View News

Advisory on Recent Changes to the GST Invoice Management System (IMS)

Advisory on Recent Changes to the GST Invoice Management System (IMS)

The Goods and Services Tax Network (GSTN) has issued an important advisory introducing a set of significant changes to the Invoice Management System (IMS). These changes, effective from the October 2025 tax period, are intended to ease compliance requirements, promote transparency, and provide flexibility in return filing. Businesses and tax professionals should carefully review the updated provisions to avoid potential issues relating to Input Tax Credit (ITC), credit note adjustments, and reconciliation.

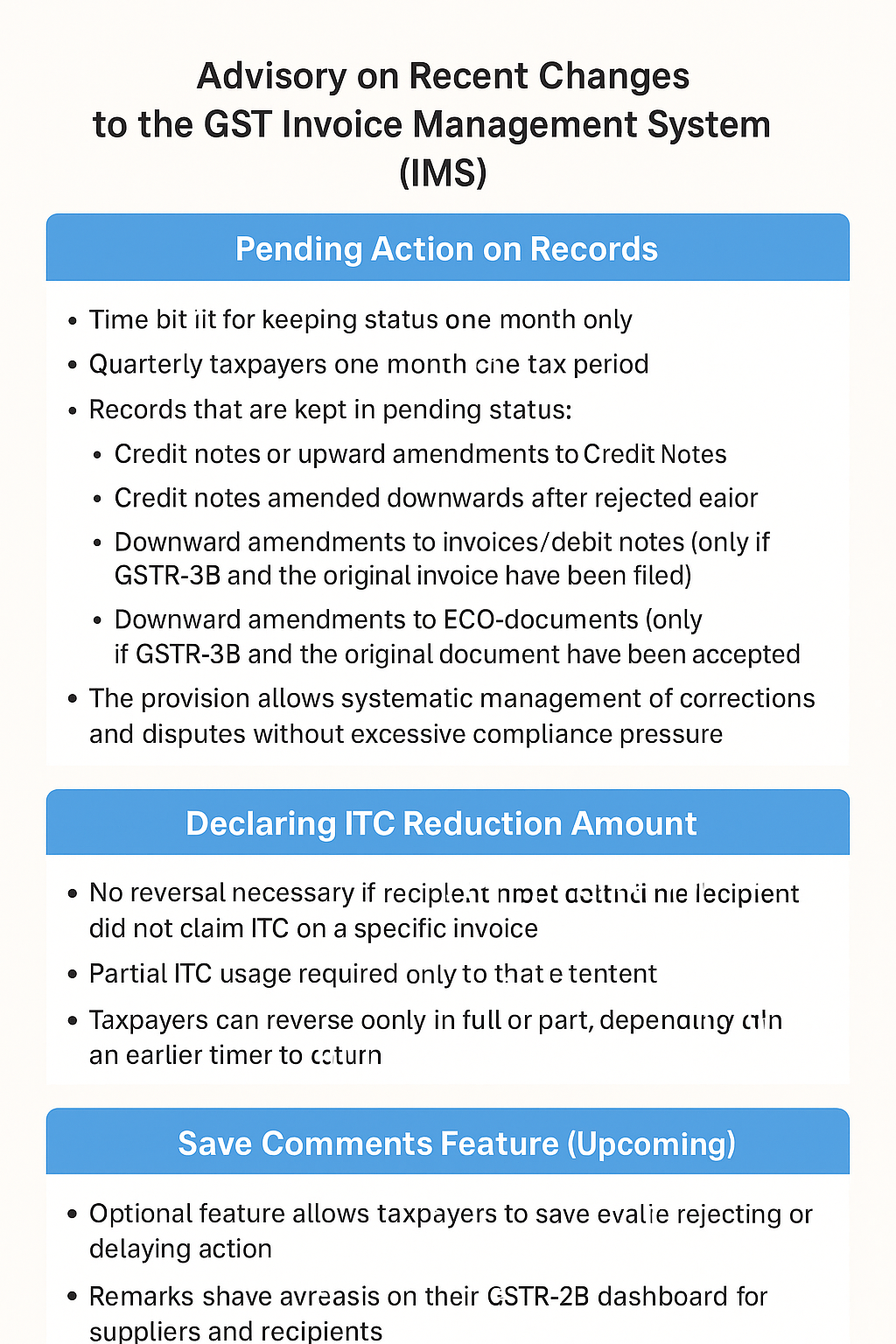

1. Pending Action on Records

Time Limit for Pending Status

-

Monthly taxpayers: Specified records may be kept in pending status for up to one month only.

-

Quarterly taxpayers: The pending status may be maintained for one tax period.

This ensures that unresolved records are addressed in a timely manner and do not remain indefinitely unresolved, thereby improving overall compliance discipline.

Types of Records Eligible for Pending Status

The following types of records can be marked as pending under the revised system:

-

Credit Notes or Upward Amendments to Credit Notes

-

Pending status can be used to delay acceptance until reconciliation or verification is complete.

-

-

Credit Notes Amended Downward after rejection of an initial credit note

-

Businesses often face disputes around downward revisions of credit notes. The pending feature allows time to reconcile such amendments.

-

-

Downward Amendments to Invoices/Debit Notes

-

Permitted only if the original invoice and GSTR-3B return for the period have already been filed.

-

-

Downward Amendments to ECO (E-Commerce Operator) Documents

-

Applicable only where both the original ECO document and GSTR-3B return have been accepted.

-

Key Implication:

This system provides a structured mechanism to manage disputes, corrections, and mismatches in a controlled manner without triggering unnecessary compliance obligations or risks of double reversals.

2. Declaring ITC Reduction Amount

The second major clarification relates to how Input Tax Credit (ITC) reversals are to be declared in IMS.

Key Provisions:

-

No Reversal Required if the recipient has not claimed ITC on the particular invoice/document.

-

Partial ITC Claimed: Reversal is required only to the extent of ITC actually availed.

-

Flexibility in Declaration:

-

Taxpayers can declare reversals in full or part, based on the ITC claimed.

-

Reversals already made (either partly or fully) in earlier tax periods can also be declared in IMS.

-

If ITC was never claimed on a document, taxpayers can indicate the same to avoid duplication.

-

Practical Benefit:

This provision significantly reduces the scope for errors in ITC reporting, prevents duplicate reversals, and aligns the ITC adjustments more closely with the taxpayer’s actual claim position in GSTR-3B. It is expected to reduce litigation and mismatches between supplier and recipient data.

3. Save Comments Feature (Upcoming)

A new feature is being introduced to allow taxpayers to save explanatory remarks/comments when rejecting or deferring action on a record.

-

Optional Nature: The feature is not mandatory but provides a facility to record reasons for rejection or delay.

-

Visibility: Remarks saved by the taxpayer will be visible in:

-

The supplier’s GSTR-2B dashboard

-

The recipient’s GSTR-2B dashboard

-

-

Purpose:

-

Helps suppliers understand the reason for rejection and make necessary corrections in subsequent filings.

-

Creates an audit trail of decisions taken, which will assist both businesses and auditors in reconciling discrepancies.

-

This feature enhances communication between suppliers and recipients, reducing disputes and delays in ITC flow.

4. Effective Dates & Applicability

-

Effective Period: The new rules for pending records and ITC reversal declarations will apply starting October 2025 tax period.

-

Due Dates: Deadlines will continue to be linked to the tax period of the supplier’s filing. For example:

-

If the supplier files for October, the due date for action by the recipient will be aligned with October’s return cycle.

-

-

Scope of Applicability:

-

The revised provisions apply only to records uploaded by suppliers after the new system comes into effect.

-

Legacy records or those uploaded prior to the cut-off date will continue to be governed by earlier rules.

-

5. Practical Impact on Businesses

-

Faster Reconciliation: The time-bound pending action feature ensures records are reconciled within the same filing cycle, preventing backlog.

-

Reduced Compliance Burden: Businesses are not required to reverse ITC unnecessarily if the credit was never claimed.

-

Transparency in Disputes: Saved remarks and pending records create a clear trail for managing mismatches, aiding both businesses and authorities.

-

Better Supplier-Recipient Coordination: Suppliers will receive immediate feedback on errors via the GSTR-2B dashboard, enabling corrective action in real-time.

Conclusion

The recent enhancements to the Invoice Management System (IMS) reflect GSTN’s continued efforts to streamline compliance and simplify taxation. By introducing structured timelines for pending records, flexible ITC reversal mechanisms, and features to improve supplier-recipient communication, the new framework promotes transparency, reduces compliance costs, and minimizes the risk of disputes.

Action Point for Businesses:

Taxpayers should update their internal GST compliance processes in line with the new provisions starting October 2025. Timely reconciliation, accurate declaration of ITC, and effective use of the pending/comment features will be critical to ensuring smooth GST compliance under the new system.

Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc