View News

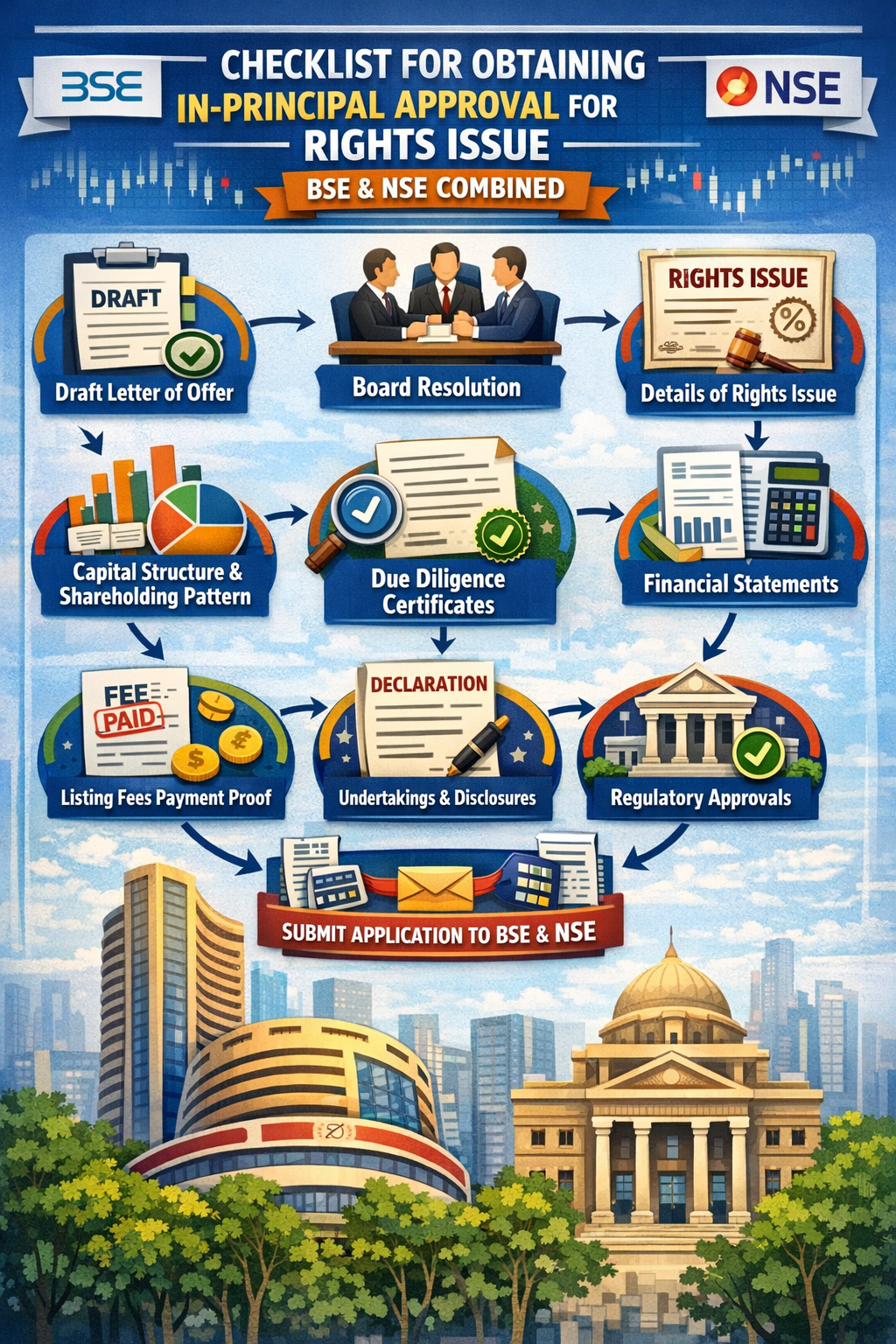

CHECKLIST FOR OBTAINING IN-PRINCIPAL APPROVAL FOR RIGHTS ISSUE- BSE & NSE COMBINED

CHECKLIST FOR OBTAINING IN-PRINCIPAL APPROVAL FOR RIGHTS ISSUE- BSE & NSE COMBINED

LIST OF DOCUMENTS

| Sr. No. | Particulars / Documents Required |

|---|---|

| 1 | Covering letter making application for In-principle approval for the proposed Rights Issue of the Company |

| 2 | Certified true copy of the Resolution passed by the Board of Directors for issue of securities under proposed Rights Issue |

| 3 | Certified true copy of the Resolution passed by the Shareholders, if any, approving: • Issue of convertible debt securities under proposed rights issue • Increase in authorised share capital (if required) |

| 4 | Details of Promoters: Where promoter is Individual: PAN, Bank Account Number, Passport Number Where promoter is Body Corporate: PAN, Bank Account Number, Company Registration Number or equivalent, Address of ROC |

| 5 | Undertaking from Managing Director / Company Secretary / Compliance Officer – Annexure A (BSE Only) |

| 6 | Confirmation from the Company – Annexure B (NSE Only) |

| 7 | Draft Letter of Offer |

| 8 | In case of Convertible Debt Instrument – Due Diligence Certificate from Debenture Trustee (Form B, Schedule V of SEBI (ICDR) Regulations, 2018) |

| 9 | If opted under Regulation 77B of SEBI (ICDR), 2018 – Details of allotment to specific investors along with disclosures in Draft Letter of Offer |

| 10 | Details of Monitoring Agency appointed under Regulation 82 of SEBI (ICDR), 2018 |

| 11 | Non-refundable Processing Fees (as applicable) |

| 12 | Processing Fee (including GST) |

| 13 | TDS, if any |

| 14 | Net amount remitted after TDS |

| 15 | UTR No./Cheque/Demand Draft No. |

| 16 | Date |

| 17 | Drawn on (Bank Name) |

PROCESSING FEES STRUCTURE

Main Board

0.025% of Issue Size

Minimum: Rs. 2,50,000

Maximum: Rs. 20,00,000

Plus GST

SME Board

0.025% of Issue Size

Minimum: Rs. 50,000

Maximum: Rs. 10,00,000

Plus GST

DISCLAIMER

THE CONTENTS OF THIS DOCUMENT ARE PROVIDED BASED ON CURRENT PROVISIONS AND INFORMATION AVAILABLE. WHILE EVERY EFFORT HAS BEEN MADE TO ENSURE ACCURACY AND RELIABILITY, NO RESPONSIBILITY IS ASSUMED FOR ANY ERRORS OR OMISSIONS. USERS ARE ENCOURAGED TO REFER TO APPLICABLE LAWS AND REGULATIONS. THIS INFORMATION IS NOT TO BE CONSTRUED AS LEGAL ADVICE, AND NO LIABILITY IS ACCEPTED FOR ANY CONSEQUENCES ARISING FROM ITS USE.

ANNEXURE A

(BSE ONLY)

Undertaking from Managing Director / Company Secretary

To,

The Manager,

Listing Operations,

BSE Limited,

Dalal Street,

Mumbai – 400001

Subject: Proposed Rights Issue (details & issue size) under SEBI (ICDR) Regulations, 2018

We hereby confirm:

-

Neither issuer nor promoters/directors is a wilful defaulter under Reg. 2(1)(lll) of SEBI (ICDR), 2018

OR

Promoter(s)/Director(s) is a wilful defaulter and disclosure made as per prescribed format. -

None of promoters/directors is a fugitive economic offender.

-

Equity shares are not suspended from trading (disciplinary measure).

-

Issue underwritten only to extent of entitlement excluding promoters/promoter group (if opted).

-

No violation of Regulation 34 of SEBI Delisting Regulations, 2021.

-

No restriction under SEBI Circular dated August 01, 2017.

-

Compliance with Companies Act, 2013, SEBI (ICDR) Regulations, 2018, SEBI Circular dated March 11, 2025 and other applicable provisions.

-

Entire issued capital is listed and fully paid-up.

-

Draft Letter of Offer includes disclosure regarding credit of REs and renunciation (SEBI Circular Jan 22, 2020).

-

Application only through ASBA.

-

No withdrawal allowed after issue closing date.

-

Neither issuer nor promoters/directors declared Fraudulent Borrower.

-

For SME Companies – if post issue paid-up capital exceeds Rs. 25 Crores, compliance with SEBI (LODR) Regulations applicable to Main Board shall be ensured.

Date:

Managing Director / Company Secretary

ANNEXURE B

(NSE ONLY)

Format of Confirmation

To,

Manager – Listing Compliance

National Stock Exchange of India Limited

Exchange Plaza, Bandra Kurla Complex

Mumbai – 400051

Subject: Application for In-principle Approval under Regulation 28(1) of SEBI (LODR), 2015

We confirm:

-

Shares issued shall rank pari passu.

-

Issue complies with SEBI (ICDR), 2018.

-

Promoters/directors not debarred from capital market.

-

No withdrawal after record date.

-

No promoter/director connected with debarred company.

-

No fugitive economic offender.

-

Shares not suspended.

-

No partly paid shares exist.

-

75% firm financial arrangements in place (excluding issue proceeds).

-

No violation of Delisting Regulations.

-

Promoter Details as below:

Promoter Details Table

| Name | PAN | Bank A/c No. | Passport No. | Company Regn. No.* | ROC Address* |

|---|

(*Applicable where promoter is body corporate)

Capital Structure

| Particulars | Amount |

|---|---|

| Issued Capital | |

| Listed Capital |

Other Pending Issues

| Type of Issue | No. of Shares | Date of Allotment | In-principle (Y/N) | Listing (Y/N) | Trading (Y/N) |

|---|

Processing Fees Details

| Particulars | Amount |

|---|---|

| Processing Fee | |

| GST | |

| TDS | |

| Net Amount Remitted | |

| Cheque/DD/NEFT No. | |

| Date | |

| Drawn on |

Contact Details

| Particulars | Details |

|---|---|

| Name & Designation | |

| Telephone (Landline & Mobile) | |

| Email ID |

Stock Exchanges where equity shares are listed: _______________________

Authorized Signatory

Date:

Disclaimer

The contents of this article are based on the legal provisions and regulatory framework in force as on the date of writing. While every effort has been made to ensure accuracy, no responsibility is assumed for any errors or omissions. Readers are advised to refer to the relevant statutes, rules, and regulations before acting upon the information contained herein. This article is intended for informational purposes only and does not constitute legal advice.

From the desk of CS Sharath