View News

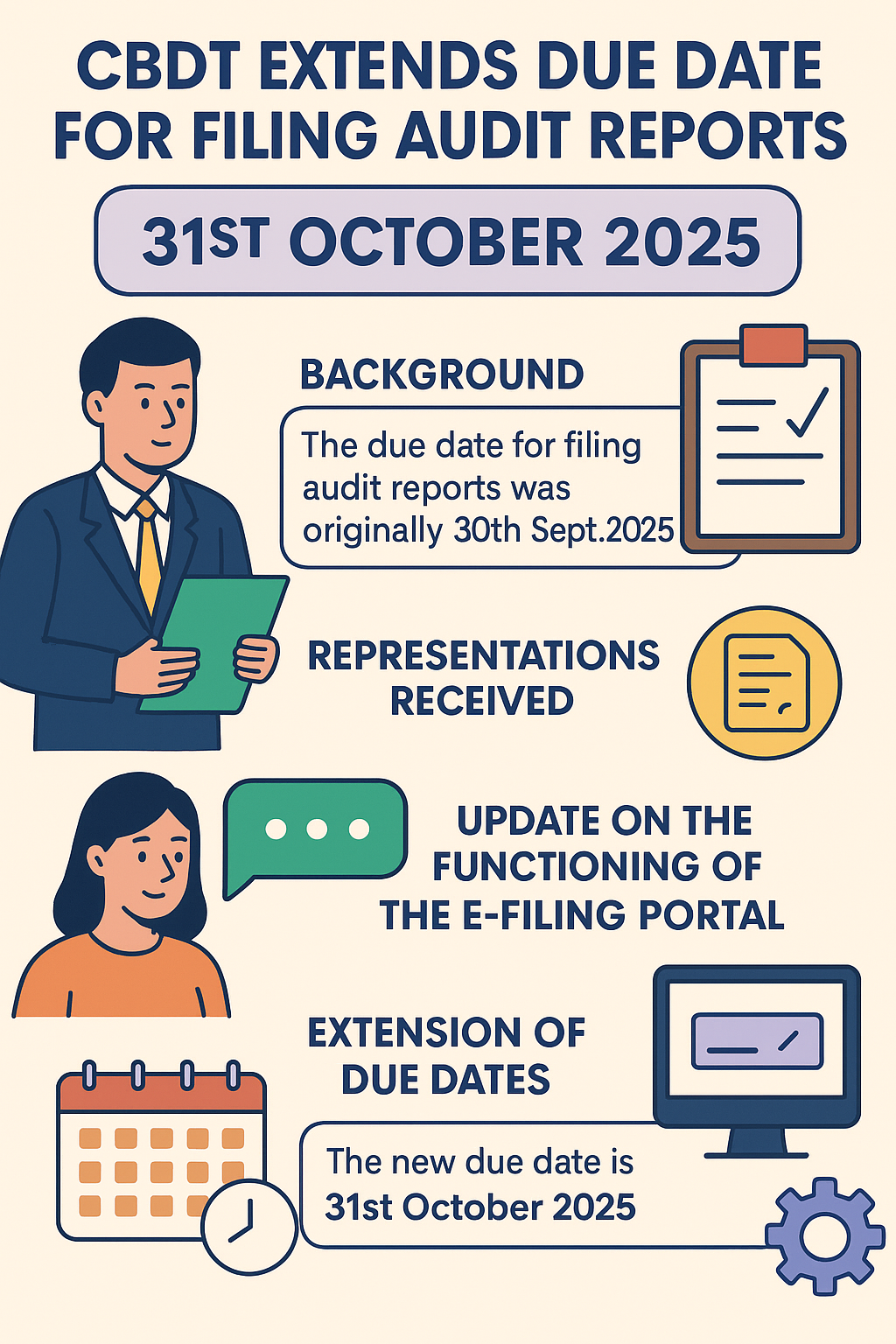

CBDT Extends Due Date for Filing Audit Reports

CBDT Extends Due Date for Filing Audit Reports for AY 2025–26: A Much-Needed Relief for Taxpayers and Professionals

The Central Board of Direct Taxes (CBDT) has provided a significant measure of relief to taxpayers and professionals across the country by extending the due date for filing various audit reports under the Income-tax Act, 1961, for the Assessment Year (AY) 2025–26. This extension acknowledges the genuine difficulties faced by taxpayers and professionals in ensuring timely compliance, particularly in the face of natural and operational disruptions.

Background: Original Due Date

As per the provisions of the Income-tax Act, 1961, the due date for furnishing audit reports under the relevant sections was originally fixed as 30th September 2025. However, considering the practical challenges faced by professionals, taxpayers, and industry stakeholders, CBDT has extended the due date by one month, i.e., to 31st October 2025.

This extension applies to all assessees referred to in Clause (a) of Explanation 2 to sub-section (1) of Section 139 of the Income-tax Act.

Representations Received from the Professional Community

The decision comes in response to persistent and reasoned representations made by various stakeholders, especially Chartered Accountant bodies and professional associations. The submissions highlighted several challenges impeding timely audit completion, such as:

-

Regional Disruptions Due to Natural Calamities

Certain parts of the country have recently witnessed floods and natural disasters, which have severely affected day-to-day business operations, audits, and compliance-related activities. -

Operational Impediments in Audit Completion

Many practitioners reported that the time frame available for completing audits was insufficient, particularly in cases of large or complex entities where statutory audits and tax audits run concurrently. -

Judicial Intervention

The matter was even brought before various Hon’ble High Courts, wherein taxpayers and professionals sought judicial relief to avoid penal consequences due to circumstances beyond their control.

CBDT took these representations into account while finalising its decision.

Update on the Functioning of the e-Filing Portal

While acknowledging the difficulties faced by stakeholders, CBDT has also clarified that the Income-tax e-filing portalcontinues to function smoothly and efficiently. Contrary to past years where portal glitches caused delays, this year’s system has demonstrated resilience. Some key updates include:

-

As of 24th September 2025, more than 4.02 lakh Tax Audit Reports (TARs) had already been filed.

-

On that very day alone, over 60,000 TARs were submitted successfully.

-

Up to 23rd September 2025, the portal recorded filing of over 7.57 crore Income-tax Returns (ITRs).

This performance, according to CBDT, highlights the robustness of the e-filing system and its ability to handle peak filing volumes effectively.

Extension of Due Dates

After considering the representations, judicial proceedings, and practical hardships, CBDT has formally extended the due date for filing audit reports to:

31st October 2025

(for AY 2025–26, applicable to all assessees covered under Clause (a) of Explanation 2 to Section 139(1) of the Income-tax Act, 1961).

This extension provides relief to taxpayers without compromising the credibility and efficiency of the compliance ecosystem.

Significance of the Extension

The extension serves several crucial purposes:

-

Relief to Taxpayers and Professionals: Provides the much-needed breathing space to complete audits and filings in a systematic and error-free manner.

-

Acknowledgment of Ground Realities: Recognises disruptions caused by natural calamities and business challenges, striking a balance between statutory deadlines and practical difficulties.

-

Ensuring Voluntary Compliance: By offering additional time, CBDT encourages accurate and timely filings, thereby reducing the chances of errors and consequent penalties.

-

Judicial Sensitivity: Reflects responsiveness to concerns raised before the courts and by professional institutions.

Conclusion

The Finance Ministry, through CBDT, has demonstrated a pragmatic and taxpayer-friendly approach by extending the due date for filing audit reports for AY 2025–26 to 31st October 2025. While affirming that the Income-tax e-filing portal is fully functional and robust, this decision acknowledges the genuine challenges faced by taxpayers and professionals in meeting compliance deadlines.

Stakeholders are strongly advised to utilise this additional time judiciously, ensuring that audit reports and related statutory filings are accurate, comprehensive, and timely. Such proactive compliance not only prevents penalties but also contributes to strengthening the overall tax ecosystem.

Author’s Note for LegalMantra.net:

This extension, though limited to one month, underscores the importance of continuous dialogue between tax authorities and professional bodies. It also highlights the evolving jurisprudence where courts and regulatory authorities play an instrumental role in balancing compliance obligations with ground realities.