View News

Due Diligence in M&A: A Critical Legal Analysis

Due Diligence in M&A: A Critical Legal Analysis

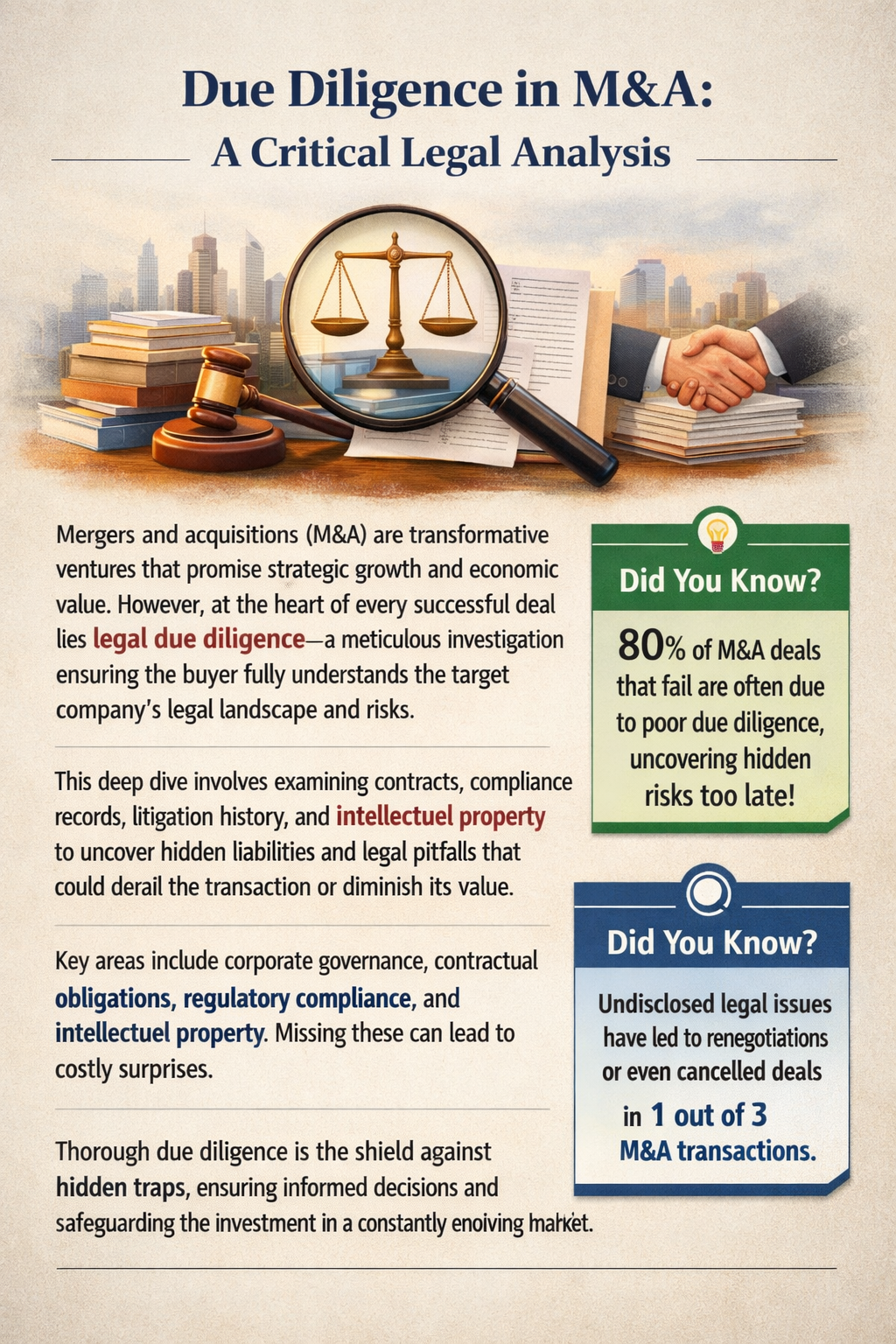

Mergers and acquisitions are often portrayed as bold corporate moves—headline-grabbing transactions that reshape industries, unlock synergies, and signal strategic ambition. Yet, behind every successful acquisition lies a rigorous, methodical, and often understated process: legal due diligence. Far from being a routine formality, legal due diligence operates as the deal’s risk radar—detecting hidden liabilities, clarifying legal exposures, and ensuring that the buyer steps into the transaction with eyes wide open.

At its core, legal due diligence is about informed decision-making. It enables the acquiring party to assess whether the target company is legally sound, compliant with applicable laws, and free from risks that could erode value post-acquisition. In a regulatory environment that is increasingly complex and unforgiving, this exercise has evolved from a checklist-driven review into a strategic legal investigation.

Understanding Legal Due Diligence in M&A

Legal due diligence involves a comprehensive examination of the target company’s legal ecosystem—its corporate records, contractual arrangements, regulatory filings, litigation history, compliance frameworks, intellectual property assets, and governance practices. The objective is simple yet critical: to identify legal risks, ambiguities, or liabilities that may materially affect the transaction’s valuation, structure, or feasibility.

This process typically commences after the execution of a confidentiality agreement or a letter of intent and continues through negotiations until deal closure. The findings are consolidated into a due diligence report, which becomes the backbone of transactional negotiations—shaping representations and warranties, indemnity provisions, closing conditions, and even the buyer’s ultimate decision to proceed.

Did you know? Many high-value M&A deals fail not because of financial mismatches, but due to legal risks discovered too late—often buried deep in contracts or compliance records.

Corporate Structure and Governance: The Legal Foundation

A critical starting point in legal due diligence is verifying the target’s corporate identity and governance framework. This includes reviewing constitutional documents, shareholder agreements, capital structure, statutory registers, and board and shareholder resolutions. Any inconsistency—such as improperly issued shares, missing approvals, or defective filings—can restrict post-acquisition control or even invalidate parts of the transaction.

Governance lapses often signal deeper issues. Weak board oversight, unresolved shareholder disputes, or non-compliance with corporate law requirements may translate into operational and reputational risks for the acquirer.

Did you know? Defective corporate authorisations have, in several cases, rendered post-acquisition decisions legally challengeable—long after the deal was closed.

Contracts and Commercial Obligations: Reading Between the Lines

Commercial contracts are where legal risk often hides in plain sight. Agreements with customers, suppliers, lenders, and strategic partners must be carefully reviewed to assess enforceability, duration, exclusivity, termination rights, and assignment provisions. Particular attention is paid to change-of-control clauses, which may allow counterparties to terminate or renegotiate contracts upon acquisition.

Unfavourable contractual terms can significantly affect deal economics. Early identification allows buyers to renegotiate pricing, seek waivers, or restructure the transaction to preserve value.

Regulatory Compliance: The Deal’s Make-or-Break Factor

Regulatory compliance is no longer a peripheral concern—it is central to deal viability. Legal due diligence must assess compliance with corporate laws, competition and antitrust regulations, environmental norms, labour laws, data protection frameworks, and sector-specific licensing requirements.

Non-compliance can invite penalties, regulatory intervention, forced divestitures, or even transaction prohibitions. In cross-border deals, the complexity multiplies as buyers must navigate overlapping jurisdictions and divergent regulatory philosophies.

Did you know? In several jurisdictions, antitrust authorities can unwind completed transactions if competition concerns surface post-closing.

Litigation and Disputes: Assessing the Shadow Risks

Pending or potential litigation poses both financial and reputational threats. Legal due diligence evaluates ongoing lawsuits, regulatory investigations, arbitration proceedings, and historical disputes to assess probable exposure. Even dormant claims can resurface post-acquisition, transferring liability squarely onto the buyer.

A clear understanding of litigation risk enables buyers to negotiate indemnities, escrow arrangements, or purchase price adjustments—effectively pricing risk into the deal.

Intellectual Property: Protecting the Core Value

For technology-driven and innovation-centric businesses, intellectual property is often the crown jewel. Legal due diligence must confirm ownership, registration validity, licensing arrangements, and freedom from infringement claims. Weak or poorly documented IP rights can severely dilute the strategic rationale of an acquisition.

Did you know? Inadequate IP assignments from founders or employees are among the most common—and costly—due diligence discoveries in startup acquisitions.

Consequences of Inadequate Legal Due Diligence

The cost of superficial due diligence can be staggering. Buyers may unknowingly inherit hidden liabilities—ranging from employee claims and tax exposures to environmental obligations—that disrupt operations and drain resources. Undisclosed risks often trigger last-minute renegotiations or deal collapses, while post-closing surprises can lead to shareholder disputes and reputational damage.

Perhaps most critically, overlooked legal issues complicate post-merger integration. Aligning compliance frameworks, contracts, and governance structures becomes exponentially harder when foundational risks were ignored at the outset.

Best Practices: Turning Due Diligence into Strategy

Effective legal due diligence is structured, collaborative, and forward-looking. Experienced legal teams rely on detailed checklists, while simultaneously applying judgment to identify deal-specific risks. Collaboration with financial, tax, and operational experts ensures that legal findings are assessed in a commercial context.

In today’s digital economy, cybersecurity and data protection due diligence has become indispensable. Evaluating data security practices, breach history, and privacy compliance can prevent regulatory sanctions and reputational fallout post-acquisition.

Did you know? Data protection violations discovered after acquisition can expose buyers to penalties for breaches that occurred before they even owned the company.

Structuring the Deal: From Due Diligence to Legal Protection

The true value of legal due diligence materialises in deal documentation. Representations, warranties, and indemnities are crafted based on diligence findings, allocating risk between buyer and seller. These provisions provide financial and legal recourse for post-closing surprises, safeguarding the buyer’s investment.

Conclusion

In the high-stakes world of mergers and acquisitions, legal due diligence functions as both shield and compass. It protects acquirers from unforeseen legal pitfalls while guiding strategic decision-making in complex transactions. By identifying, evaluating, and mitigating legal risks early, due diligence enhances deal certainty, preserves value, and lays the groundwork for seamless post-merger integration.

In an era of evolving regulations and heightened enforcement, ignoring legal due diligence is not just risky—it is commercially reckless. When executed thoughtfully, it ensures that the promise of growth and synergy is realised, rather than undone by overlooked legal realities.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

LegalMantra.net team

Prerna Yadav