View News

SFT-Compliance-Alert-File-Before-May

SFT Compliance Alert – File Before May 31, 2025

What is SFT?

The Statement of Financial Transactions (SFT) is a mandatory reporting requirement under Section 285BA of the Income Tax Act, 1961. It obligates certain specified entities to report high-value financial transactions to the Income Tax Department through Form 61A, as per Rule 114E. The objective of SFT is to track significant financial activities across the economy and ensure better tax compliance and transparency.

Who Needs to File SFT?

SFT filing is mandatory for the following categories:

-

Banks and Financial Institutions

-

Sub-Registrars involved in property registration

-

Companies and Professionals subject to Tax Audit under Section 44AB

-

Credit Card Issuers and NBFCs

-

Mutual Funds and Entities issuing Shares, Debentures, or Bonds

-

Companies distributing Dividends

These reporting entities are required to monitor and report specified transactions if they exceed the applicable thresholds.

What Transactions Must Be Reported?

Certain high-value transactions must be reported under SFT, based on the following thresholds:

-

Purchase/Sale of Immovable Property: ?30 lakh or more

-

Cash Deposits/Withdrawals in Current Accounts: ?50 lakh or more

-

Cash Deposits (Savings/Other Accounts): ?10 lakh or more

-

Credit Card Payments: ?10 lakh or more annually

-

Investments in Shares, Mutual Funds, Debentures, Bonds: ?10 lakh or more annually

-

Cash Received for Sale of Goods/Services (for Tax Audit assessees): Over ?2 lakh

-

Dividend Distributions: No minimum threshold — report all

-

Time Deposits (excluding renewals): ?10 lakh or more

-

Foreign Currency Purchases/Remittances: ?10 lakh or more

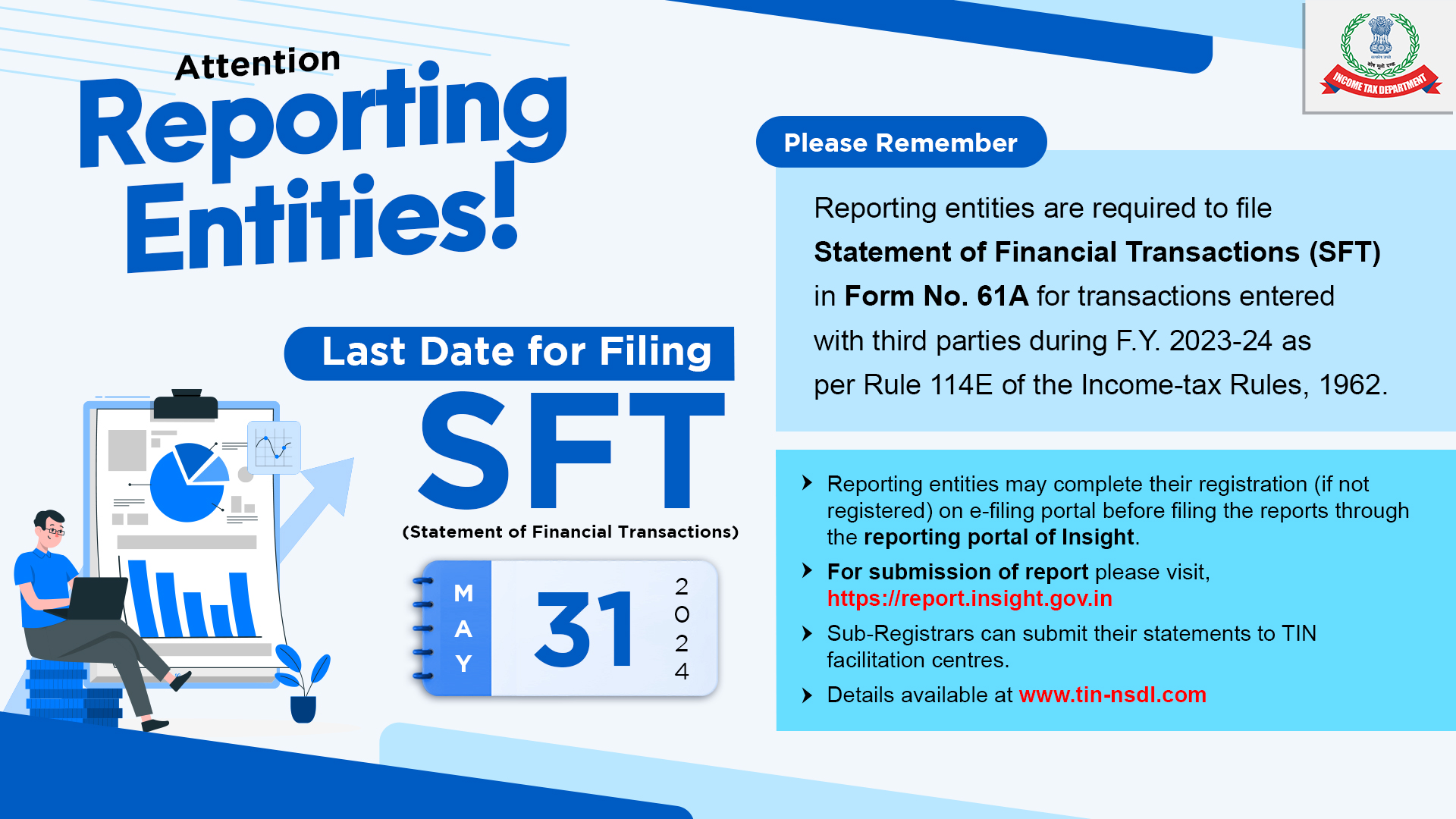

Filing Deadline

The deadline for SFT filing for the financial year is May 31, 2025. All reporting entities must ensure that Form 61A is submitted electronically through the Income Tax Reporting Portal before this date to remain compliant.

Why Timely Filing is Important

Filing your SFT on time offers several benefits and avoids significant consequences:

-

Avoid Penalties: ?500/day for delay; ?1,000/day after notice (up to ?21,000 per notice)

-

Maintain Clean Compliance Records: Helpful in audits and regulatory reviews

-

Avoid Scrutiny: Reduces the chance of being flagged for tax investigation

-

Data Consistency: Ensures alignment with client and internal records

Increased Vigilance from the Tax Department

The Income Tax Department is now closely monitoring SFT compliance. In recent months, there has been a noticeable increase in notices issued for:

-

Delayed filings

-

Incorrect information

-

Non-reporting of eligible transactions

This emphasizes the need for accurate, timely, and complete reporting.

Need Help Filing?

If you are a bank, NBFC, corporate entity, tax audit assessee, or a compliance professional, it is advisable to seek expert assistance. Professional service providers can help with:

-

Identifying reportable transactions

-

Preparing and validating Form 61A

-

Filing through the official Reporting Portal

-

Ongoing compliance support

Professional help ensures that your reporting is complete and correct, and that you're protected from penalties or future complications.

Conclusion

With the SFT deadline approaching on May 31, 2025, it is imperative for all concerned entities to act promptly. Timely and accurate SFT filing helps maintain legal compliance, avoid penalties, and supports a healthy financial reporting environment. Entities are encouraged to review their transaction records, seek expert guidance if necessary, and complete their SFT obligations without delay.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc.