View News

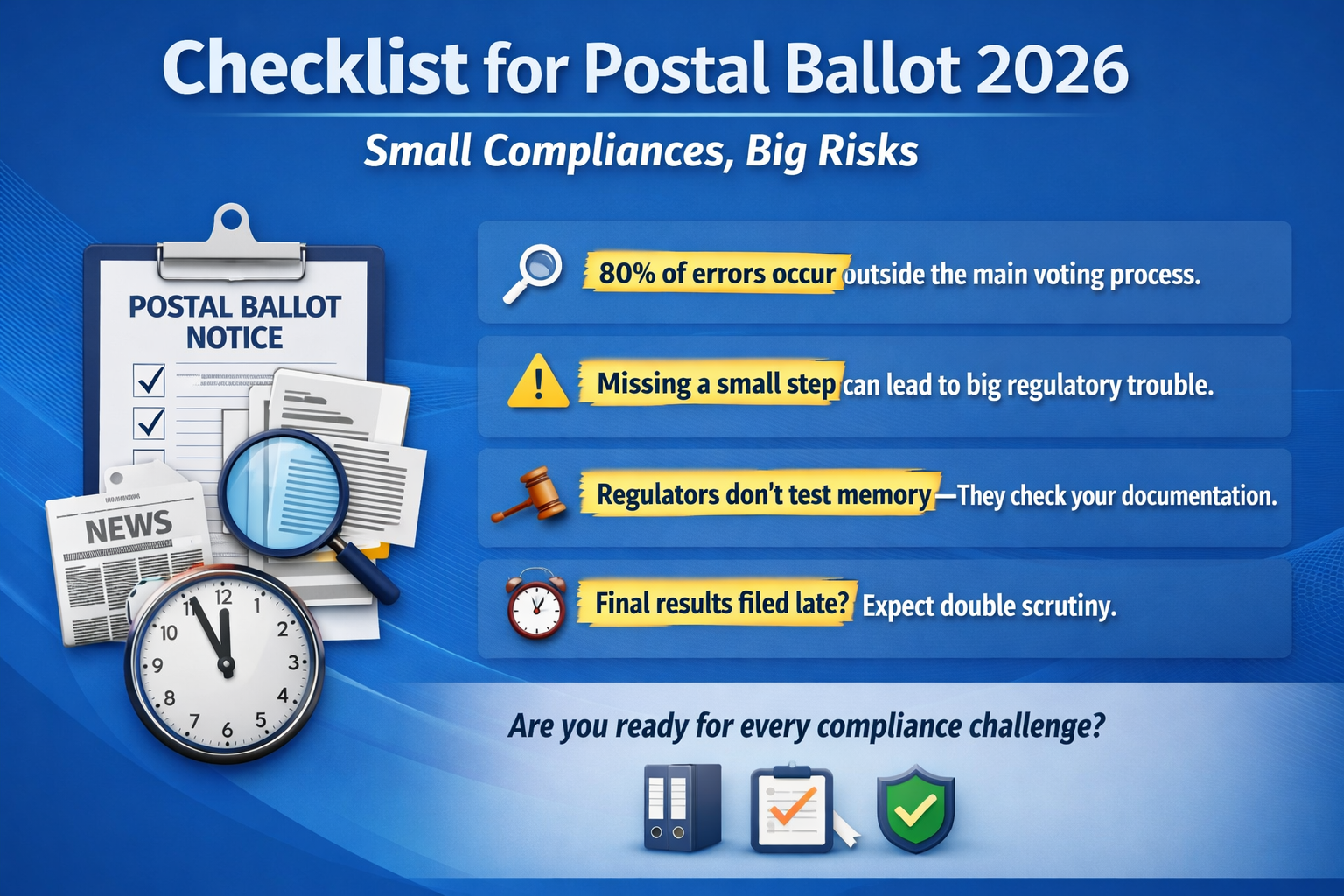

Checklist for Postal Ballot 2026: Why the Smallest Compliance Can Create the Biggest Risk

Checklist for Postal Ballot 2026: Why the Smallest Compliance Can Create the Biggest Risk

At 05:00 PM, my phone rang. A friend confidently told me that the Postal Ballot notice had been released and the newspaper advertisement published, and that the next step would be voting results intimation. One simple counter-question — “Did you file the newspaper advertisement intimation with the stock exchanges?” — was enough to halt the conversation. That pause said everything. It wasn’t negligence. It was a missed routine compliance that quietly creates regulatory exposure.

Interesting Fact:

Most Postal Ballot non-compliances do not occur during voting or result declaration — they occur in the supporting disclosures that teams assume are “obvious” and therefore skip.

Why Postal Ballots Fail Despite Best Intentions

Postal Ballot exercises receive intense attention because they are shareholder-facing and regulator-visible. Ironically, this attention is often misdirected toward the “main event” while the surrounding compliances — filings, uploads, intimation timelines — are treated as secondary. Over time, this creates gaps that only surface during SEBI scrutiny or investor complaints.

Interesting Fact:

SEBI rarely questions why a resolution was passed. The regulator focuses on how the process was executed.

Why Memory Is Not a Compliance Tool

After observing repeated misses by experienced professionals, I realised that memory is unreliable in a regulatory ecosystem that changes constantly. Circulars evolve, formats are revised, and timelines shift subtly. What worked in the previous year can fail silently in the current one. That is when I stopped relying on recall and built a working Postal Ballot checklist grounded in real filings and real scrutiny comments.

Interesting Fact:

Regulators do not test experience or intent — they test documented evidence.

Phase 1: Before You Even Call the Board Meeting

The seeds of Postal Ballot failure are usually sown before the Board Meeting is even scheduled. Issuing the Board Notice is important, but parallel coordination with the RTA and e-voting agencies is critical. Cut-off dates, benpos generation, and dispatch timelines must be aligned early, or the entire voting schedule becomes compressed and risky.

Interesting Fact:

Late coordination with RTAs is one of the most common reasons companies struggle to complete the full 30-day e-voting window.

Phase 2: The Board Meeting Is Your Legal Foundation

The Board Meeting must approve not only the concept of a Postal Ballot but also the precise resolutions, notice, scrutinizer appointment, and voting mechanics. Vague authorisations create legal ambiguity. Every resolution passed by the Board should mirror the language that will appear before shareholders.

Interesting Fact:

SEBI has flagged cases where Board approvals were generic but shareholder resolutions were specific — treating this mismatch as a governance lapse.

Phase 3: Drafting the Postal Ballot Notice

Postal Ballot Notices cannot be recycled. Legal provisions, SEBI LODR disclosures, and depository instructions evolve continuously. Drafting must balance statutory compliance with shareholder readability. A legally perfect notice that confuses shareholders still fails the governance test.

Interesting Fact:

Clear drafting and layout directly improve voting participation and reduce shareholder helpdesk queries.

Phase 4: E-Voting Setup and Benpos Control

Creating the EVSN, uploading schedules, and activating the voting window are procedural steps, but obtaining the benpos as on the cut-off date is foundational. This list defines who can vote and who cannot. Any discrepancy here can invalidate challenges raised later.

Interesting Fact:

In shareholder disputes, the benpos as on the cut-off date is the single most decisive document.

Phase 5: Dispatch Day — Where Most Risks Hide

Dispatch day starts the statutory clock. Notices must be emailed, uploaded on the website, sent to Directors and Auditors, and filed with stock exchanges. However, email bounce-backs are routinely ignored. Shareholders who never received the notice can later question the process — unless you have evidence of re-dispatch.

Interesting Fact:

3–5% of shareholder emails typically bounce, and failure to track this weakens the company’s defence in disputes.

Phase 6: The Voting Window Requires Active Monitoring

Publishing newspaper advertisements is mandatory, but uploading them on the website and filing them with stock exchanges is equally critical. Many companies miss this step and unknowingly violate Regulation 46. Monitoring participation and sending reminders, though optional, reflects strong governance.

Interesting Fact:

Voting participation often doubles in the last week when reminder emails are sent.

Phase 7: Results Declaration Is a Timed Compliance

Once voting closes, the scrutinizer prepares the report and the RTA generates Regulation 44 disclosures. Filing voting results within two working days is non-negotiable. Any mismatch in numbers can lead to re-filing and enhanced regulatory scrutiny.

Interesting Fact:

Revised or corrected voting result filings attract more scrutiny than first-time disclosures.

Phase 8: Documentation Is Your Long-Term Protection

Even after results are declared, ROC filings, Postal Ballot minutes, and a comprehensive compliance folder must be completed. Years later, when questions arise, this documentation — not explanations — becomes your shield.

Interesting Fact:

Most compliance challenges surface long after the transaction, when key personnel have already changed.

Beyond Compliance: The Shareholder Experience

Leading companies have shown that Postal Ballot notices can be compliant and intuitive. Hyperlinks, live indexes, contextual annexures, and visual e-voting flows reduce friction and empower shareholders to make informed decisions.

Interesting Fact:

Shareholders are more likely to vote when explanations are accessible exactly where doubt arises.

The One Lesson Every Company Secretary Learns

Postal Ballots are not merely regulatory exercises. They are trust-building mechanisms. Every disclosure, advertisement, and filing contributes to how shareholders perceive corporate governance. The real benchmark is simple — would you trust this process if you were on the other side?

Interesting Fact:

Strong governance processes reduce investor complaints more effectively than defensive legal drafting.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

Mayank Garg

LegalMantra.net team