View News

SME IPOs Regain Momentum After a Three-Month Lull

SME IPOs Regain Momentum After a Three-Month Lull

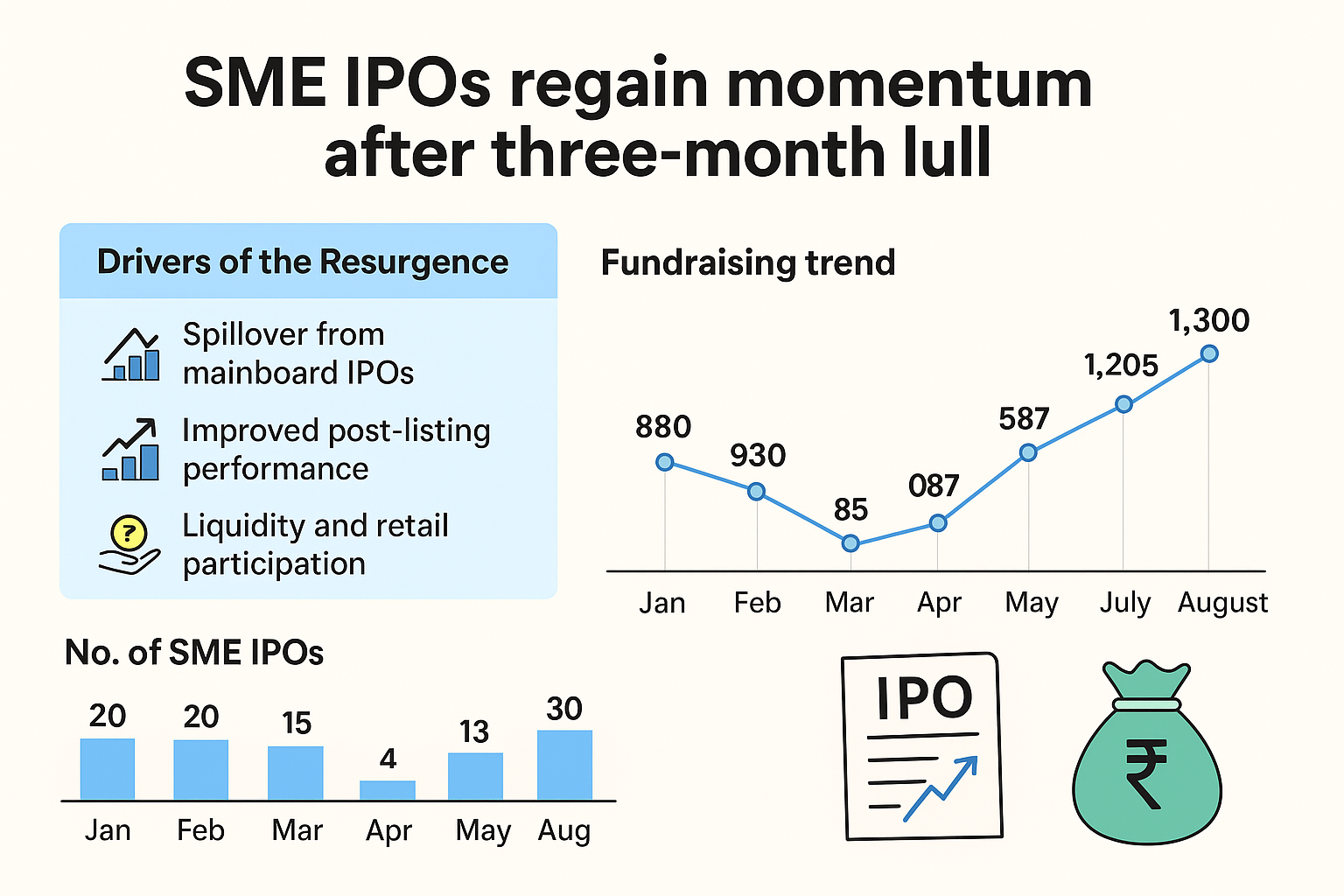

After witnessing subdued activity between March and May 2025, India’s market for Small and Medium Enterprises (SMEs) Initial Public Offerings (IPOs) has rebounded strongly. Since June, 68 SME IPOs have collectively mobilised over Rs. 3,133 crore, signaling renewed investor interest and market optimism.

1. The Rebound Story

-

Muted Phase (March–May 2025): During this period, SME IPO activity was relatively sluggish with limited fundraising. In May, for example, only ?587 crore was raised.

-

Revival (June–August 2025): A sharp uptick was recorded from June onwards, with SME IPO fundraising crossing ?1,300 crore in June and ?1,205 crore in July. Even by mid-August, 14 SME IPOs had already mobilised ?626 crore.

Comparative Snapshot:

| Month | No. of SME IPOs | Amount Raised (? crore) |

|---|---|---|

| January | 20 | 880 |

| February | 20 | 930 |

| March | 15 | 560 |

| April | 4 | 85 |

| May | 13 | 587 |

| June | 30 | 1,300 |

| July | 30 | 1,205 |

| August* | 14 | 626 |

(*Data as of 13th August 2025)

This surge surpasses the combined tally of the preceding five months, indicating a robust turnaround.

2. Drivers of the Resurgence

(i) Spillover from Mainboard IPOs

-

The momentum in mainboard IPOs (?33,813 crore raised in June–July) has had a positive knock-on effect on SME IPOs.

-

Buoyant secondary markets have encouraged investors to explore opportunities in the SME segment.

(ii) Improved Post-Listing Performance

-

Strong performance of SME stocks post-listing has bolstered confidence.

-

Even marginal gains relative to mainboard IPOs have created wealth-generation opportunities.

(iii) Liquidity and Retail Participation

-

High market liquidity has supported SME IPO subscriptions.

-

However, SEBI and NSE’s revised norms have limited participation of very small retail investors pooling less than Rs 1 lakh, focusing instead on more serious and affluent investor classes.

3. Regulatory Tightening

To ensure quality listings, regulators have tightened eligibility norms for SMEs migrating to the mainboard:

-

Companies must now show operating profit in at least two of the last three years.

-

Revenues must exceed ?100 crore in the latest year.

-

Promoters must maintain at least 20% holdings at the time of application.

Additionally, in April 2025, NSE doubled the minimum application size for SME IPOs from Rs 1 lakh to ?2 lakh, filtering out smaller retail participants.

4. Expert Views

-

Pranav Haldea, Managing Director, Prime Database highlighted that whenever mainboard IPO activity rises, the SME segment follows, fueled by secondary market buoyancy and investor appetite for new issuances.

-

Ambareesh Baliga, Independent Analyst pointed out that strong post-listing performance continues to attract investors despite regulatory tightening.

-

He also noted that promoters need to strengthen communication with stakeholders by making analyst presentations and information easily accessible to shareholders and prospective investors.

5. Key Challenges

While the SME IPO market has revived, certain challenges remain:

-

Reduced retail inclusion: By raising the minimum application threshold, smaller investors have been squeezed out.

-

Higher compliance burden: Stricter eligibility norms may deter smaller SMEs from considering public listing.

-

Disclosure requirements: Experts stress the need for stronger and more transparent disclosures in SME prospectuses.

6. Outlook

The resurgence of SME IPOs reflects:

-

Growing investor confidence in India’s equity markets.

-

A maturing SME ecosystem that is transitioning towards greater transparency and institutional participation.

-

A stronger alignment with mainboard IPO dynamics, ensuring that SME capital raising is no longer seen as isolated but part of a broader market trend.

With regulatory checks in place and robust investor appetite, SME IPOs are poised to remain a vital instrument for growth financing of emerging enterprises in India.

Conclusion:

The rebound in SME IPOs after a three-month lull signals resilience in India’s capital markets. With stronger governance, improved investor confidence, and regulatory fine-tuning, the SME IPO market is set for a more sustainable growth trajectory, enabling smaller companies to access public funds while safeguarding investor interests.

"Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc