View News

POSH Annual Return Deadlines Explained – A Detailed Compliance Guide for 2025–26

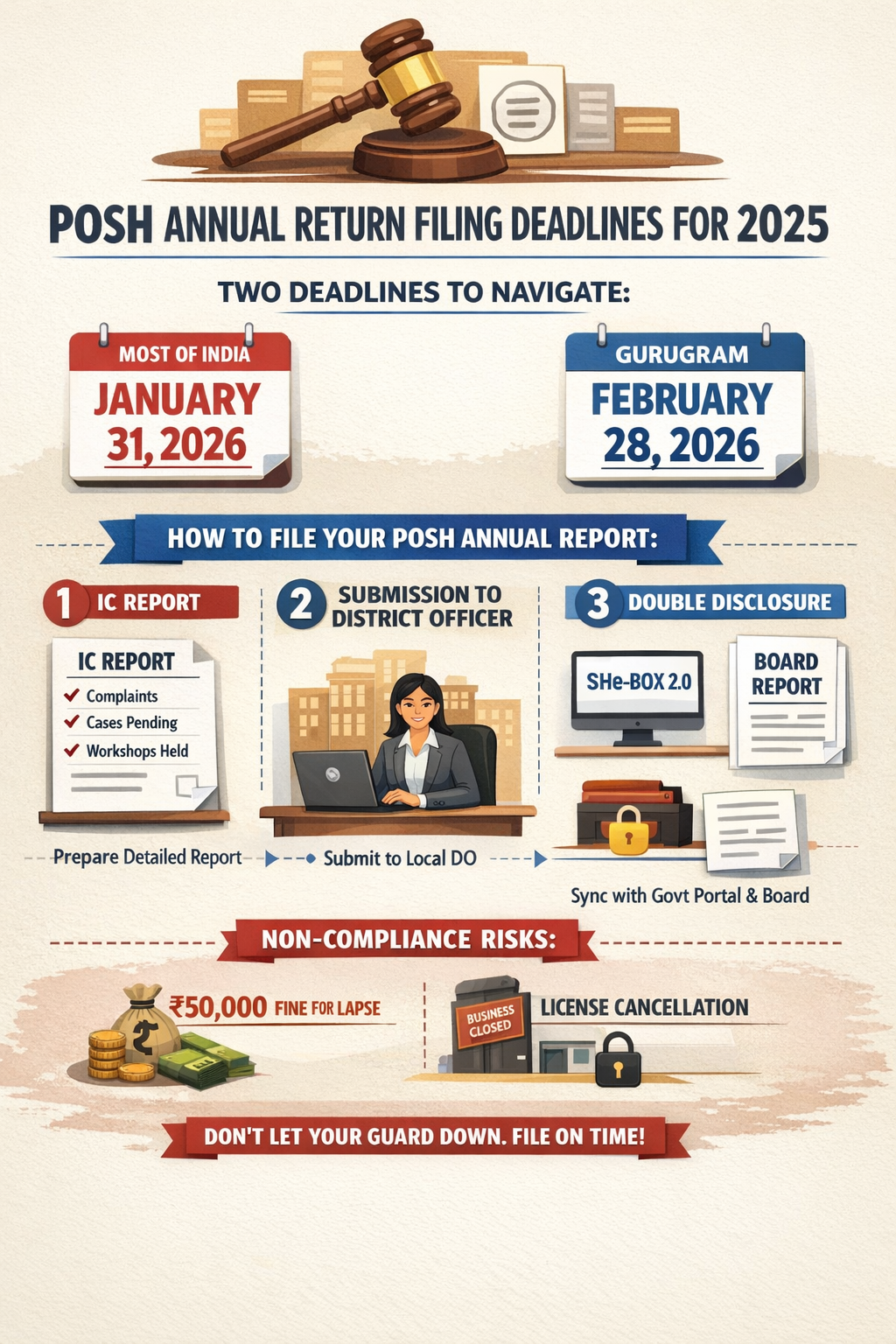

January 31st or February 28th?

POSH Annual Return Deadlines Explained – A Detailed Compliance Guide for 2025–26

1. Introduction

The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 (POSH Act) casts a statutory obligation on every establishment in India having ten or more employees to ensure a safe and dignified working environment for women. One of the most critical annual compliances under this framework is the filing of the POSH Annual Return.

While organisations are generally preoccupied with financial closures, audits and board compliances during the last quarter of the financial year, POSH compliance often remains overlooked. This oversight can prove costly, as regulatory authorities have significantly intensified scrutiny in recent years.

For the calendar year 2025 (January to December), employers must be particularly careful about timelines, as POSH filing is no longer governed by a uniform national deadline but by district-wise practices.

2. Is There a Uniform POSH Annual Return Deadline?

The POSH Act and the POSH Rules, 2013 do not prescribe a single nationwide due date for submission of the annual report. Instead, Rule 14 requires the Internal Committee to submit its report to the employer, who in turn is required to forward the same to the District Officer.

Over time, District Officers across India have developed their own filing mechanisms and timelines, which are now being strictly enforced.

2.1 The Generally Followed Deadline – 31 January 2026

Across most districts in India, the unwritten but consistently enforced deadline for filing the POSH Annual Return is 31 January of the year following the relevant calendar year. Accordingly, for the calendar year 2025, the widely accepted deadline is 31 January 2026.

Compliance professionals should treat this date as the default cut-off unless a district-specific notification provides otherwise.

2.2 The Gurugram Exception – 28 February 2026

For establishments located within the jurisdiction of Gurugram, Haryana, the District Officer has formally prescribed a later deadline. Organisations operating in Gurugram are required to submit the POSH Annual Return on or before 28 February 2026.

This extension is district-specific and cannot be applied to other NCR locations such as Delhi or Noida.

2.3 Practical Rule for Employers

Employers must verify the requirement applicable to each district in which they operate. Many District Officers now issue local notifications, prescribe specific Google Form links, or mandate submission through designated official email addresses. Reliance on past practices without verification can lead to non-compliance.

3. Applicability of POSH Annual Return Filing

The obligation to file the POSH Annual Return applies to every establishment that:

(a) Employs ten or more persons; and

(b) Is required to constitute an Internal Committee under Section 4 of the POSH Act.

This requirement applies irrespective of the legal structure of the organisation and covers companies, LLPs, partnership firms, trusts, NGOs, and start-ups.

Importantly, the obligation exists even if no sexual harassment complaint was received during the year.

4. Step-by-Step POSH Annual Return Filing Process

POSH compliance is not limited to a single document submission. It involves coordination between the Internal Committee, management, HR and compliance teams.

4.1 Preparation of Internal Committee Report

Under Rule 14 of the POSH Rules, 2013, the Internal Committee is required to prepare an annual report on the employer’s letterhead. The report must be duly signed by the Presiding Officer of the Committee.

The report must contain the following particulars:

(a) Number of complaints of sexual harassment received during the year;

(b) Number of complaints disposed of during the year;

(c) Number of cases pending for more than ninety days along with reasons;

(d) Number of awareness or sensitisation programmes conducted; and

(e) Nature of action taken by the employer on the recommendations of the Internal Committee.

This report forms the foundational document for all further disclosures.

4.2 Submission to the District Officer

The employer is required to submit the Internal Committee report to the District Officer having jurisdiction over the establishment.

4.2.1 Multiple Locations

If an organisation has offices in more than one district, a separate POSH Annual Return must be filed with each respective District Officer. For example, offices located in Delhi, Gurugram and Noida require three independent filings.

4.2.2 Mode of Filing

Several District Officers now mandate electronic filing through Google Forms or designated government email IDs. Physical submission with stamped acknowledgement is increasingly being treated as secondary evidence rather than the primary mode of compliance.

5. Additional Mandatory Disclosures

Filing the POSH Annual Return with the District Officer is no longer sufficient by itself.

5.1 SHe-Box 2.0 Compliance

Employers must ensure that the Internal Committee is registered on the SHe-Box 2.0 portal and that details relating to committee composition and case status are updated. Failure to register or update information may invite regulatory action.

5.2 Disclosure in the Board’s Report

In case of companies, the data disclosed in the POSH Annual Return must be consistent with the disclosures made in the Director’s Report under the Companies Act, 2013. Any discrepancy between the Internal Committee report, SHe-Box data and Board disclosures may result in penalties under corporate law in addition to POSH-related consequences.

6. Importance of Filing NIL Returns

A common misconception among employers is that no filing is required if no sexual harassment complaints were received during the year. This assumption is incorrect.

A NIL return serves as evidence that the Internal Committee is properly constituted and functional, and that the employer has taken preventive measures through awareness and sensitisation initiatives. In enforcement proceedings, a NIL return often becomes critical proof of compliance with the POSH Act.

7. Consequences of Non-Compliance

Failure to file the POSH Annual Return can result in penalties of up to fifty thousand rupees under the POSH Act. Repeated non-compliance may lead to enhanced penalties and cancellation or non-renewal of business licences.

Following recent judicial and administrative directions strengthening workplace safety enforcement, inspections and audits have increased significantly, making timely compliance essential.

8. Conclusion

POSH compliance is not merely a procedural requirement. It reflects the organisation’s commitment to lawful governance, workplace dignity and ethical responsibility.

Employers should plan well in advance, verify district-wise filing requirements, and ensure alignment between Internal Committee records, SHe-Box disclosures and Board-level reporting. Timely and accurate filing of the POSH Annual Return is no longer optional; it is a core component of corporate compliance culture.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc

Mayank Garg

LegalMantra.net team