View News

REVISED MSME DEFINITION (FROM 1 APRIL 2025) AND COMPLIANCES

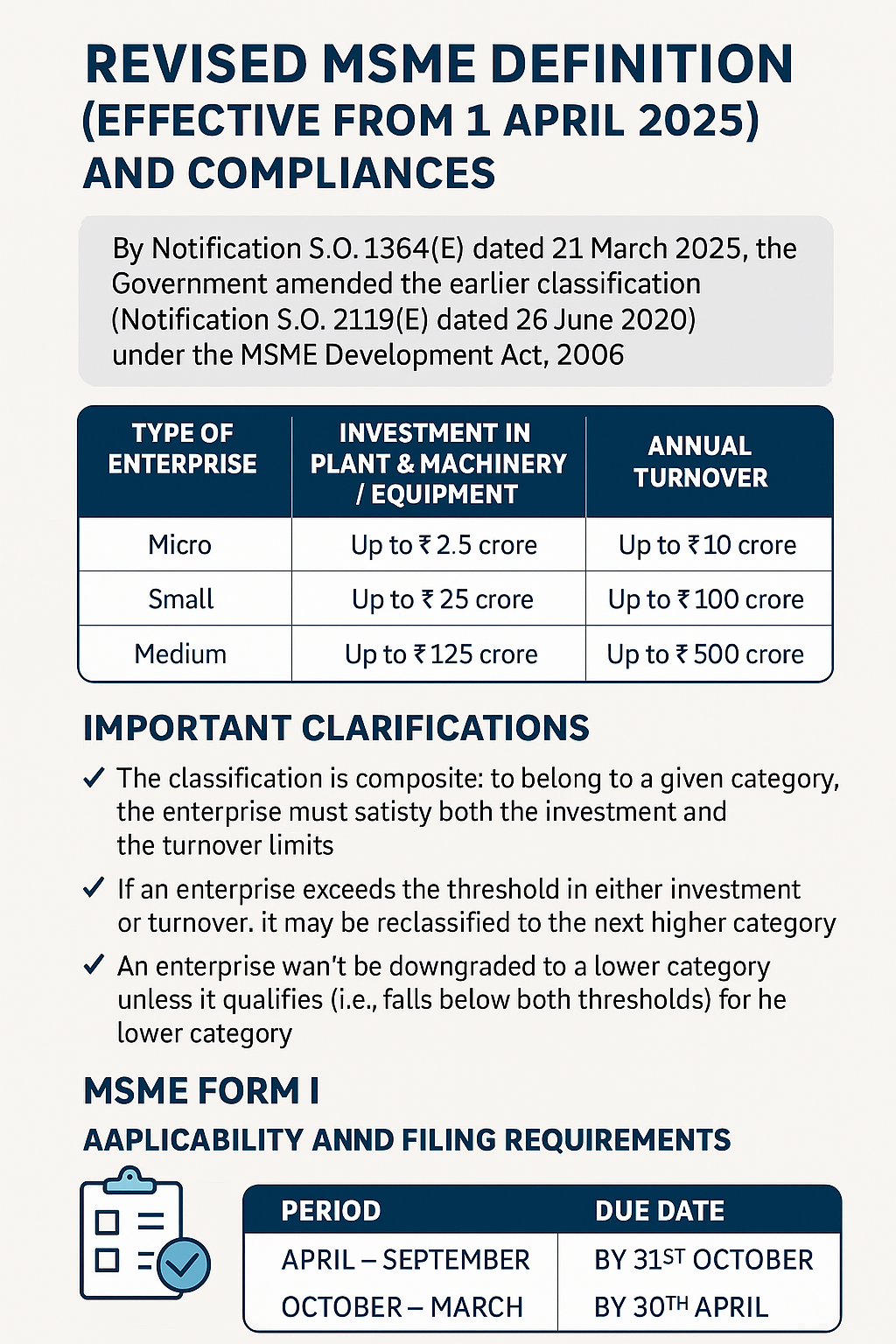

REVISED MSME DEFINITION (EFFECTIVE FROM 1 APRIL 2025) AND COMPLIANCES

1. Background

By Notification S.O. 1364(E) dated 21 March 2025, the Government of India has amended the earlier classification of Micro, Small, and Medium Enterprises as prescribed under Notification S.O. 2119(E) dated 26 June 2020, issued under the provisions of the Micro, Small and Medium Enterprises Development Act, 2006 (“MSMED Act”).

The revised classification comes into effect from 1 April 2025.

2. Revised MSME Classification

| Type of Enterprise | Investment in Plant & Machinery / Equipment | Annual Turnover |

|---|---|---|

| Micro Enterprise | Up to Rs 2.5 crore | Up to Rs 10 crore |

| Small Enterprise | Up to Rs 25 crore | Up to Rs 100 crore |

| Medium Enterprise | Up to Rs 125 crore | Up to Rs 500 crore |

3. Important Clarifications

-

The classification is composite — to be categorized under a particular class, an enterprise must satisfy bothinvestment and turnover limits.

-

If an enterprise exceeds either of the prescribed limits, it will be reclassified to the next higher category.

-

An enterprise will not be downgraded to a lower category unless it falls below both thresholds applicable for that lower category.

-

The earlier thresholds notified in June 2020 are superseded effective 1 April 2025.

4. MSME FORM I — OVERVIEW

MSME Form I is a mandatory half-yearly return to be filed by specified companies with the Ministry of Corporate Affairs (MCA), providing information on outstanding payments due to MSME suppliers beyond 45 days.

-

Statutory Reference: Section 405 of the Companies Act, 2013

-

Relevant Notification: MCA Order dated 22 January 2019

5. Applicability of MSME Form I

A company (public or private) is required to file MSME Form I if it meets both of the following conditions:

| Condition | Explanation |

|---|---|

| 1. Transactions with MSMEs | The company has procured goods or services from suppliers registered as MSMEs under the MSMED Act, 2006. |

| 2. Delay in Payment | Payments to such MSME suppliers remain unpaid for more than 45 days from the date of acceptance or deemed acceptance of goods/services. |

Note:

The form must be filed even if the delay is due to genuine disputes or administrative reasons.

6. How to Identify an MSME Vendor

To ascertain whether a supplier qualifies as an MSME, the company should obtain a copy of the supplier’s Udyam Registration Certificate or a written declaration confirming registration under the MSMED Act, 2006.

7. Filing Timeline for MSME Form I

The return is to be filed half-yearly, as per the following schedule:

| Reporting Period | Due Date for Filing |

|---|---|

| April – September | 31st October |

| October – March | 30th April |

For the current period (April – September 2025), the due date for filing MSME Form I is 31 October 2025.

8. Information to be Furnished in MSME Form I

The following particulars are required:

| Details Required |

|---|

| Name of MSME Supplier(s) |

| PAN of Supplier |

| Total Amount Due |

| Date from which the Amount is Due |

| Reasons for Delay in Payment |

9. Clarification — Applicability Threshold (45 Days)

Question: Should MSME Form I be filed if outstanding payments are less than 45 days?

Answer: No.

The form is applicable only where payment to MSME suppliers exceeds 45 days from the date of acceptance or deemed acceptance, in line with Section 9 of the MSMED Act, 2006.

However, the latest e-form format includes four data categories for better transparency:

| Category | Description |

|---|---|

| (a) | Payments made within 45 days |

| (b) | Payments made after 45 days |

| (c) | Amounts outstanding for 45 days or less |

| (d) | Amounts outstanding for more than 45 days |

Only companies falling within the applicability (i.e., with payments exceeding 45 days) are required to submit MSME Form I to MCA, duly reporting the respective details.

10. Legal Reference Summary

| Particulars | Reference |

|---|---|

| Governing Law | Micro, Small and Medium Enterprises Development Act, 2006 |

| Relevant Section (Companies Act) | Section 405 |

| MCA Notification | Order dated 22 January 2019 |

| Latest MSME Amendment | Notification S.O. 1364(E) dated 21 March 2025 |

| Effective Date | 1 April 2025 |

11. Disclaimer

Disclaimer:

The information contained herein is compiled based on the current legal framework, notifications, and circulars as available at the time of publication. While due care has been taken to ensure accuracy, the author assumes no responsibility for errors or omissions. Readers are advised to refer to the official notifications and seek professional advice before acting upon this information.This document is intended for educational and informational purposes only and should not be construed as legal advice.

From the desk of CS SHARATH