View News

Applicability of Reverse Charge Mechanism (RCM) on Import of Services

Applicability of Reverse Charge Mechanism (RCM) on Import of Services

1. Issue

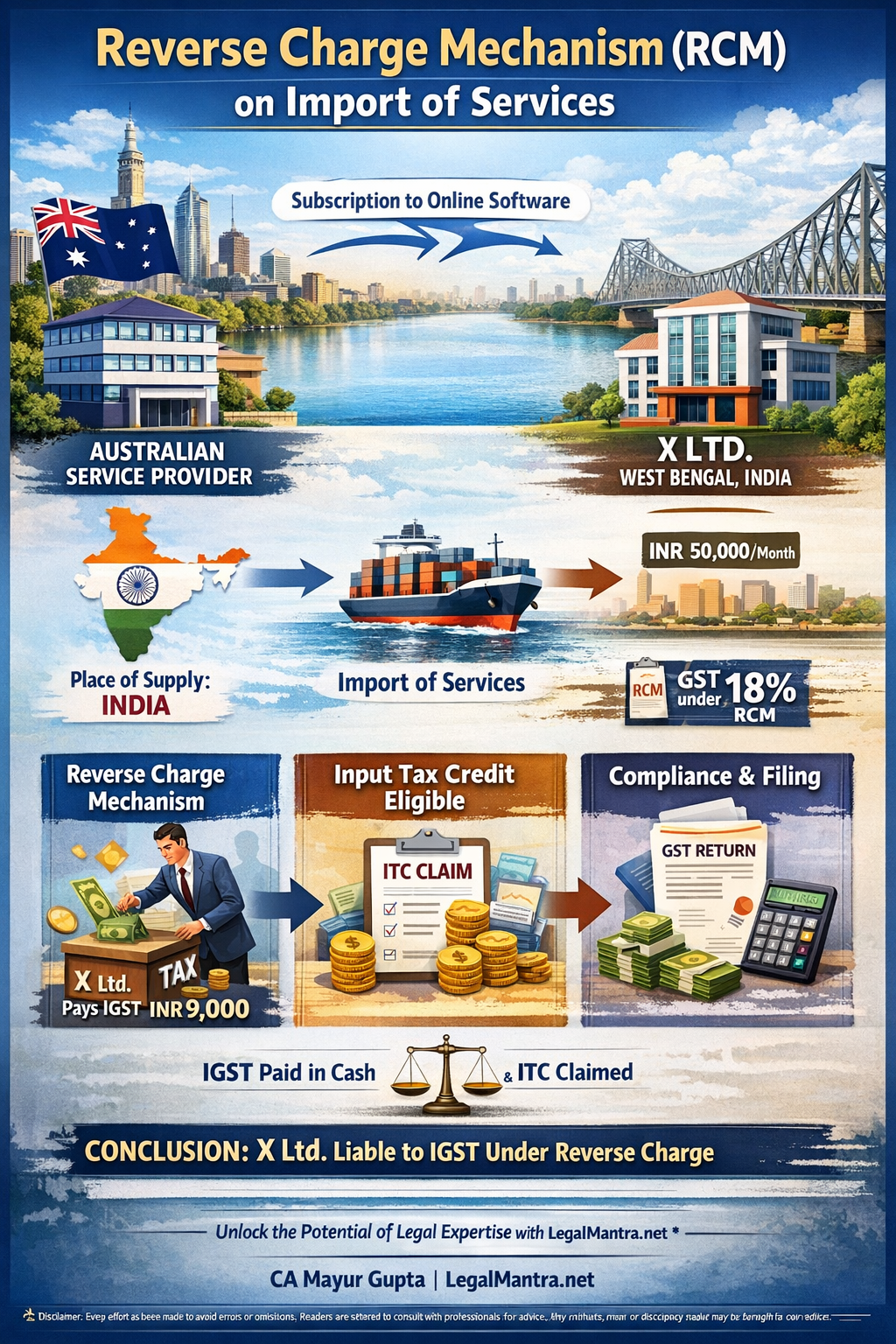

The issue under consideration is whether GST is payable by a taxpayer on payment of subscription fees to a service provider located outside India, where the supplier does not have a Permanent Establishment (PE) or authorized representative in India.

2. Facts of the Case

X Ltd., located in West Bengal, is availing subscription-based services from a service provider situated outside India, specifically in Australia. The supplier does not have a PE or authorized representative in India. The services availed are of the nature of online information and database access or retrieval (OIDAR services).

Example: In this case, suppose X Ltd. subscribes to an online management software provided by an Australian company for a monthly fee of INR 50,000. The supplier has no PE or representative in India. Even though the supplier is outside India, the subscription service is used in India, and therefore, the transaction qualifies as an import of service.

3. Relevant Provisions under the IGST Act, 2017

3.1 Definition of Import of Services

Section 2(11) of the IGST Act, 2017, defines "import of services" as the supply of any service where the supplier of the service is located outside India, the recipient is located in India, and the place of supply of service is in India. In the present case, the supplier is in Australia, the recipient is in West Bengal, India, and the place of supply is determined as the location of the recipient, which is in India. Therefore, the subscription services qualify as import of services under Section 2(11) of the IGST Act, 2017.

3.2 Taxability of Import of Services

Import of services is taxable under GST in two situations. First, when services are imported for a consideration, whether or not in the course or furtherance of business. Second, when services are imported without consideration, by a taxable person, from a related person or any of his establishments outside India, in the course or furtherance of business. In the present case, the subscription services are availed for consideration, and therefore, are taxable under GST.

3.3 Determination of Place of Supply

Section 13 of the IGST Act, 2017, governs the determination of place of supply where either the supplier or the recipient is located outside India. The general rule under Section 13(2) states that the place of supply shall be the location of the recipient of services. Section 13(12) specifically covers OIDAR services and provides that the place of supply of such services shall be the location of the recipient. In this case, since the supplier is located in Australia, the recipient is located in India, and the services are used in India, the place of supply of subscription-based OIDAR services is India.

Example: In the previous example, although the Australian software provider invoices X Ltd. in Australia, the services are accessed and used in West Bengal. Therefore, the place of supply is India, and the transaction is considered an import of services.

4. Applicability of Reverse Charge Mechanism

As per Notification No. 10/2017–IT(R) dated 28.06.2017, services supplied by any person located in a non-taxable territory to any person other than a non-taxable online recipient are subject to GST under the Reverse Charge Mechanism (RCM). In the present case, the supplier is located outside India, the recipient is a taxable person in India, and the services availed are subscription-based OIDAR services. Therefore, X Ltd. is liable to pay IGST under RCM. The IGST liability under RCM must be discharged in cash. Input tax credit can be claimed to the extent of IGST paid in cash, subject to the conditions specified under the IGST Act, 2017.

Example: Continuing the example, X Ltd. must calculate IGST at 18% on the INR 50,000 monthly subscription fee, i.e., INR 9,000. The company pays this IGST in cash under RCM and can claim ITC for this amount in the same month, provided all conditions are satisfied.

5. Conclusion

In view of the facts and provisions of the IGST Act, 2017, the subscription services availed by X Ltd. from a supplier located outside India qualify as import of services under Section 2(11) of the IGST Act, 2017. The supplier is located outside India, the recipient is located in India, and the place of supply is determined as the location of the recipient under Section 13(12) of the IGST Act, 2017. Accordingly, the transaction is liable to IGST under the Reverse Charge Mechanism as per Notification No. 10/2017–IT(R). The IGST liability has to be discharged in cash, and eligible input tax credit can be availed subject to applicable conditions.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

CA Mayur Gupta

LegalMantra.net team