View News

Related-Party-Transactions-Independent-Director-Partner-Independence

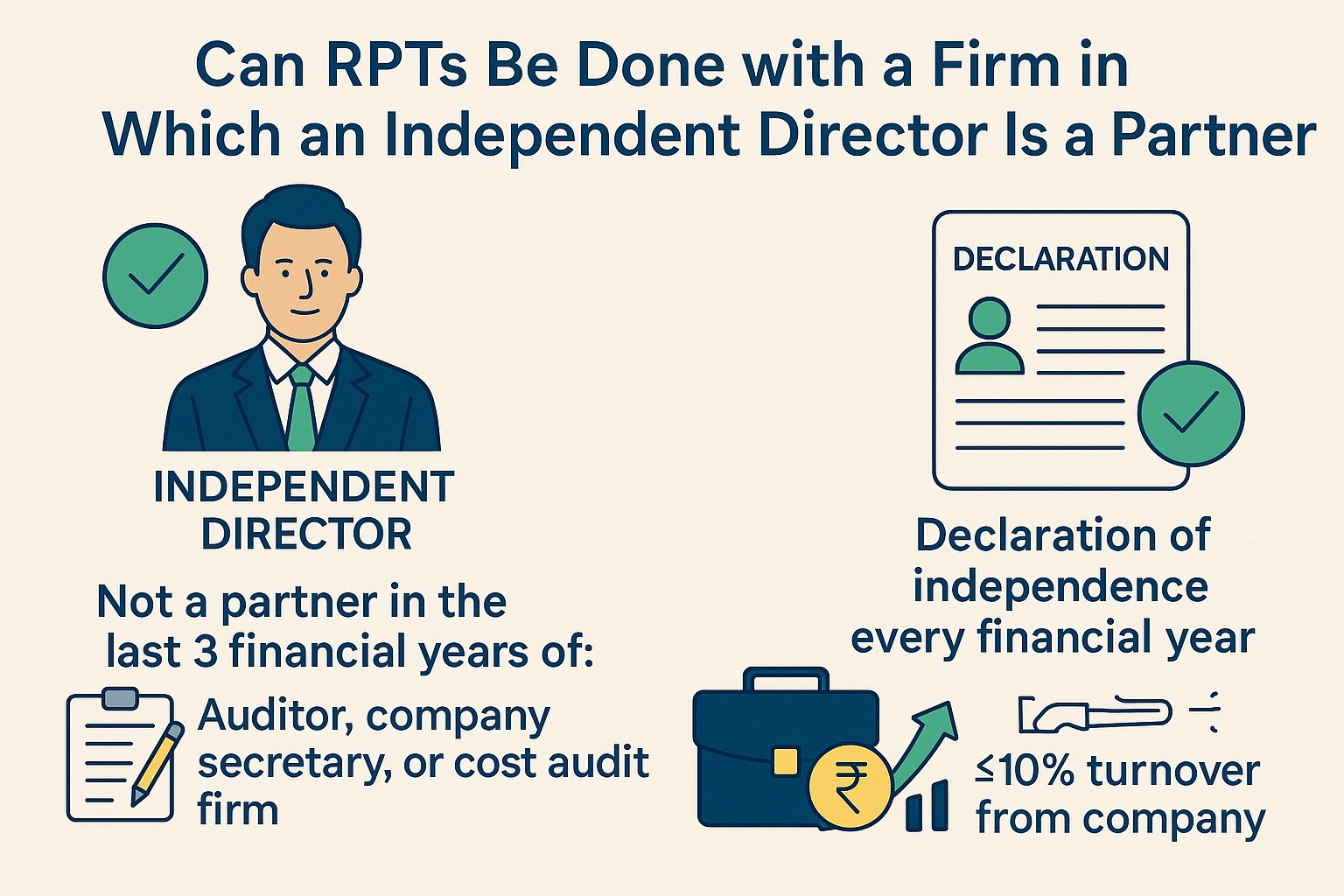

Can Related Party Transactions Be Done with a Firm in Which an Independent Director Is a Partner without affecting the Independence?

Yes and No — let’s explore how…

Who is an Independent Director?

As per Regulation 16(1)(b) of the SEBI LODR Regulations, 2015, an Independent Director is a non-executive director who meets specific criterions to ensure independence.

In order to determine the validity of transactions, we must refer to key clause (vi) of Regulation 16, which states “independent director” means a non-executive director, other than a nominee director of the listed entity:

(vi) who, neither himself /herself, nor whose relative(s) —

(1)a firm of auditors or company secretaries in practice or cost auditors of the listed entity or its holding, subsidiary or associate company; or

(2) any legal or a consulting firm that has or had any transaction with the listed entity, its holding, subsidiary or associate company amounting to ten per cent or more of the gross turnover of such firm;

So, Can RPTs Be Done?

Related Party Transactions (RPTs) with a firm in which an Independent Director is a partner can be done without losing the Independence, only if the following two conditions are satisfied:

If they (or their relatives) were not a partner, proprietor, or employee in the last 3 financial years of:

- An auditor, company secretary in practice, or cost audit firm of the company or its group; or

- A legal or consulting firm that had transactions with the company (or its group) amounting to 10% or more of the firm’s turnover.

One might observe that it only related to preceding 3 years and not about current year.

For this we must refer to Regulation 25(8) which states:-

Every independent director shall, at the first meeting of the board in which he/she participates as a director and thereafter at the first meeting of the board in every financial year or whenever there is any change in the circumstances which may affect his/her status as an independent director, submit a declaration that he meets the criteria of independence as provided in clause (b) of sub-regulation (1) of regulation 16 and that he is not aware of any circumstance or situation, which exist or may be reasonably anticipated, that could impair or impact his/her ability to discharge his/her duties with an objective independent judgment and without any external influence.

Hence giving the declaration every financial year under Regulation 25(8) specifying clause (b) of sub-regulation (1) of regulation 16 ensures the related party transactions are done without affecting the Independence of a Director.

Disclaimer:

The contents of this article are based on current provisions and available information. While every effort has been made to ensure accuracy and reliability, no responsibility is assumed for any errors or omissions. Users are encouraged to refer to applicable laws and regulations. This article is not intended as legal advice, and no liability is accepted for any consequences arising from its use.

From the desk of CS SHARATH