View News

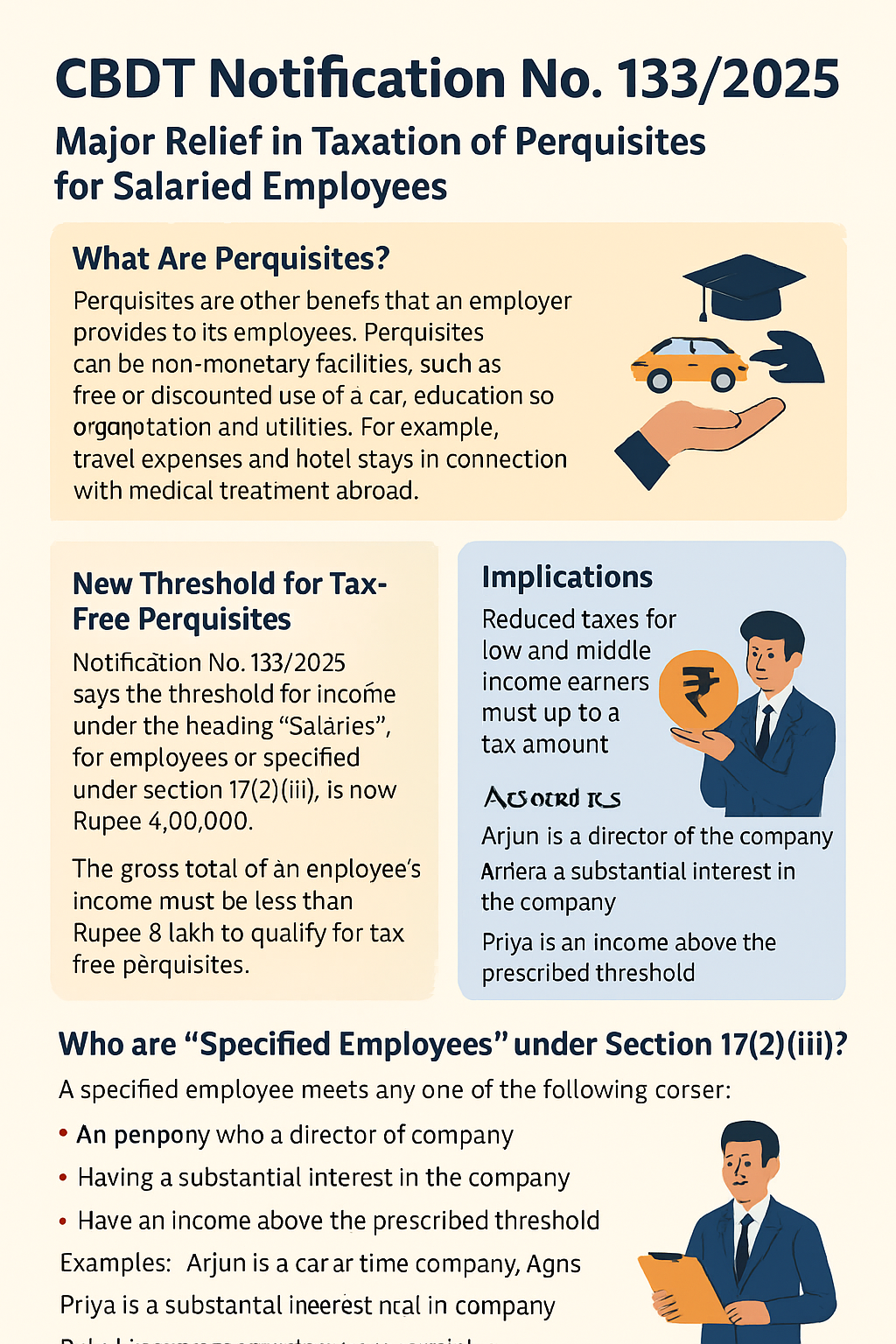

CBDT Notification No. 133/2025: Major Relief in Taxation of Perquisites for Salaried Employees

CBDT Notification No. 133/2025: Major Relief in Taxation of Perquisites for Salaried Employees

Introduction

On 18 August 2025, the Central Board of Direct Taxes (CBDT) issued Notification No. 133/2025, inserting Rule 3C into the Income Tax Rules, 1962. This amendment directly impacts the taxation of perquisites under Section 17(2) of the Income Tax Act, 1961. The changes will apply from 1 April 2025, that is, from the Financial Year 2025-26 corresponding to the Assessment Year 2026-27. The notification substantially raises exemption thresholds for salaried individuals, particularly benefiting employees in the low and middle-income groups.

Understanding Perquisites

Perquisites, often referred to as “perks,” are non-cash benefits or facilities provided by an employer to an employee in addition to the regular salary. They can be monetary in nature, but more often they consist of facilities and benefits provided free of cost or at a concessional rate.

Common examples of perquisites include the use of a company-owned car, housing facilities, subsidized or free education for the employee’s children, payment of utilities such as electricity or water by the employer, or even free meals. In certain cases, perquisites extend to more specialized benefits such as travel, lodging, and treatment expenses for an employee or family members when medical treatment is undertaken abroad.

Section 17(2) of the Income Tax Act, 1961 specifies the kinds of perquisites that are to be treated as part of salary and therefore taxed, unless a specific exemption is available under the rules.

Key Provisions of Notification No. 133/2025

The most important change introduced by Notification No. 133/2025 relates to the thresholds that determine when perquisites become taxable.

First, in the case of specified employees covered by Section 17(2)(iii), the exemption threshold has been raised. Previously, perquisites exceeding fifty thousand rupees in value were taxable. The new notification increases this limit to four lakh rupees. Therefore, an employee whose salary is up to four lakh rupees per year can now enjoy perquisites without being subjected to additional tax.

Second, the notification modifies the rules for exemption in respect of overseas medical treatment. Earlier, the exemption for travel and accommodation expenses for medical treatment abroad was restricted to employees whose gross total income did not exceed two lakh rupees. The revised rule raises this limit to eight lakh rupees. Consequently, employees with gross income below eight lakh rupees can avail employer-funded travel and stay for medical treatment outside India without incurring additional tax liability.

Illustrative Examples

To understand the impact of these changes, let us consider a few examples.

Suppose Ravi is employed with a private company and his annual salary is three lakh sixty thousand rupees. His employer provides him the free use of a company-owned car, valued at seventy thousand rupees for the year, and subsidized accommodation, valued at forty thousand rupees. The total value of perquisites received by him is one lakh ten thousand rupees. Under the old regime, the moment perquisites exceeded fifty thousand rupees, the entire value was taxable in the hands of the employee. Hence, Ravi would have paid tax on one lakh ten thousand rupees in addition to his regular salary income. Under the new rule, however, since his salary is below the four lakh rupees threshold, the entire amount of perquisites is exempt from tax.

Consider another case of Meena, whose gross income for the year is seven lakh fifty thousand rupees. She is sent abroad for the medical treatment of her child, and the employer bears expenses of three lakh rupees towards travel and hotel accommodation. Earlier, the benefit of exemption could not be claimed by her because her income exceeded two lakh rupees. The entire three lakh rupees would have been taxable as perquisite. Under the new provisions, since her income is below eight lakh rupees, the full three lakh rupees is exempt.

These illustrations make clear that the revised thresholds will result in significant savings for employees in the low and middle income categories.

Implications of the Change

The reform has multiple implications.

For employees with lower and middle-level incomes, the revision brings immediate relief. They no longer need to worry about the taxation of modest benefits such as the use of a company vehicle, subsidized housing, or reimbursement of certain facilities. Employees who earlier found themselves paying tax on relatively small perquisites now stand fully exempt if their salary or income is within the new limits.

For overseas medical treatment, the enhanced exemption limit of eight lakh rupees means that a much larger section of salaried families can avail employer support without being burdened by taxation. Given the rising cost of international medical treatment, this provision is likely to be widely used.

For employers, payroll and compliance systems need to be updated to reflect the new Rule 3C. Employers must ensure that perquisites are valued, reported, and taxed (or exempted) correctly. This will affect tax deduction at source calculations, issuance of Form 16, and employee ITR compliance. Proper classification and valuation of perquisites will be critical to avoid disputes during assessment.

For higher-income employees, that is, those whose salary exceeds four lakh rupees or whose gross total income exceeds eight lakh rupees, there is little direct relief. Such employees will continue to be taxed on perquisites as earlier. Therefore, individuals in higher brackets will need to pay attention to structuring their salary packages and perquisite components carefully to minimize tax incidence.

Rationale Behind the Change

The earlier thresholds had remained unchanged for more than a decade. The fifty thousand rupees limit for specified employees was set at a time when salary levels were significantly lower. Similarly, the two lakh rupees cap for overseas medical exemptions was entirely out of sync with the current cost of living and medical expenses, particularly for international treatment.

With rising inflation, higher salary structures, and increased healthcare costs, these thresholds had become outdated and led to undue taxation of modest benefits. By revising the limits upwards, the government has aligned the tax rules with current economic realities, thus making the taxation of perquisites fairer and more relevant.

Practical Guidance for Employees

Employees should carefully examine their salary structure and gross income in the light of the revised rules. Those falling below the thresholds should ensure that they are availing the exemptions fully and that their employer is classifying perquisites accordingly. It is advisable to coordinate with the payroll or human resources department to confirm that the exemptions are properly reflected in Form 16.

Employees who are close to the four lakh or eight lakh rupees thresholds should engage in careful tax planning. For instance, they may need to evaluate the timing of increments, performance bonuses, or non-cash benefits, as even a slight increase in income could take them out of the exempt category. In such cases, consultation with a tax advisor may be beneficial.

At the time of filing income tax returns for the assessment year 2026-27, employees should ensure accurate reporting of perquisites. Even when perquisites are exempt under Rule 3C, proper disclosure will prevent any confusion during assessment proceedings.

Conclusion

CBDT’s Notification No. 133/2025 is a welcome reform in the taxation of perquisites. By raising the exemption thresholds to four lakh rupees for salary and eight lakh rupees for gross income, the government has provided meaningful relief to employees in the low and middle-income groups. The change reduces unnecessary tax burden, particularly in relation to overseas medical expenses and everyday employment-related benefits.

For employers, the notification necessitates updates in payroll and compliance systems, while for employees it offers an opportunity for better tax planning and greater financial relief. Overall, this reform brings the tax treatment of perquisites in line with present-day salary levels and economic conditions, thereby promoting fairness and efficiency in the Indian tax system.

|

Who are “Specified Employees” under Section 17(2)(iii)? The concept of “specified employees” is important because certain perquisites are taxable only if they are provided to this category of employees. Section 17(2)(iii) of the Income Tax Act lays down the rules for identifying who qualifies as a specified employee. An employee is treated as a specified employee if he or she falls into any one of the following categories: Director of the company

Employee having substantial interest in the company

Employee with income above the prescribed threshold

Examples for Clarity Example 1: Director as Specified Employee

Example 2: Substantial Interest

Example 3: Salary Threshold

Why the Classification Matters Only specified employees are subject to taxation on certain types of perquisites such as the use of employer-owned cars, free or concessional education, or utilities. Non-specified employees may not face taxation on these perquisites in the same manner. With the latest notification, the salary threshold for being classified as a specified employee has been increased from fifty thousand rupees to four lakh rupees. This revision ensures that only employees at a reasonable salary level or higher, or those in positions of significant control, are covered. |

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

Anshul Goel

LegalMantra.net Team