View News

Dissolution of Company and Claim over Undistributed Assets

Dissolution of Company and Claim over Undistributed Assets: Grover Leasing Ltd. v. Rank Suspension (P) Ltd.

Introduction

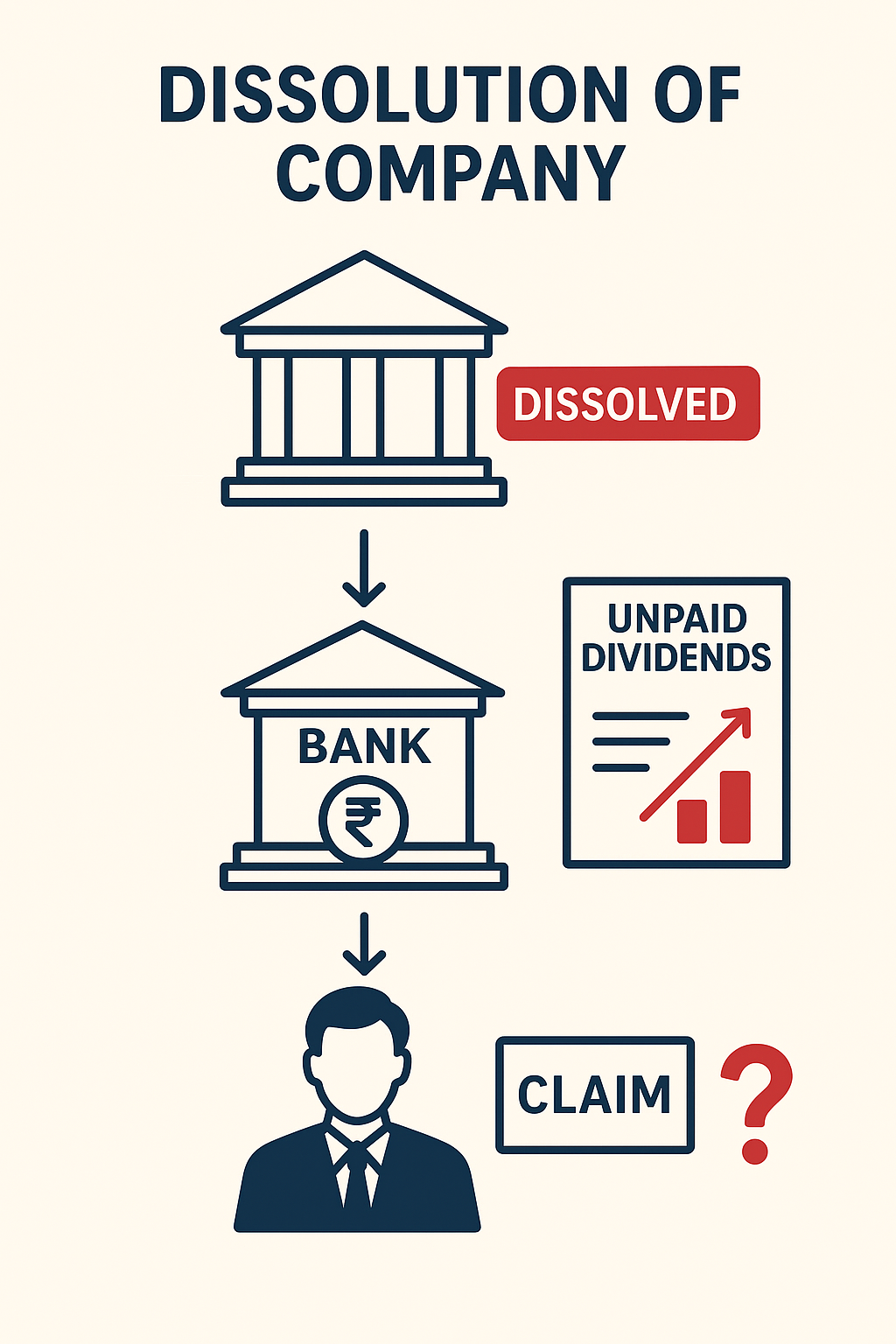

The dissolution of a company under the Companies Act entails a formal closure of its legal existence. However, the law recognizes that certain assets, particularly unpaid dividends and undistributed amounts, may remain unclaimed at the time of winding up. Section 555 of the Companies Act, 1956 (corresponding to Section 352 of the Companies Act, 2013) provides that such amounts shall be paid into the Companies Liquidation Account maintained with the Reserve Bank of India. Shareholders and creditors can subsequently claim these sums upon producing satisfactory evidence of entitlement.

The case of Grover Leasing Ltd. v. Rank Suspension (P) Ltd. is significant in clarifying the evidentiary burden placed on claimants who seek payment of amounts deposited in the RBI account after dissolution. It highlights the necessity of conclusive proof of shareholding or entitlement, and the judiciary’s reluctance to permit claims in the absence of substantive documentary evidence.

Facts of the Case

-

Company Dissolution: Rank Suspension (P) Ltd. was dissolved following winding-up proceedings under the Companies Act.

-

Deposit of Undistributed Assets: In compliance with statutory requirements, undistributed assets, including unpaid dividends, were transferred into the Reserve Bank of India’s Companies Liquidation Account.

-

Claim by Petitioner: Grover Leasing Ltd., claiming to be a shareholder of the dissolved company, approached the court seeking release of amounts standing to the company’s credit in the RBI account.

-

Supporting Evidence: The petitioner, however, failed to produce share certificates, share transfer records, register of members, or any official corporate record to establish that it was in fact a shareholder of Rank Suspension (P) Ltd.

Issue

The central issue before the court was:

Whether a claimant can successfully seek release of sums deposited into the RBI’s Companies Liquidation Account without furnishing conclusive documentary evidence proving that it was a shareholder or otherwise entitled beneficiary of the dissolved company.

Court’s Observations and Decision

-

Evidentiary Requirement: The court emphasized that the Companies Act places a clear obligation on claimants to establish their entitlement with evidence. Section 555(7) (Companies Act, 1956) specifically empowers the court to order payment of the deposited sums, but only when the claimant demonstrates a legitimate right.

-

Absence of Proof: The petitioner failed to provide the essential proof of shareholding. Mere assertion of being a shareholder, unsupported by company records or legal documentation, was deemed insufficient.

-

Burden of Proof: The burden rests squarely on the claimant to substantiate the claim. The court observed that allowing payment without proof would open the floodgates for speculative or fraudulent claims on unclaimed amounts lying with the RBI.

-

Outcome: The petition was rejected. The court held that Grover Leasing Ltd. could not be treated as a shareholder in the absence of any documentary proof and hence was not entitled to withdraw any sum from the Companies Liquidation Account.

Conclusion

The decision in Grover Leasing Ltd. v. Rank Suspension (P) Ltd. underscores the strict evidentiary standard governing claims to unclaimed dividends and undistributed assets after dissolution. The judgment reaffirms the principle that statutory deposits with the Reserve Bank of India can only be disbursed upon incontrovertible proof of entitlement.

For corporate stakeholders, this case serves as a practical reminder of the importance of maintaining updated records of shareholding and entitlement, particularly in situations where companies face liquidation. It also highlights the judiciary’s priority in safeguarding statutory funds against speculative or fraudulent claims.

Thus, the case aligns with the broader objective of corporate law: ensuring fairness, certainty, and accountability in the distribution of corporate assets post-dissolution.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc