View News

How the Financial Crisis Transformed Global Law and Indian Legal Systems

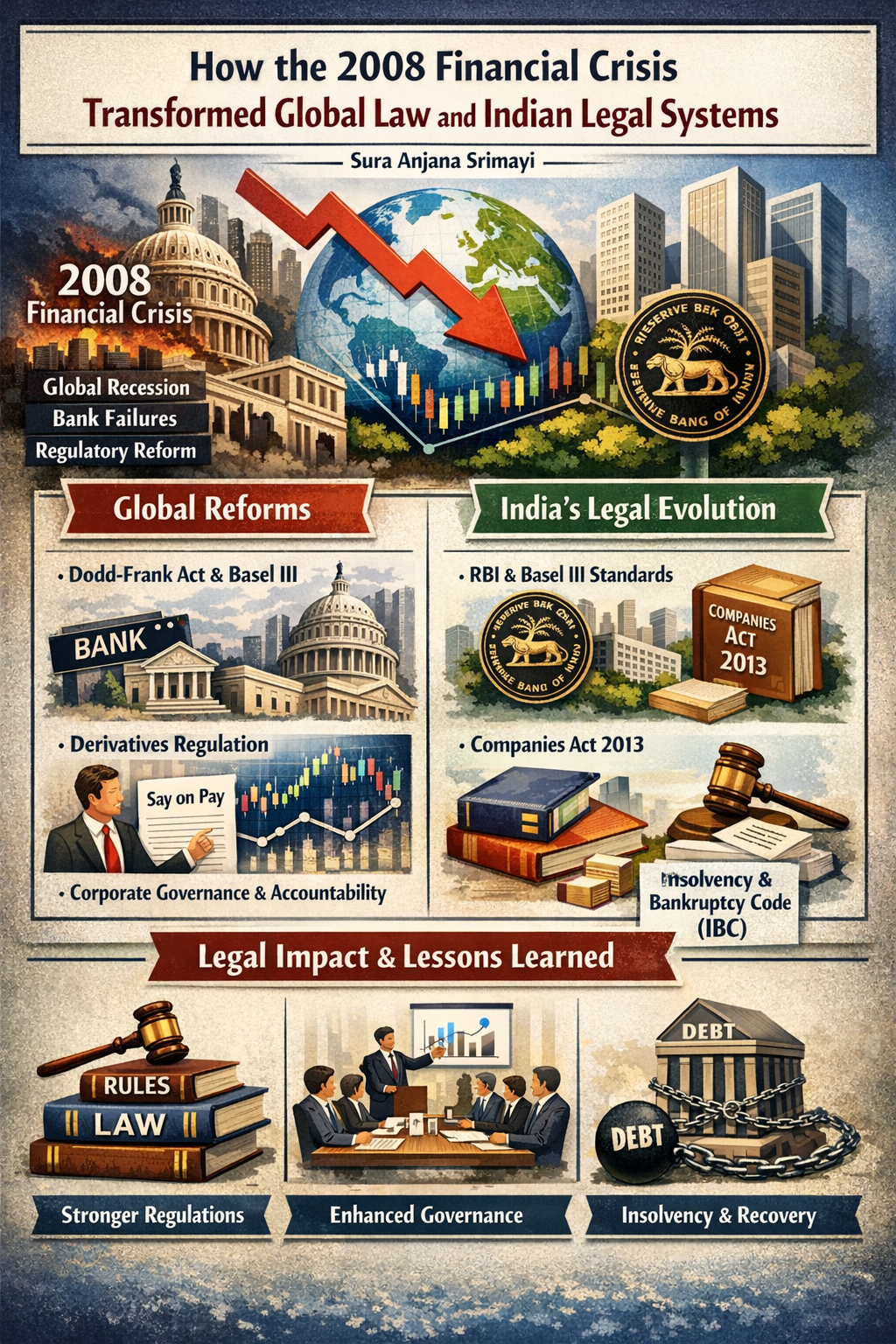

How the 2008 Financial Crisis Transformed Global Law and Indian Legal Systems

~Sura Anjana Srimayi

INTRODUCTION

2008 carved itself into world memory as the beginning of the worst financial crisis since the Great Depression. Initiated by the failure of the U.S. subprime mortgage market and the subsequent collapse of intricate financial derivatives, this crisis tore through global banking systems, immobilized credit markets, and pushed big economies into recession. Its far-reaching consequences reached far beyond economics, triggering a fundamental rethink of regulatory systems, corporate governance, and accountability systems across the globe.

Reimagining Regulation and Accountability

The immediate post-2008 crisis revealed glaring inadequacies in pre-crisis legal and regulatory frameworks in developed economies. The dominant philosophy of deregulation and self-regulation in the financial sector was undermined, opening the door for a new era of strong regulation.

1. Financial Regulation and Systemic Risk

At the international level, the crisis put the issue of "systemic risk" in the spotlight—risk of failure of a whole financial system or market, as opposed to the failure of a single firm or asset class. Legal measures concentrated on avoiding such chain failures.

Dodd-Frank Act (U.S.): The most wide-ranging legislative reaction was the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 in the United States. This historic law established tighter capital standards for banks, established the Financial Stability Oversight Council (FSOC) to track systemic risk, created the Consumer Financial Protection Bureau (CFPB), and instituted the "Volcker Rule" to restrict proprietary trading at banks. Its legal impacts were vast, requiring extensive compliance transformation on the part of financial institutions and pushing the scope of regulatory agencies.

Basel III Accords: Globally, the Basel Committee on Banking Supervision launched Basel III as a worldwide voluntary bank regulatory framework for bank capital adequacy, stress testing, and market liquidity risk. Not being legally binding as a treaty, however, its guidelines were adopted into national laws in large jurisdictions, compelling banks to maintain greater levels of capital, lower leverage, and enhance liquidity buffers. Such international pressure for more robust prudential regulation required reforms in the corporate treasury, risk management, and legal compliance divisions of banks globally.

Derivatives Regulation: The lack of transparency of the Over-The-Counter (OTC) derivatives market was one of the prime causes of the crisis. Post-2008 regulations, including Dodd-Frank and the European Market Infrastructure Regulation (EMIR), mandated centrally the clearing and exchange trading of standardized derivatives, and reporting for all derivatives trades. This dramatically raised transparency and lowered counterparty risk, involving significant legal effort to refinance outstanding contracts and implement new compliance procedures.

2. Executive Accountability and Corporate Governance

Failures of corporate governance, specifically executive pay and risk-taking incentives, were exposed during the crisis. Legal reforms attempted to restrain excessive risk-taking and position executive interests in line with long-term shareholder value.

"Say on Pay" and Clawbacks: Most jurisdictions established "say on pay" provisions, providing shareholders with non-binding approval on executive compensation. In addition, legislation was enacted or amended to permit the clawback of executive bonuses and compensation in instances of financial misstatements or misbehavior. These regulatory requirements altered corporate board duties and executive agreements.

Board Oversight: There was a growing legal focus on the function of independent directors and audit committees in monitoring risk management and internal controls, resulting in more rigorous legal responsibilities for board members.

3. Criminal and Civil Enforcement

The public outcry for accountability for individuals who allegedly brought about the crisis resulted in increased criminal and civil investigations.

More Prosecutions and Fines: Regulators and prosecutors brought legal action against banks for mortgage-backed securities misconduct, LIBOR rate manipulation, and money laundering. Although few senior executives were criminally convicted, financial institutions settled and paid billions of dollars in fines, marking a legal trend towards corporate responsibility and severe penalties for systemic abuses. The institutional legal staff were swamped by enforcement proceedings and litigation.

India's Resilience and Legal Evolution in the Post-2008 Era

India's financial sector was largely immune from the immediate effects of the 2008 crisis because of its conservative regulatory strategy, limited susceptibility to subprime loans, and overwhelmingly domestic-oriented economy. Nevertheless, global contagion led India to take affirmative steps in strengthening legal and regulatory systems from global experience.

1. Strengthening Regulation of the Financial Sector

Reserve Bank of India (RBI) and the Ministry of Finance implemented a number of legal and policy steps in order to make the Indian financial system more resilient:

Capital Adequacy and Basel III Implementation: India acted quickly to align its banking regulations with Basel III standards, even before most developed countries. The RBI made higher capital adequacy ratios, more stringent liquidity management guidelines, and more robust risk management practices for Indian banks compulsory through legal means. This involved banking law and regulation amendments placing more legal burdens on financial institutions.

Strengthening NBFC Regulation: The crisis underscored the vulnerabilities of non-banking financial companies (NBFCs). The RBI, through legislative amendments, tightened oversight of NBFCs, introducing stricter prudential norms, enhanced disclosure requirements, and clearer guidelines for asset-liability management. This expanded the legal and regulatory reach of the RBI to a broader segment of the financial system.

Derivatives Market Reforms: Indian derivatives markets were simpler compared to the West, but RBI and SEBI enforced legal reforms to enhance transparency and minimize risk in over-the-counter (OTC) derivative markets. They included reporting obligations for OTC derivatives and a phaseout of movement toward central clearing where possible, affecting legal documentation and compliance for market participants.

2. Corporate Governance and Investor Protection

The international emphasis on corporate governance resonated in India, and there were improvements in legal and regulatory standards.

Companies Act, 2013: Although not the sole reaction to 2008, enacting the Companies Act, 2013, ushered in bold reforms of corporate governance in the form of independent directors, added responsibility for audit committees, increased shareholder involvement, and higher disclosure standards. Most of these provisions drew from international best practices developed after the crisis to avoid corporate misconduct.

SEBI Regulations: SEBI, through its Listing Obligations and Disclosure Requirements (LODR) Regulations, 2015, further strengthened the governance requirements for listed companies, stressing transparency, protection of stakeholders, and greater compliance, particularly in financial reporting and related-party transactions.

3. Insolvency and Bankruptcy Code (IBC), 2016

Perhaps the single most revolutionary law reform that was shaped by the lessons of the crisis was the passage of the Insolvency and Bankruptcy Code (IBC), 2016. Though India's non-performing asset (NPA) crisis had domestic causes, the international crisis served to underline the imperative necessity of an effective legal regime for the resolution of corporate insolvency.

The IBC provided a unified, time-bound, and creditor-driven legal framework for resolving insolvencies, replacing a fragmented and inefficient system. This landmark legislation significantly altered the legal landscape for debt recovery, corporate restructuring, and the rights of creditors and debtors, ensuring that failing businesses could be resolved swiftly, minimizing economic contagion.

CONCLUSION

The financial crisis of 2008 was a harsh, worldwide wake-up call, illustrating the absolute interconnectedness of economies and the disastrous impact of regulatory failure. Its legal legacy is marked by a long-term movement toward tighter financial regulation, better corporate governance, and international focus on systemic risk prevention.

For India, the immediate effect was minimal, but the crisis had a strong role as a pre-emptive catalyst for anticipatory legal change. From strengthening banking regulations and enhancing corporate governance under the Companies Act to overhauling debt resolution through the IBC, India voluntarily aligned its legal systems. These reforms have served not only to reinforce its financial architecture but also to place India's legal framework near best global practices. The continued development of these legal tools indicates an ongoing global and national dedication to creating more robust, transparent, and accountable financial systems, so that lessons from the "Great Recession" continue to inform the contours of law for decades to come.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

LegalMantra.net team