View News

India Transition Towards a High?Growth, Resilient and Structurally Transforming Economy

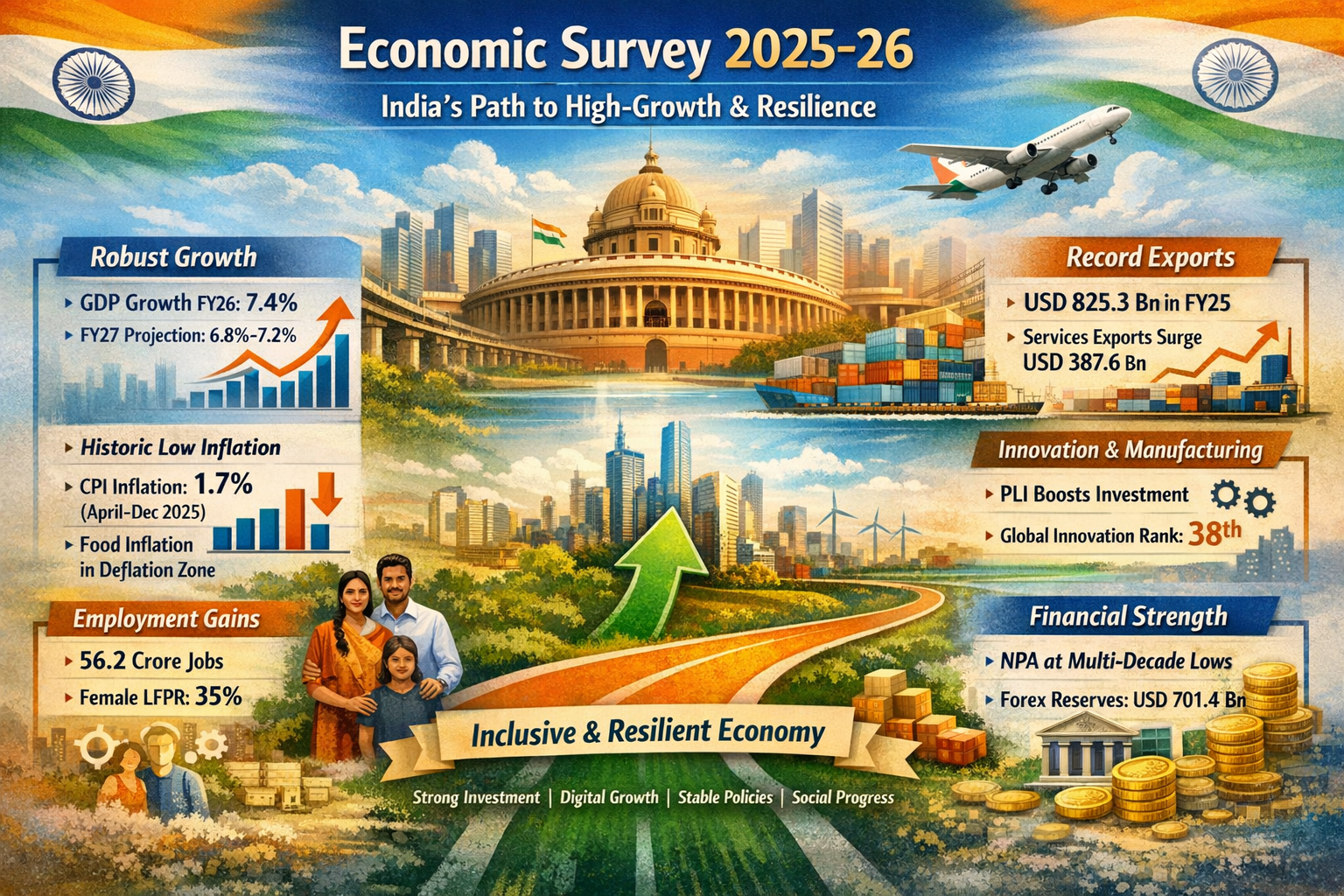

Economic Survey 2025–26: India’s Transition Towards a High Growth, Resilient and Structurally Transforming Economy

The Economic Survey 2025–26 offers one of the most comprehensive narratives of India’s macroeconomic evolution in recent decades. Far from being a routine statistical document, the Survey captures India’s transition from post pandemic recovery to a phase of sustained, broad based and structurally resilient growth. Against a backdrop of global slowdown, geopolitical fragmentation, supply chain realignments and monetary tightening in advanced economies, India has emerged as a rare outlier—combining high growth, low inflation, fiscal consolidation and financial stability. The Survey underscores that India’s current growth momentum is not accidental or purely cyclical, but the outcome of coordinated fiscal, monetary and structural policy interventions.

Macroeconomic Stability and Growth Momentum

India entered FY26 with strong economic momentum supported by stable macroeconomic fundamentals. As per the First Advance Estimates, real GDP growth for FY26 is placed at 7.4 per cent, while Gross Value Added (GVA) is estimated to grow by 7.3 per cent. What makes this performance notable is the composition of growth: it is broad based across agriculture, industry and services, and increasingly driven by domestic demand rather than external dependence. The Survey estimates India’s potential growth at around 7 per cent, with real GDP growth for FY27 projected in the range of 6.8 to 7.2 per cent, reflecting durable medium term growth capacity even amid global uncertainty.

An important structural insight highlighted in the Survey is the rising contribution of private consumption, which has reached its highest share of GDP in over a decade. This reflects rising household incomes, improved tax compliance, expanding formal employment and a gradual shift towards a consumption?led growth model that is more internally resilient. Public capital expenditure has complemented this trend by crowding in private investment, especially in infrastructure?linked sectors.

Historic Disinflation and Policy Credibility

One of the most striking features of FY26 has been India’s success in achieving historically low inflation. Average headline CPI inflation during April–December 2025 moderated sharply to 1.7 per cent, the lowest since the CPI series began. This disinflationary trend was not limited to headline numbers alone but was broad?based, encompassing food, fuel and core components. The Survey notes that food inflation even entered deflationary territory during certain months—an exceptionally rare occurrence in India’s economic history.

This inflation moderation reflects effective supply?side management, improved agricultural output, easing global commodity prices and strong policy coordination between the Centre and the Reserve Bank of India. Among major emerging market economies, India recorded one of the sharpest declines in inflation during 2025, reinforcing policy credibility and providing monetary authorities with space to support growth without compromising price stability.

Agriculture and Rural Demand as a Stabilising Anchor

Agriculture and allied activities continued to play a stabilising role in India’s growth cycle. The sector is estimated to grow by 3.1 per cent in FY26, supported by a favourable monsoon and improved crop performance. Agricultural GVA expanded by 3.6 per cent in the first half of FY26, significantly higher than the previous year. The Survey highlights that allied activities such as livestock and fisheries, growing at a steady rate of 5–6 per cent, have become critical drivers of income diversification in rural India.

An interesting structural insight is the role of agriculture not merely as a growth contributor, but as a demand stabiliser. Improved rural incomes have supported consumption of FMCG goods, two wheelers and entry?level consumer durables, thereby linking rural prosperity directly to industrial and services sector growth.

Industry and Manufacturing: From Recovery to Structural Momentum

The industrial sector gained further traction in FY26, with overall industrial growth projected at 6.2 per cent. Manufacturing, in particular, has emerged as a key growth engine, with GVA growth accelerating sharply in the first two quarters of FY26. The Survey emphasises that this is not a short?term rebound but evidence of a structural recovery driven by policy reforms, infrastructure investment and rising capacity utilisation.

Government initiatives such as the Production Linked Incentive (PLI) schemes have played a catalytic role in revitalising manufacturing. As of September 2025, PLI schemes across fourteen sectors have attracted actual investments exceeding Rs 2 lakh crore, generated incremental production worth over Rs 18 lakh crore and created more than 12 lakh jobs. These outcomes highlight a strategic shift from import substitution to building globally competitive manufacturing ecosystems integrated into global value chains.

The Survey also draws attention to India’s improving innovation landscape. India’s rank in the Global Innovation Index improved to 38th in 2025 from 66th in 2019, reflecting stronger linkages between manufacturing, research, startups and technology adoption. This reinforces the idea that India’s manufacturing growth is increasingly knowledge and innovation driven rather than purely labour?intensive.

Services Sector: The Backbone of India’s Growth Model

The services sector remains the dominant pillar of India’s economy. Estimated to grow by 9.1 per cent in FY26, services now account for over half of India’s GDP and GVA, reaching historic highs. The Survey highlights that India has become the world’s seventh largest exporter of services, with its share in global services trade more than doubling over the last two decades.

Services exports reached an all time high in FY25, driven by strong demand for IT, financial, professional and digitally delivered services. An important insight from the Survey is the resilience of services exports even during periods of global trade slowdown, making services a key buffer against external shocks. The sector also remains the largest recipient of foreign direct investment, underscoring global confidence in India’s human capital and digital capabilities.

Employment Trends and Labour Market Transformation

India’s labour market continued to demonstrate resilience alongside economic expansion. Total employment for persons aged 15 years and above reached 56.2 crore in FY26, reflecting steady job creation. Key labour indicators show rising labour force participation, a declining unemployment rate and improving female participation, which crossed 35 per cent—an important milestone for inclusive growth.

The Survey also highlights the growing formalisation of the labour market. Employment in organised manufacturing increased significantly, while digital platforms such as e?Shram and the National Career Service expanded coverage of unorganised and gig workers. An interesting structural development is the increasing role of platform?based employment, which has prompted the government to integrate gig and platform workers within the social security framework under the labour codes.

Trade, External Sector and Global Integration

India’s external sector performance reflects diversification, resilience and strategic recalibration. Total exports reached record levels in FY25 and remained strong in FY26, driven primarily by services exports and non?traditional merchandise segments. India’s share in global merchandise exports has steadily increased, while its services exports have positioned the country as a global hub for technology and knowledge?based services.

The Survey notes that India ranks among the most diversified trading nations in the Global South, reducing vulnerability to tariff shocks and geopolitical disruptions. Strong foreign exchange reserves, providing import cover of nearly eleven months, along with record remittance inflows, have significantly strengthened India’s external buffers and macroeconomic resilience.

Industrial Output and Infrastructure?Led Expansion

High?frequency indicators such as the Index of Industrial Production and the Index of Eight Core Industries signal synchronised industrial recovery. Strong growth in sectors such as cement, steel, automobiles and electronics reflects sustained infrastructure spending and robust domestic demand. The Survey highlights that infrastructure development has emerged as a powerful multiplier, generating spill?over effects across manufacturing, logistics, energy and construction.

Fiscal Consolidation with Growth Orientation

A key theme of the Survey is India’s success in strengthening fiscal credibility without sacrificing growth. Improved revenue buoyancy, expansion of the direct tax base and disciplined expenditure management have supported fiscal consolidation. The share of direct taxes has increased significantly, reflecting better compliance and rising incomes.

Public capital expenditure has remained central to the growth strategy, rising to historically high levels and crowding in private investment. At the same time, the general government debt to GDP ratio has declined steadily, reinforcing macro?fiscal sustainability.

Financial Sector Strength and Credit Expansion

India’s financial system remains robust and well capitalised. Banking sector indicators show multi decadal lows in non?performing assets, strong capital adequacy and improving profitability. Monetary policy actions during FY26 supported liquidity, credit flow and investment, with particular momentum in MSME lending.

An important behavioural shift highlighted in the Survey is the growing financialisation of household savings. Increasing participation of households in equity and mutual fund markets reflects rising financial awareness, improved digital access and deepening capital markets.

Conclusion: A Confident and Credible Growth Narrative

The Economic Survey 2025–26 presents a confident narrative of an economy that has successfully balanced stability with momentum. Broad-based growth, historically low inflation, improving employment indicators, strong external buffers and a resilient financial system collectively point to strengthening economic fundamentals. As India moves into the next phase of development, the Survey underscores the importance of sustaining public and private investment, fostering innovation-led productivity, deepening financial and social inclusion, and maintaining institutional and policy credibility.

Equally significant is the Survey’s emphasis on long-term resilience over short-term acceleration, highlighting structural reforms, fiscal discipline and human capital development as the cornerstones of durable growth. Together, these elements position India to remain one of the most influential and reliable drivers of global economic growth, capable of navigating external uncertainties while advancing inclusive, sustainable and high-quality development in the years ahead.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

Anshul Goel

LegalMantra.net team