View News

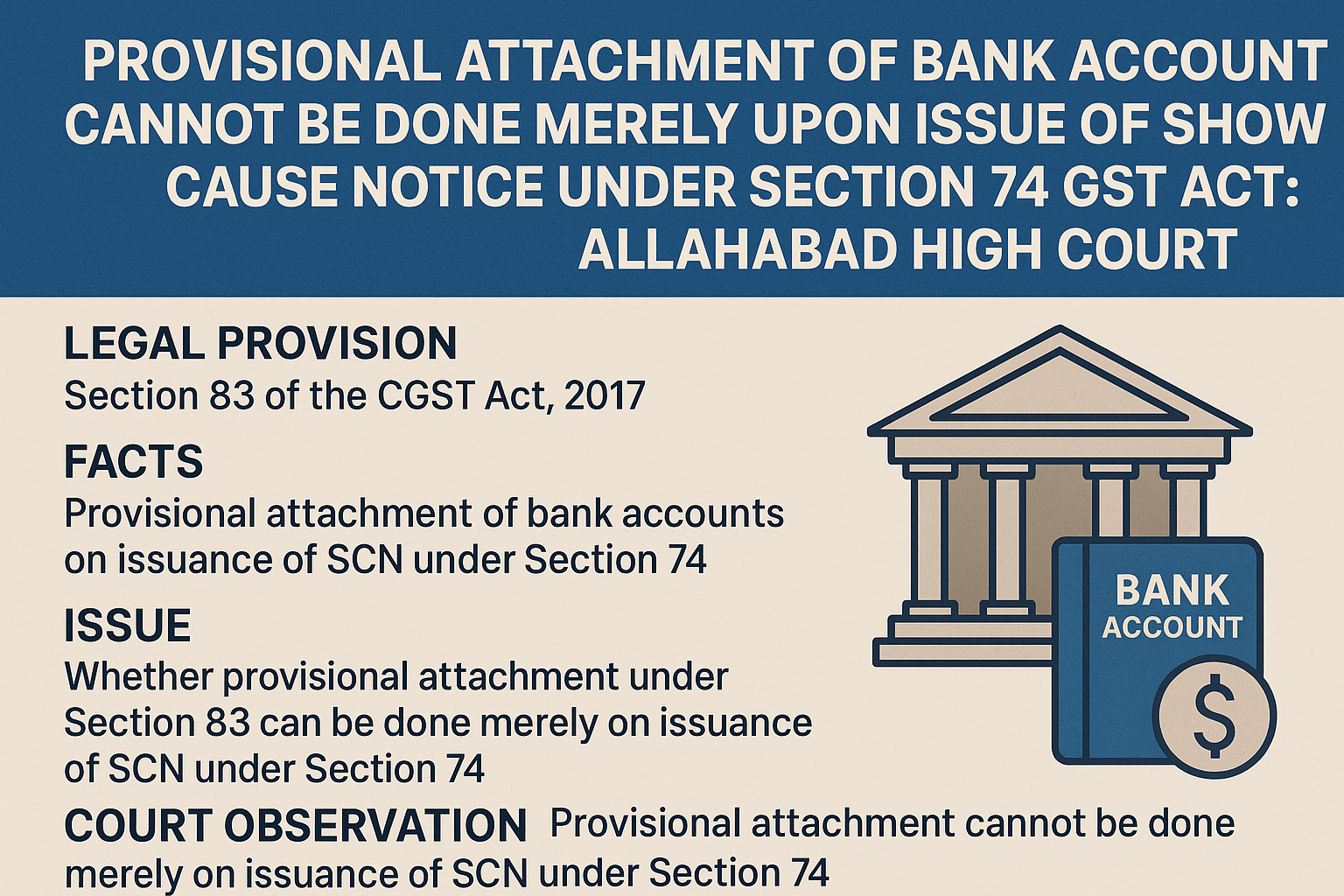

Provisional Attachment of Bank Accounts Cannot Be Done Merely Upon Issue of Show Cause Notice under Section 74 GST Act: Allahabad High Court

Provisional Attachment of Bank Accounts Cannot Be Done Merely Upon Issue of Show Cause Notice under Section 74 GST Act: Allahabad High Court

Introduction

The power of provisional attachment under the Goods and Services Tax (GST) regime has consistently attracted judicial scrutiny due to its drastic implications on taxpayers. Recently, the Allahabad High Court reiterated the principle that such attachment of bank accounts cannot be exercised in a routine manner, especially not merely upon the issuance of a show cause notice under Section 74 of the Central Goods and Services Tax Act, 2017 (“CGST Act”). The Court relied on the binding precedent of the Supreme Court in Radha Krishan Industries v. State of Himachal Pradesh and its earlier decision in R.D. Enterprises v. Union of India, to restrict arbitrary exercise of this extraordinary power by the tax authorities.

Legal Provision

-

Section 83 of the CGST Act, 2017: Empowers the Commissioner to provisionally attach property, including bank accounts, of a taxable person to protect the interest of government revenue, during the pendency of certain proceedings.

-

Section 74 of the CGST Act, 2017: Provides for determination of tax not paid or short paid due to fraud, wilful misstatement, or suppression of facts. A show cause notice is the initial step before adjudication under this section.

-

Judicial Precedents:

-

Radha Krishan Industries v. State of H.P. [(2021) 6 SCC 771]: The Supreme Court held that provisional attachment is a drastic measure that should not be exercised in a mechanical manner. The Commissioner must form an opinion on the necessity of attachment based on tangible material.

-

R.D. Enterprises v. Union of India [2021 (46) G.S.T.L. 113 (All.)]: The Allahabad High Court held that mere issuance of a notice under Section 74 does not justify attachment of bank accounts.

-

Facts of the Case

-

The petitioner was issued a show cause notice under Section 74 of the CGST Act alleging short payment of tax.

-

Soon thereafter, the respondent authorities provisionally attached the petitioner’s bank accounts under Section 83.

-

The petitioner challenged this action before the High Court, contending that such attachment was wholly unjustified, disproportionate, and contrary to law.

-

The revenue authorities argued that the attachment was necessary to protect government revenue pending adjudication.

Issues

-

Whether provisional attachment of bank accounts under Section 83 can be ordered merely upon the issuance of a show cause notice under Section 74?

-

Whether the Commissioner formed a proper opinion based on tangible material to justify the provisional attachment?

-

Whether such attachment violated the principles of proportionality and the constitutional rights of the petitioner?

Court’s Observations

-

The Court noted that provisional attachment is a draconian power that affects the very ability of an assessee to conduct business. Such power must be exercised with utmost caution.

-

Relying on Radha Krishan Industries, the Court reiterated that the Commissioner must record reasons and form an independent opinion that attachment is necessary to protect revenue.

-

The Court emphasized that mere issuance of a show cause notice does not imply an imminent threat to revenue recovery, as adjudication is yet to be completed.

-

Referring to its own precedent in R.D. Enterprises, the Court observed that attaching bank accounts without concrete material is arbitrary and violates Article 14 and Article 19(1)(g) of the Constitution.

-

The attachment order, therefore, was found to be unsustainable in law.

Conclusion

The Allahabad High Court reaffirmed that provisional attachment under Section 83 of the CGST Act cannot be invoked mechanically upon the mere issuance of a show cause notice under Section 74. The ruling underscores the need for tax authorities to exercise restraint and adhere to judicially recognized principles of proportionality and fairness. This judgment strengthens taxpayer protection by ensuring that their right to carry on trade or business is not hampered unnecessarily through arbitrary freezing of bank accounts.

The decision serves as a reminder to GST authorities across India that extraordinary powers must be exercised with responsibility, backed by cogent reasons, and only in cases where the interest of revenue is genuinely at risk.

Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc