View News

Recent Judicial Developments in Corporate and Securities Law: A Case Law Analysis

Recent Judicial Developments in Corporate and Securities Law: A Case Law Analysis

Introduction

The Indian corporate law framework has undergone significant transformation with the enactment of the Companies Act, 2013, and the strengthening of the regulatory regime under the Securities and Exchange Board of India Act, 1992 (“SEBI Act”). The judiciary, particularly the Supreme Court of India and High Courts, has played a pivotal role in interpreting these statutory provisions and setting benchmarks for corporate governance, securities regulation, and criminal liability in corporate frauds. This article analyses recent case laws that shed light on critical issues such as insider trading, fraudulent incorporation, related party transactions, cheque dishonour, private placement of securities, and locus standi in company restoration proceedings.

Legal Provisions in Context

-

Companies Act, 2013 – Provisions relating to fraud (Sections 447, 271(c)), related party transactions (Section 188), restoration of companies (Section 252), and winding up of fraudulent companies.

-

SEBI Act, 1992 and SEBI (Prohibition of Insider Trading) Regulations, 2015 – Prohibiting trading while in possession of unpublished price sensitive information (UPSI).

-

Negotiable Instruments Act, 1881 – Section 138 (dishonour of cheque) and Section 141 (liability of company and officers).

-

Code of Criminal Procedure, 1973 (CrPC) – Section 167(2) relating to the right to default bail.

-

Tamil Nadu Protection of Interests of Depositors (TNPID) Act, 1997 – Governing public deposits and fraudulent financial establishments.

-

SEBI (Stockbrokers and Sub-Brokers) Regulations, 1992 – Requirements for registration and fee structure for intermediaries.

Judicial Pronouncements

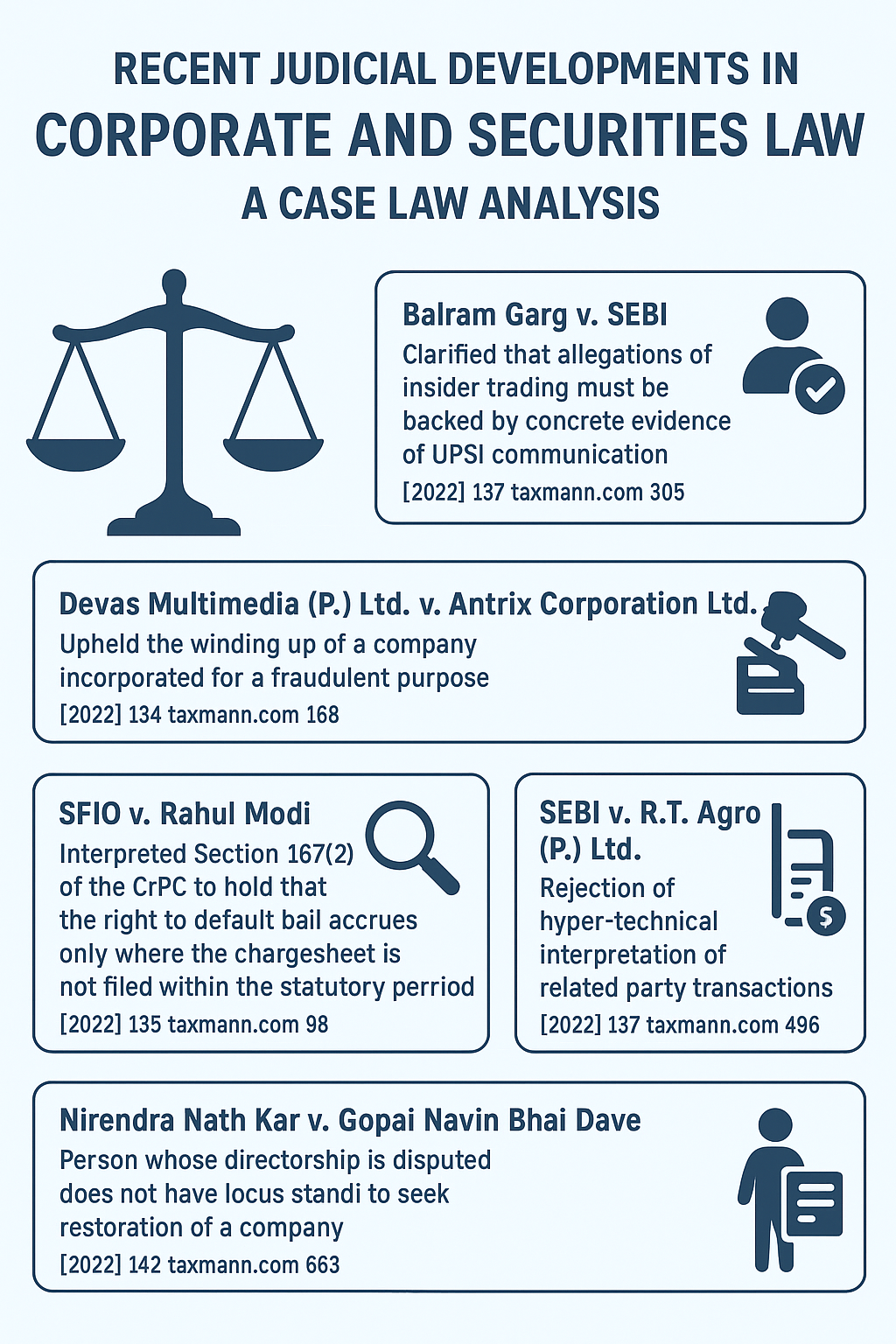

The Supreme Court in Balram Garg v. SEBI ([2022] 137 taxmann.com 305) clarified that allegations of insider trading must be backed by concrete evidence of UPSI communication, and that circumstantial evidence such as close relations, timing of trades, or trading patterns cannot, by themselves, establish guilt. This ruling strengthens the jurisprudence on strict proof of insider trading under the SEBI Regulations.

Similarly, in Devas Multimedia (P.) Ltd. v. Antrix Corporation Ltd. ([2022] 134 taxmann.com 168), the Court upheld the winding up of a company incorporated for a fraudulent purpose, holding that fraud under Section 271(c) of the Companies Act, 2013, is wider than contractual fraud and encompasses the very incorporation of a company as a device to defraud. Importantly, it ruled that the absence of adverse auditor reports does not immunize a company from winding up when fraud is otherwise established.

In SFIO v. Rahul Modi ([2022] 135 taxmann.com 98), the Supreme Court interpreted Section 167(2) of the CrPC, holding that the right to default bail accrues only where the chargesheet is not filed within the statutory period. The Court clarified that the filing of a chargesheet within time, even if cognizance is delayed, defeats the claim of default bail, thereby harmonising procedural law with the objective of effective investigation into economic offences.

On the issue of related party transactions, the Court in SEBI v. R.T. Agro (P.) Ltd. ([2022] 137 taxmann.com 496) rejected a hyper-technical interpretation advanced by SEBI, holding that related parties are barred from voting only at the time of approving such transactions but are permitted to vote in resolutions rescinding or cancelling them. This judgment ensures a purposive reading of Section 188 of the Companies Act, 2013.

Another important clarification came in Nirendra Nath Kar v. Gopal Navin Bhai Dave ([2022] 142 taxmann.com 563), where the Supreme Court ruled that a person whose directorship is disputed does not have locus standi to seek restoration of a company under Section 560 of the Companies Act, 1956 (analogous to Section 252 under the 2013 Act). The Court stressed that only the company, its members, or creditors can seek such restoration.

On the criminal liability of directors, the decision in Pawan Kumar Goel v. State of U.P. ([2022] 145 taxmann.com 57) reaffirmed that for offences under Section 138 of the Negotiable Instruments Act, the company itself must be arraigned as an accused before its directors can be prosecuted vicariously under Section 141. Mere designation as a director is insufficient unless it is pleaded that the director was in charge of and responsible for the conduct of business at the relevant time.

In the context of financial frauds, the Madras High Court in Ravi Parthasarathy v. DSP, EOW-II ([2021] 133 taxmann.com 325) held that privately placed debentures (NCDs) issued to a limited group of investors cannot be treated as “deposits” under the TNPID Act, 1997. Accordingly, companies resorting to private placement are not “financial establishments” within the meaning of the Act. The Court also restrained parallel investigations, given that the Serious Fraud Investigation Office (SFIO) was already seized of the matter.

Lastly, in SEBI v. National Stock Exchange Members Association ([2022] 143 taxmann.com 192), the Supreme Court emphasised that a stockbroker must obtain a separate certificate of registration from SEBI for each stock exchange where it intends to operate, and must pay ad valorem fees accordingly. This ruling underscores the principle of exchange-wise regulation and oversight of intermediaries under the SEBI framework.

Conclusion

These judicial pronouncements reflect a clear trend towards strict scrutiny of corporate misconduct, while also ensuring that regulatory interpretations remain purposive rather than hyper-technical. The Supreme Court has consistently upheld principles of fair trial, procedural safeguards, and corporate accountability, striking a balance between protecting investors and avoiding over-criminalisation of business decisions. Emerging jurisprudence signals a pro-investor and pro-governance approach while also reinforcing that corporate fraud and insider abuse will not be tolerated. Collectively, these cases strengthen the corporate legal regime and provide much-needed clarity to regulators, corporates, and legal practitioners alike.

Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc