View News

GSTN Issues Advisory on Invoice Management System

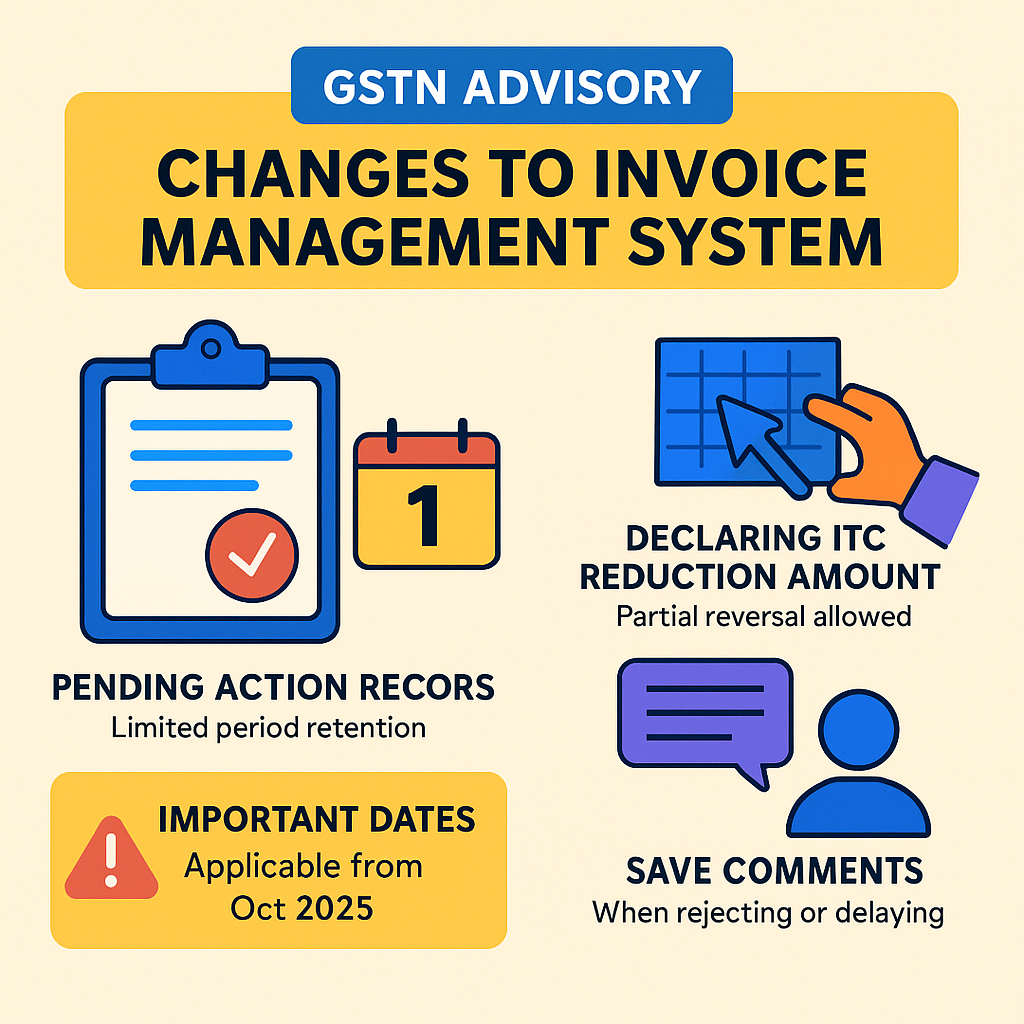

GSTN Issues Advisory on Invoice Management System: Key Changes for Businesses and Taxpayers

The Goods and Services Tax Network (GSTN) has recently issued an important advisory regarding significant changes to the Invoice Management System (IMS). These updates, effective from the October 2025 tax period, are aimed at reducing compliance burdens, ensuring accuracy in credit adjustments, and simplifying return filing proceduresfor taxpayers.

The advisory introduces several crucial changes concerning pending records, Input Tax Credit (ITC) reversal and declaration, and the introduction of remarks in the system. Businesses and tax professionals must take careful note of these modifications to avoid errors in compliance and prevent disputes during return reconciliation.

1. Pending Action Records – Limited Period Retention

One of the most notable changes introduced by GSTN concerns the time limit for keeping records in “pending” status.

-

For Monthly Taxpayers: Records can remain in pending status for only one month.

-

For Quarterly Taxpayers: The pending status is restricted to a single quarterly tax period.

The facility to mark certain records as pending is meant to provide flexibility in resolving disputes or discrepancies. However, it cannot be used indefinitely and must be resolved within the prescribed timeline.

Types of Records That Can Be Kept Pending

The following categories of documents are eligible to be marked as pending:

-

Credit Notes or Upward Amendments to Credit Notes

– Credit notes that increase tax liability can be kept pending temporarily. -

Downward Amendment of Rejected Credit Notes

– If an original credit note was rejected, any downward amendment can also be marked pending. -

Downward Amendments to Invoices/Debit Notes

– Allowed only where the supplier has filed GSTR-3B and the original invoice/debit note has been reported. -

E-commerce Operator (ECO) Document Downward Amendments

– Applicable only when both the GSTR-3B return and the original ECO document have already been accepted.

This measure ensures that disputes relating to credit notes, invoices, and ECO-documents can be systematically managed without overburdening taxpayers with repeated compliance filings.

2. Declaring ITC Reduction Amount

Another major update pertains to the declaration of Input Tax Credit (ITC) reversals. GSTN has provided clarity that brings relief to taxpayers:

-

No Reversal Needed Where ITC Not Availed: If a recipient has not claimed ITC on a particular invoice/document, no reversal is required.

-

Partial ITC Utilisation: Where ITC has been claimed only in part, the reversal will be limited to that exact portion.

-

Flexibility for Past Reversals: Taxpayers can use IMS to declare reversals that were made earlier in part or full.

Key Benefit

This provision ensures transparency in ITC adjustments and eliminates the risk of duplicate reversals. Taxpayers can now declare ITC reductions accurately, based on their actual utilisation, rather than facing blanket reversals on all documents.

3. New Feature: Saving Comments While Rejecting or Deferring Records

GSTN has introduced an optional feature that allows taxpayers to save comments/remarks at the time of rejecting or keeping a record pending.

-

These remarks will be stored in the system for future reference.

-

They will also be visible to suppliers in their GSTR-2B dashboard, enabling them to correct mistakes in subsequent filings.

This feature enhances communication between suppliers and recipients and reduces disputes by ensuring that reasons for rejections or delays are clearly documented.

4. Important Dates and Applicability

-

The changes will be applicable from the October 2025 tax period onwards.

-

Due dates will continue to be calculated based on the tax period mentioned by the supplier.

-

The provisions apply only to records/documents submitted by suppliers after implementation of the new IMS system.

Businesses must therefore carefully verify the effective period of each document and take timely corrective action while filing returns.

5. Practical Impact on Businesses

These changes in IMS are expected to bring several benefits for taxpayers:

-

Reduced Compliance Pressure: By allowing pending records for a limited duration, taxpayers get sufficient time to reconcile disputes without unnecessary penalties.

-

Clarity on ITC Adjustments: The system now prevents double reversals and allows precise reporting of ITC actually availed.

-

Enhanced Transparency: Optional remarks foster greater accountability between suppliers and recipients.

-

Simplified Dispute Management: Pending status, comments, and ITC declarations create a structured mechanism for handling mismatches.

Conclusion

The recent changes announced by GSTN in the Invoice Management System (IMS) represent a positive step towards rationalising GST compliance. By limiting the duration of pending records, clarifying ITC reversal obligations, and introducing optional remarks, the system balances compliance efficiency with business practicality.

Taxpayers and professionals must stay updated and adapt quickly to these changes from October 2025 onwards. Proper implementation of these provisions will not only prevent compliance failures but also ensure smooth credit flow and accurate return filing.

Author’s Note for LegalMantra.net:

These measures reflect the government’s broader intent to improve ease of doing business under GST. The IMS updates reduce procedural complexity while providing flexibility and transparency in handling mismatches—a long-standing concern for businesses and professionals alike.