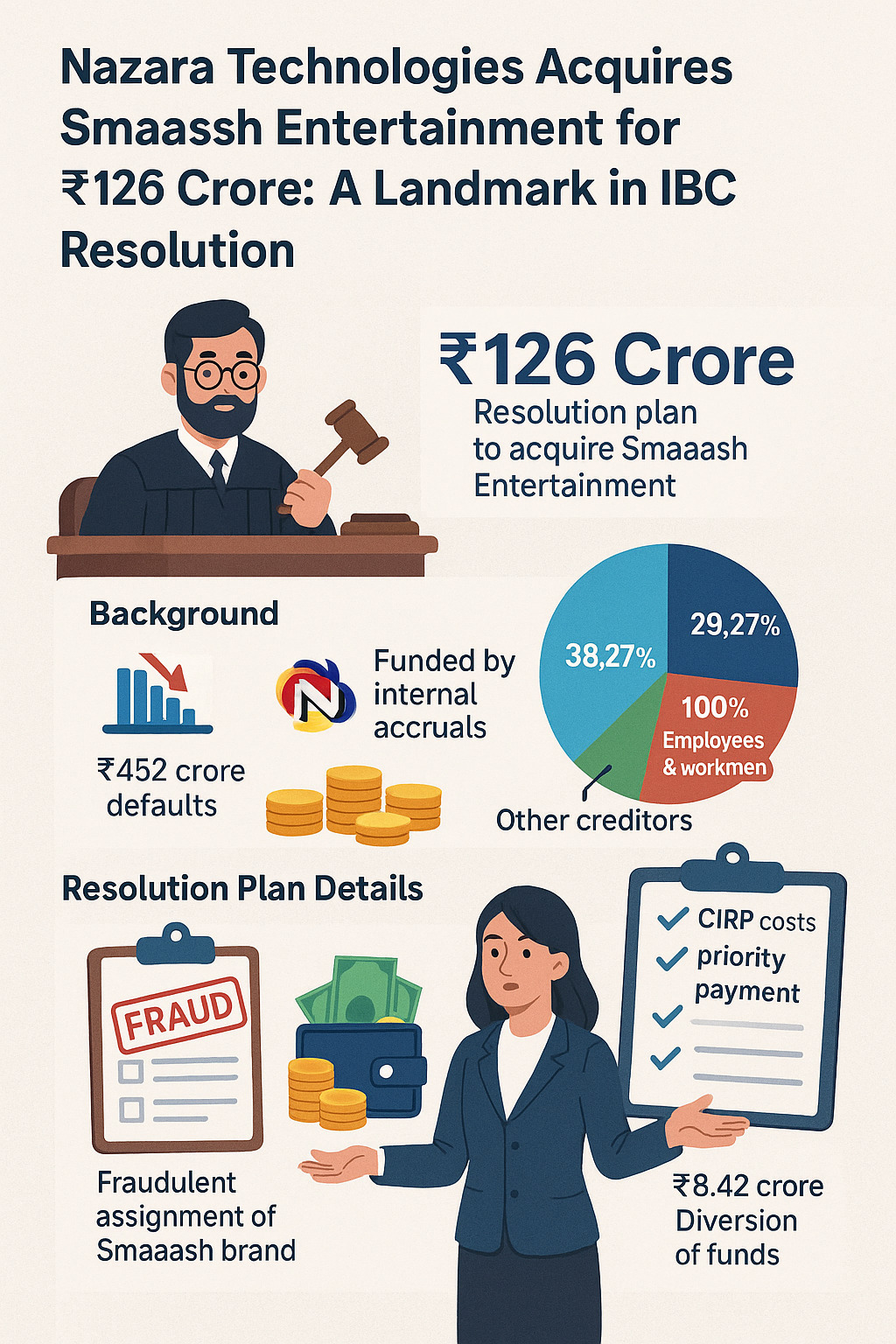

In a significant milestone for India's insolvency landscape, the National Company Law Tribunal (NCLT), Mumbai Bench, approved a resolution plan worth ?126 crore submitted by Nazara Technologies Limited for the acquisition of Smaaash Entertainment Private Limited, a distressed but prominent sports and entertainment company. This acquisition highlights the robust and adaptive nature of the Insolvency and Bankruptcy Code, 2016 (IBC) in enabling strategic turnarounds of stressed businesses, especially in the backdrop of fraudulent conduct by former promoters.

2. Background of Insolvency Proceedings

2.1 Initiation of CIRP under Section 7

The Corporate Insolvency Resolution Process (CIRP) for Smaaash was initiated on 6 May 2022, following a Section 7 petition filed by Edelweiss Asset Reconstruction Company Limited, one of the key financial creditors. The petition was admitted by the NCLT due to persistent defaults by Smaaash in repaying its financial obligations. Upon admission, Mr. Bhrugesh Amin was appointed as the Interim Resolution Professional (IRP), later confirmed by the Committee of Creditors (CoC) to continue as the Resolution Professional (RP).

2.2 Composition of the Committee of Creditors (CoC)

The CoC was constituted on 3 June 2022, and comprised key financial stakeholders of the company. Major members included:

-

Edelweiss ARC – holding the highest voting share of 38%

-

Mabella Investment Advisors Pvt. Ltd.

-

Small Industries Development Bank of India (SIDBI)

-

Yes Bank Limited

-

Sadhana Nitro Chem Limited

This diverse structure reflected the complexity of Smaaash’s financial commitments and debt profile.

3. Valuation and Resolution Plan Process

3.1 Appointment of Valuers

Two registered valuers, Adroit Appraisers and G. Somani, were appointed to determine the Fair Value and Liquidation Value of Smaaash:

-

Fair Value: ?108.32 crore (average)

-

Liquidation Value: ?65.77 crore

These valuations formed the benchmark against which resolution plans were assessed.

3.2 Call for Resolution Plans

The RP issued three rounds of Expressions of Interest (EoI) due to complications arising from internal mismanagement and fraudulent transactions. Ultimately, two eligible resolution applicants submitted plans:

-

Nazara Technologies Limited

-

Consortium of Resurgent Property Ventures Pvt. Ltd. and Sanjay Lodha

After evaluation and negotiations, only Nazara’s revised plan was found commercially viable and was approved with 59% voting share during the 30th CoC meeting on 26 July 2024.

4. Financial Structure of the Approved Resolution Plan

4.1 Total Resolution Value and Guarantees

Nazara Technologies committed to a total resolution value of ?126 crore, funded entirely through internal accruals. Additionally, a ?20 crore bank guarantee was offered as a performance commitment.

4.2 Treatment of Stakeholders

| Category | Admitted Claims (? Cr) | Amount Offered (? Cr) | Recovery % |

|---|---|---|---|

| Secured Financial Creditors | 426.94 | 124.47 | 29.27% |

| Unsecured Financial Creditors | 0.68 | 0 | 0% |

| Government Dues | 13.89 | 0.58 | 4.17% |

| Employees and Workmen | 0.44 | 0.44 | 100% |

| Operational Creditors | 6.78 | 0.28 | 4.13% |

| Other Creditors | 5.12 | 0.21 | 4.10% |

4.3 CIRP Costs

Nazara has also agreed to bear ?97.76 lakhs as CIRP costs, which are to be paid in priority under Section 30(2)(a) of the IBC.

5. Monitoring and Implementation Framework

5.1 Formation of Monitoring Committee

To ensure effective and transparent implementation, a Monitoring Committee was constituted comprising:

-

Two representatives from the CoC

-

Two from Nazara Technologies

-

The RP as the Monitoring Agent

5.2 Effective and Closing Dates

-

Effective Date: Date of NCLT approval of the plan

-

Closing Date: Within 30 days from Effective Date, by which all preconditions and payments must be completed

Nazara will bear any additional interim management or CIRP expenses incurred between these two dates.

6. Forensic Audit and Avoidance Transactions

6.1 Fraudulent Assignment of Brand “Smaaash”

One of the most serious irregularities uncovered was the fraudulent assignment of the 'Smaaash' brand by suspended directors to a related entity, Fun Gateway Arena Pvt. Ltd. (FGAPL). Executed just days before the insolvency petition, this deed was reversed by the NCLT in its order dated 22 November 2023, restoring ownership to the corporate debtor.

6.2 Diversion of Funds to Related Parties

The RP also discovered a diversion of ?8.42 crore to related entities without justification. This was challenged through IA/4888/2023, and the NCLT ruled in favor of the RP on 20 February 2025, categorizing it as fraudulent trading under Section 66 of the IBC.

6.3 Preferential Treatment Allegation – Tata Capital

An alleged preferential transaction with Tata Capital was also examined under IA/1019/2023. However, the NCLT ruled this as within ordinary course of business, and dismissed the application on 24 October 2024.

7. Promoter Ineligibility under Section 29A(g)

7.1 Applicability of Disqualification Despite MSME Status

Although Smaaash qualified as an MSME and thus ordinarily benefited from relaxed eligibility norms under the IBC, the suspended directors were disqualified under Section 29A(g) due to their involvement in fraudulent activities.

7.2 Tribunal Findings

The NCLT found the promoters responsible for:

-

Fraudulent brand assignment

-

Diversion of significant funds

Consequently, their ?200 crore competing resolution plan was rejected, reinforcing the principle that fraudulent promoters cannot regain control, even under MSME exemptions.

8. Significance of the Acquisition

8.1 Strategic Fit for Nazara Technologies

The acquisition of Smaaash allows Nazara to expand into location-based entertainment and experiential gaming, complementing its digital gaming and eSports business. It presents a powerful cross-sector synergy, tapping into physical venues to reinforce digital growth.

8.2 Strengthening of IBC Jurisprudence

This case reiterates the core objectives of the IBC:

-

Equitable treatment of creditors

-

Penalizing fraudulent conduct

-

Revival of distressed but viable businesses

It underscores that the IBC framework remains resilient and adaptable even in complex cases involving fraud and promoter disqualification.

9. Conclusion

Nazara Technologies' acquisition of Smaaash Entertainment represents not only a major corporate restructuring success but also a strong judicial endorsement of India's insolvency resolution ecosystem. The detailed handling of fraudulent transactions, enforcement of promoter disqualification, and equitable treatment of stakeholders stand as guiding principles for future resolution processes. This case also sends a clear message: fraud will be penalized, and only credible, compliant entities can participate in the revival of distressed assets.

Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc.