View News

GST 2.0: A Legal and Economic Analysis of the New Regime

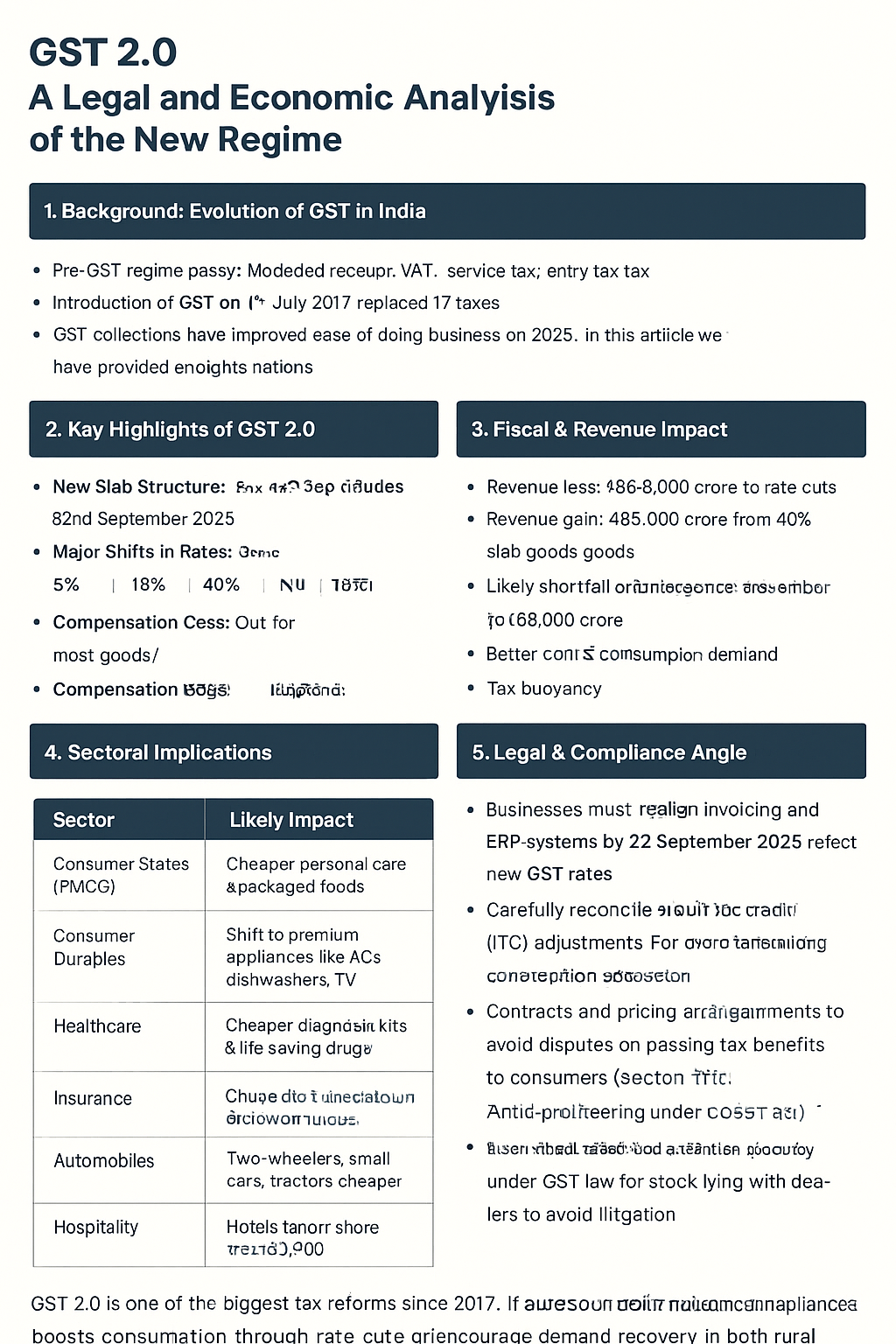

GST 2.0: A Legal and Economic Analysis of the New Regime

Date of Implementation: 22nd September 2025

Approved by: GST Council in its 53rd Meeting held on 3rd September 2025

1. Background: Evolution of GST in India

-

Pre-GST Regime: India followed a multi-layered indirect tax structure—Excise Duty, Service Tax, VAT, Entry Tax, Octroi, etc.—causing double taxation and compliance hurdles.

-

Introduction of GST (2017): Launched on 1st July 2017 as “One Nation, One Tax”, GST subsumed 17 taxes and multiple cesses into CGST, SGST, and IGST, enabling credit flow and seamless supply chains.

-

Achievements till Date:

-

Improved ease of doing business (World Bank ranking improved from 130 in 2017 to 63 in 2020).

-

E-way bill and GSTN digitisation streamlined logistics.

-

GST collections touched ?22.08 lakh crore in FY 2024–25, nearly double of FY 2020–21.

-

2. Key Highlights of GST 2.0

The reforms announced by the Council on 3rd September 2025 mark a rationalisation of GST slabs with the objective of boosting consumption-led growth and reducing litigation on classification disputes.

a. New GST Slab Structure

-

Existing multiple slabs (0%, 5%, 12%, 18%, 28% + cess) restructured.

-

New slabs effective from 22nd September 2025:

-

5% (essential goods and services)

-

18% (standard goods and services)

-

40% (luxury & sin goods)

-

Nil (specific exemptions for education, healthcare, insurance, defence items, etc.)

-

b. Major Shifts in Rate Changes

-

From 28% ? 18%: Small cars (engine capacity <1500cc>32”, ACs, dishwashers).

-

From 18% ? 5%: FMCG items (shampoo, soap, biscuits, chocolates), medical instruments, fertiliser & tractor inputs, footwear above ?2,500.

-

To 40% slab: Luxury vehicles, yachts, aircraft, pan masala, cigarettes, aerated drinks.

-

Exemptions: Paneer, roti, erasers, life-saving drugs, individual health & life insurance, defence supplies.

c. Compensation Cess

-

Abolished for most goods/services from 22nd Sept 2025.

-

Retained only for tobacco & allied products till loan obligations under the GST compensation fund are discharged (likely before Dec 2025).

3. Fiscal & Revenue Impact

-

Revenue loss: Approx. ?93,000 crore due to rate cuts.

-

Revenue gain: Approx. ?45,000 crore from 40% slab goods.

-

Net impact: Likely shortfall of ~?48,000 crore, but may be offset by:

-

Increased consumption demand.

-

Better GST compliance and tax buoyancy.

-

States compensating via higher excise and property taxes.

-

4. Sectoral Implications

| Sector | Likely Impact |

|---|---|

| Consumer Staples (FMCG) | Cheaper personal care & packaged foods; rural demand revival expected. |

| Consumer Durables | Shift to premium appliances (ACs, dishwashers, TVs) due to price rationalisation. |

| Healthcare | Cheaper diagnostic kits & life-saving drugs ? improved affordability. |

| Insurance | Exemption of health & life insurance to drive penetration, though ITC loss may affect insurers’ margins. |

| Automobiles | Two-wheelers, small cars, tractors cheaper; luxury car demand may soften due to 40% rate. |

| Hospitality | Hotels with tariff |

5. Legal & Compliance Angle

-

Businesses must realign invoicing and ERP systems by 22nd Sept 2025 to reflect new GST rates.

-

Input Tax Credit (ITC) adjustments to be carefully reconciled, especially for inventory purchased under old rates.

-

Contracts and pricing arrangements should be reviewed to avoid disputes on passing tax benefits to consumers (Section 171, Anti-profiteering under CGST Act).

-

Transitional provisions under GST law may need to be issued for stock lying with dealers to avoid litigation.

6. Conclusion

GST 2.0 is one of the biggest tax reforms since 2017, aiming at:

-

Simplifying compliance,

-

Boosting consumption through rate cuts,

-

Encouraging demand recovery in both rural and urban markets.

However, fiscal sustainability remains a challenge with the revenue shortfall. The government must strike a balance between affordability for consumers and revenue security for states.

As India moves towards its USD 5 trillion economy target, GST 2.0 could prove to be a cornerstone for consumption-led growth, provided compliance bottlenecks are smoothly addressed.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc