View News

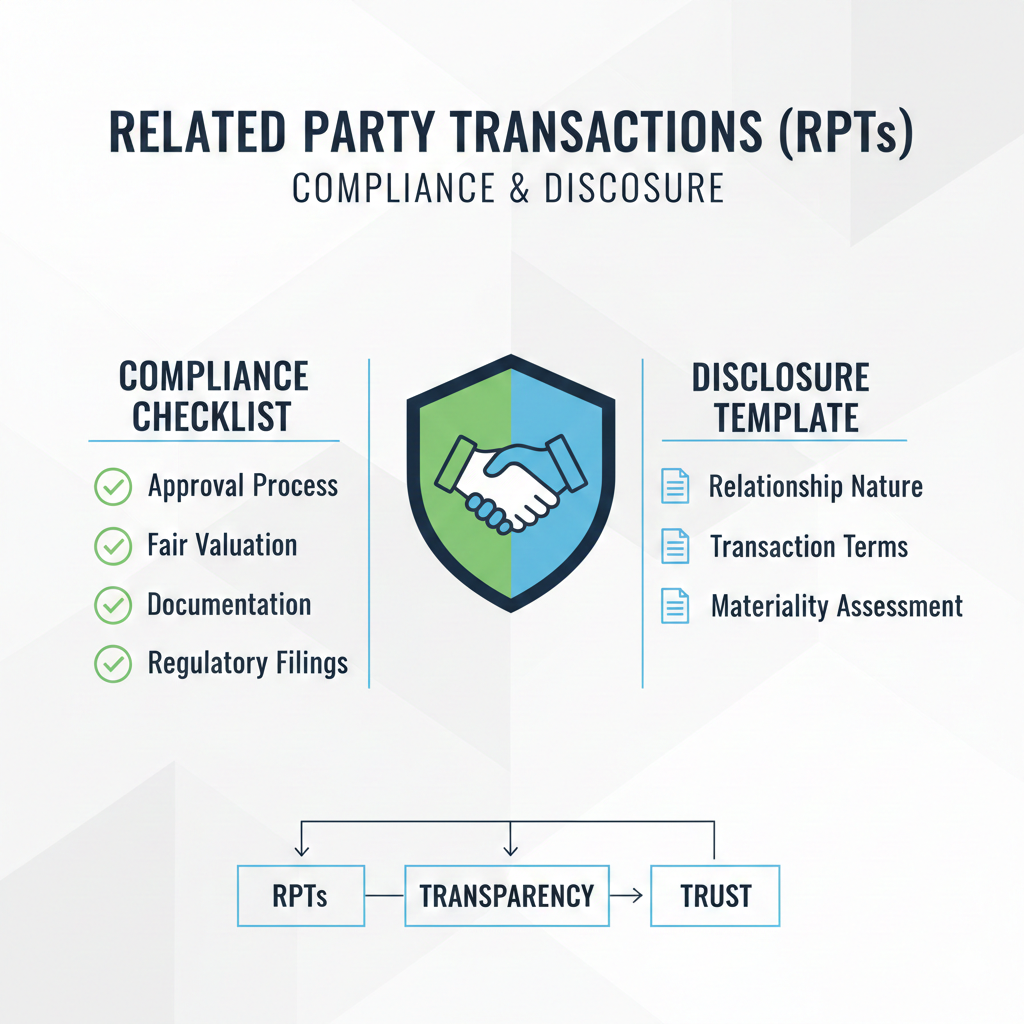

Compliance Checklist & Disclosure Template for Related Party Transactions (RPTs)

SEBI Circular No. SEBI/HO/CFD/CFD-PoD-2/P/CIR/2025/135 (October 13, 2025)

Compliance Checklist & Disclosure Template for Related Party Transactions (RPTs)

- Objective

To ensure compliance with SEBI Circular No. 135/2025, prescribing minimum and full information requirements for approval of Related Party Transactions (RPTs) under Regulation 23 of SEBI (LODR) Regulations, 2015.

- Applicability

- Applicable to all listed entities under SEBI (LODR) Regulations, 2015.

- Applies to all Related Party Transactions requiring Audit Committee or shareholder approval.

- Effective from 13 October 2025.

3. Thresholds & Information Category

|

Transaction Value |

Information Requirement |

Reference Annexure |

Remarks |

|

≤ Rs 1 crore (per year) |

No minimum information required |

- |

Exempt, but approval still required |

|

> Rs 1 crore but ≤ 1% of annual consolidated turnover or Rs 10 crore |

Minimum Information |

Annexure 13A |

Simplified disclosure |

|

> 1% of annual consolidated turnover or Rs 10 crore |

Full Information |

Industry Standards |

Detailed disclosure required |

4.Minimum Information Format – Annexure 13A

Table A: Minimum Information to the Audit Committee for Approval of RPTs

|

Sr. No. |

Information Required |

Details / Description |

|

a |

Type, material terms, and particulars |

Nature and details of the proposed transaction |

|

b |

Related party name and relationship |

Name of related party and its relationship (including financial or other interest) |

|

c |

Tenure |

Specific period of the proposed transaction |

|

d |

Value |

Total value of the proposed transaction |

|

e |

Turnover percentage |

Percentage of listed entity’s annual consolidated turnover represented by transaction value; for subsidiaries, also based on subsidiary’s standalone turnover |

|

f |

Loans / ICDs / Advances / Investments |

Additional details required: |

|

g |

Justification |

Reasons why the RPT is in the interest of the listed entity |

|

h |

Valuation / external report |

Copy of any external party report relied upon |

|

i |

Counter-party turnover percentage |

Voluntary disclosure of counter-party’s annual consolidated turnover impacted by the RPT |

|

j |

Other relevant information |

Any additional material information relevant to the approval |

Table B: Minimum Information to the Shareholders for Approval of RPTs

|

Sr. No. |

Information Required |

Details / Description |

|

a |

Summary information |

Summary of details provided to the Audit Committee (as per Table A) |

|

b |

Justification |

Explanation of why the proposed transaction is in the interest of the listed entity |

|

c |

Loans / ICDs / Advances / Investments |

Details as specified under Audit Committee point (f) |

|

d |

Valuation / external report availability |

Statement that any valuation or external report relied upon will be available via registered email of shareholders |

|

e |

Counter-party turnover percentage |

Voluntary disclosure of counter-party’s annual consolidated turnover affected by the RPT |

|

f |

Other relevant information |

Any additional material information relevant for shareholder decision-making |

5. Compliance Checklist

- Identify all related parties as per Regulation 2(1)(zb) of LODR & Section 2(76) of Companies Act, 2013.

- Compute 1% of consolidated turnover or ?10 crore threshold (whichever is lower).

- Categorize RPTs as Exempt, Simplified, or Full disclosure.

- Prepare Annexure 13A for simplified cases or full format for material RPTs.

- Obtain prior Audit Committee approval with relevant details.

- Where required, seek shareholder approval and ensure interested parties abstain from voting.

- Maintain cumulative tracking of RPTs with each related party throughout the financial year.

- Disclose RPTs quarterly to Stock Exchanges under Regulation 23(9) of LODR.

- Update internal RPT policy, Board templates, and disclosure formats to align with SEBI Circular 135/2025.

DISCLAIMER: THE CONTENTS OF THIS DOCUMENT ARE PROVIDED BASED ON CURRENT PROVISIONS AND INFORMATION AVAILABLE. WHILE EVERY EFFORT HAS BEEN MADE TO ENSURE ACCURACY AND RELIABILITY, NO RESPONSIBILITY IS ASSUMED FOR ANY ERRORS OR OMISSIONS. USERS ARE ENCOURAGED TO REFER TO APPLICABLE LAWS AND REGULATIONS. THIS INFORMATION IS NOT TO BE CONSTRUED AS LEGAL ADVICE, AND NO LIABILITY IS ACCEPTED FOR ANY CONSEQUENCES ARISING FROM ITS USE

From the desk of CS SHARATH