View News

MCA & SEBI Important Amendments – January 2026

MCA & SEBI Important Amendments – January 2026

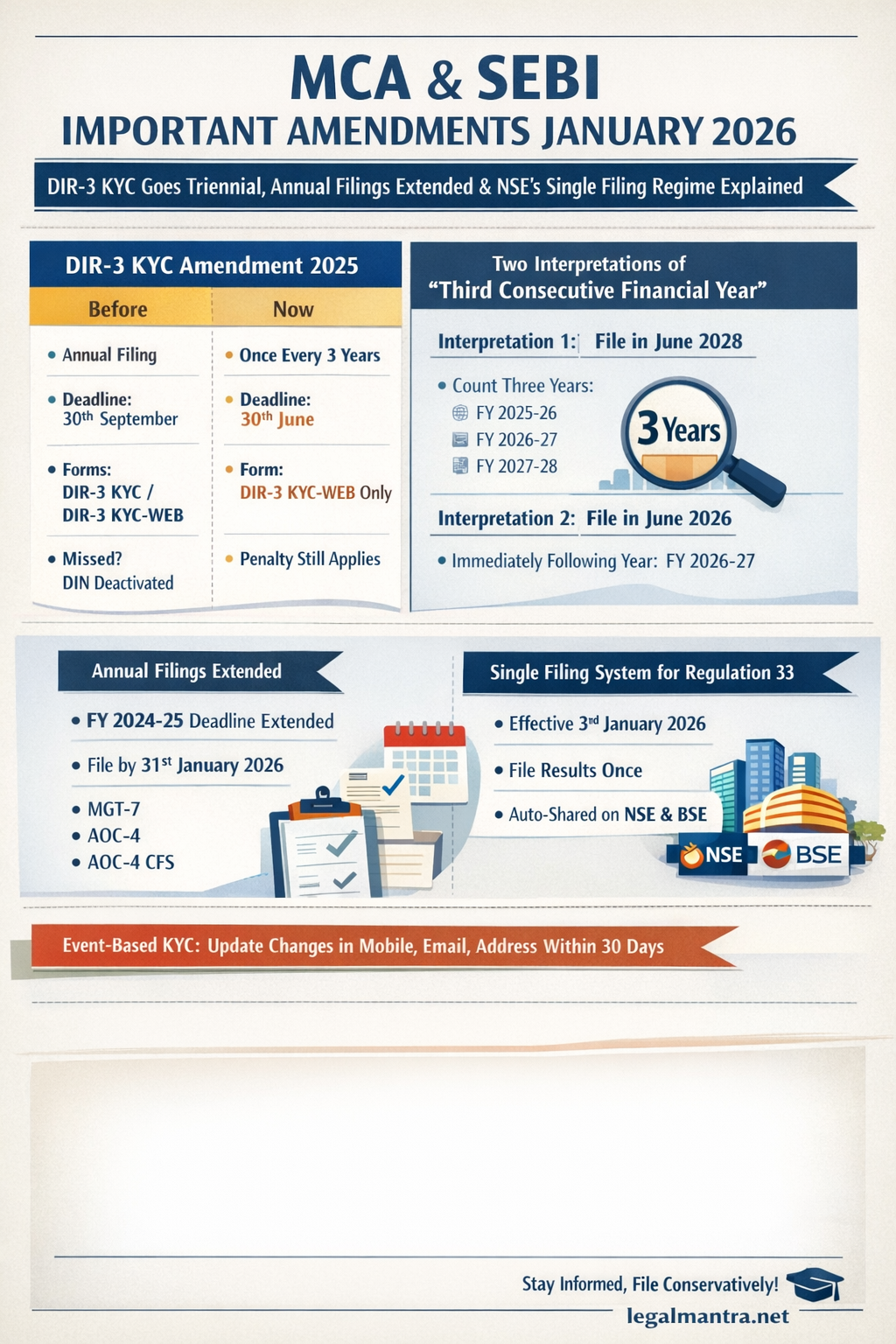

DIR-3 KYC Goes Triennial, Annual Filings Extended & NSE’s Single Filing Regime Explained

1. Introduction: Why January 2026 Matters for Compliance Professionals

December 2025 and early January 2026 have quietly delivered some of the most impactful regulatory changes for Company Secretaries in recent years. While none of these amendments appear dramatic at first glance, their practical consequences are significant, particularly for director compliance, annual filings, and stock exchange disclosures.

Among these changes, the DIR-3 KYC amendment stands out—not merely because it reduces frequency, but because it introduces interpretational ambiguity that could materially affect DIN status if misunderstood. This article distills what truly matters, explains competing interpretations, and provides a risk-safe compliance approach.

2. DIR-3 KYC Amendment, 2025: From Annual Burden to Triennial Compliance

2.1 What Changed on 31 December 2025

The Ministry of Corporate Affairs notified the Companies (Appointment and Qualification of Directors) Amendment Rules, 2025, bringing a single but transformative change:

Director KYC is no longer an annual compliance.

It is now required once every three financial years.

This marks a clear departure from the long-standing annual DIR-3 KYC regime and aligns with the government’s broader objective of reducing repetitive compliance without diluting oversight.

2.2 Compliance Position Before the Amendment (Up to FY 2024-25)

Until FY 2024-25, the position was straightforward:

-

DIR-3 KYC had to be filed every year

-

Due date: 30 September

-

Forms available: DIR-3 KYC or DIR-3 KYC-WEB

-

Non-filing resulted in DIN deactivation

The system was rigid, unforgiving, and operationally burdensome—especially for professionals managing multiple directors.

2.3 Compliance Position After the Amendment (Effective 31 March 2026)

From 31 March 2026 onwards:

-

DIR-3 KYC is required once every three financial years

-

New due date: 30 June

-

Only DIR-3 KYC-WEB remains

-

Penalty and DIN deactivation provisions continue unchanged

The filing window has been shortened (from six months to three), but the overall burden has reduced substantially due to triennial filing.

3. The Real Issue: When Is the First Filing Due?

The amendment introduces the following phrase:

“on or before 30th June of the immediately following every third consecutive financial year”

For Company Secretaries, this wording raises an immediate red flag. The language allows two equally plausible interpretations, each leading to a different compliance deadline.

4. Interpretation One: Filing After Completion of Three Financial Years

Under this interpretation, the phrase “third consecutive financial year” is treated as a counting instruction.

-

Reference year: FY 2025-26 (DIN active as on 31 March 2026)

-

Three consecutive years:

-

FY 2025-26

-

FY 2026-27

-

FY 2027-28

-

-

Filing due by: 30 June 2028

This interpretation provides a long transition window and aligns with a literal reading of “third consecutive financial year.”

5. Interpretation Two: Filing in the Immediately Following Financial Year

The second interpretation places greater emphasis on the phrase “immediately following”.

-

FY 2025-26 ends on 31 March 2026

-

The “immediately following” compliance window is 30 June 2026

-

The word “third” is read as describing frequency, not the first trigger point

Under this view, directors must file by 30 June 2026, after which the three-year cycle begins.

6. Why Both Interpretations Appear Legally Sound

Supporters of the first view argue that:

-

The amendment became effective on 31 March 2026

-

The wording explicitly mentions “third consecutive financial year”

-

Therefore, filing should arise only after three years are completed

Supporters of the second view counter that:

-

Every financial year carries its own compliance obligations

-

Historically, KYC for a financial year is filed immediately thereafter

-

There is no express exemption granted for FY 2025-26

Notably, MCA has not yet issued a clarification circular, leaving professionals to rely on risk assessment.

7. Practical Risk Analysis: Why Conservative Compliance Wins

Consider a director whose DIN is active on 31 March 2026.

-

If filing is done by 30 June 2026 and later it is clarified that the due date was 2028—there is no adverse consequence.

-

If filing is deferred until 2028 and MCA expects compliance by June 2026—the DIN risks being marked non-compliant, potentially triggering deactivation and consequences under Section 164.

In compliance practice, early filing is always safer than delayed interpretation.

8. One Point Beyond Interpretation: Event-Based KYC Updates Remain Mandatory

Regardless of the triennial cycle, the following rule is not debatable:

Any change in a director’s:

-

Mobile number

-

Email ID

-

Residential address

must be updated within 30 days through DIR-3 KYC-WEB.

This requirement is event-based, independent of the three-year filing cycle, and continues to attract fees under the Companies (Registration Offices and Fees) Rules, 2014.

9. What Company Secretaries Should Do Now

-

Adopt the conservative approach and file DIR-3 KYC-WEB by 30 June 2026

-

Create alerts for personal data changes of directors

-

Maintain a centralized KYC record folder with SRNs and acknowledgements

-

Proactively inform directors—many remain unaware of the amendment

10. Annual Filing Deadline Extended for FY 2024-25

Through General Circular No. 08/2025 dated 30 December 2025, MCA has extended the due date for filing annual returns without additional fees until 31 January 2026.

Forms Covered:

-

MGT-7 / MGT-7A

-

AOC-4 / AOC-4 CFS

-

AOC-4 XBRL

-

AOC-4 NBFC (Ind AS)

This extension provides crucial relief to companies still completing statutory audits or board approvals.

11. NSE Circular: Single Filing System for Regulation 33

Effective 3 January 2026, NSE has operationalized API-based integration for Regulation 33 filings.

Key Impact:

-

Financial results need to be filed only once on either NSE or BSE

-

The system automatically shares disclosures with the other exchange

Applicability:

-

Equity-listed companies

-

Equity + debt-listed companies

Exclusions include exclusively debt-listed entities, REITs, and InvITs (guidance awaited).

12. Additional MCA Update: Small Company Status Visibility

MCA has introduced a “Small Company” status tab in the master data section, improving transparency and reducing ambiguity during compliance verification.

13. Conclusion: Less Compliance, More Responsibility

The DIR-3 KYC amendment represents a genuine shift toward ease of doing business. However, reduced frequency does not eliminate responsibility. Interpretation risks, event-based filings, and strict penalties continue to demand professional vigilance.

For Company Secretaries, the message is clear:

Know the law, manage the risk, and file conservatively.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

Mayank Garg

LegalMantra.net team