View News

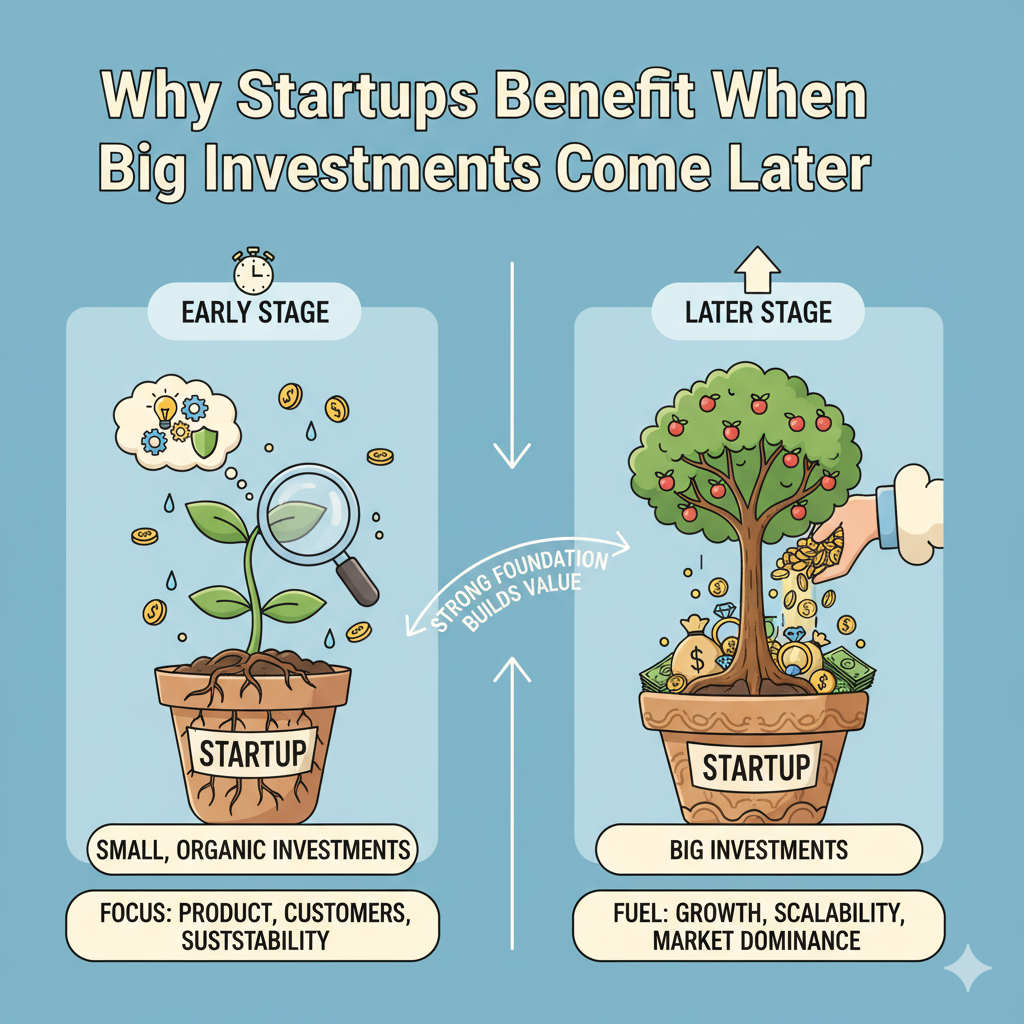

Why Startups Benefit When Big Investments Come Later

Why Startups Benefit When Big Investments Come Later

By: Somil Gupta, BBA, MBA (Finance)

Bharati Vidyapeeth Deemed University

1. Introduction

In India’s fast-evolving entrepreneurial landscape, the timing of capital infusion can determine the long-term success and sustainability of a startup. Many founders aspire to secure substantial funding at the earliest opportunity, assuming that it accelerates growth and validates the business model. However, from a financial, legal, and strategic perspective, startups often benefit when big investments come later—after the business model stabilizes, compliance systems mature, and the company achieves better valuation metrics.

Delayed large-scale investment enables startups to retain ownership, strengthen governance, and negotiate from a position of strength, all while ensuring legal compliance and operational discipline.

2. The Early-Stage Funding Reality

At inception, most startups depend on bootstrapping, family funds, or angel investment. These limited funds are crucial for developing a Minimum Viable Product (MVP), testing the business concept, and building an initial customer base.

During this stage:

-

Uncertainty is high — cash flows are unpredictable, and market fit is still being tested.

-

Valuation is low — leading to significant equity dilution if large funds are raised prematurely.

-

Compliance systems are underdeveloped — making due diligence challenging for future investors.

Thus, postponing major funding until the startup reaches a stable revenue or proof-of-concept stage can protect founders from excessive dilution and compliance challenges.

3. The Valuation Advantage of Patience

Valuation, as derived from models such as Discounted Cash Flow (DCF) and Comparable Company Analysis (CCA), improves as a business achieves milestones and demonstrates revenue traction.

Illustration:

If a startup valued at ?5 crore raises ?1 crore at an early stage, founders dilute 20% equity.

However, if the same startup achieves growth and is later valued at ?25 crore, raising ?1 crore will lead to just 4% dilution.

Lesson: Delaying big investments until the company’s valuation grows ensures higher capital efficiency and lower equity dilution.

4. Legal and Regulatory Preparedness

Before accepting substantial funding, especially from institutional or foreign investors, startups must comply with several statutory and regulatory provisions:

A. Companies Act, 2013

-

Proper maintenance of statutory registers, Board/Shareholder approvals, and filing of PAS-3, MGT-14, and SH-7 forms.

-

Adherence to provisions relating to private placement (Section 42) and share allotment (Section 62).

B. FEMA (Non-Debt Instruments) Rules, 2019

-

In case of Foreign Direct Investment (FDI), valuation must be certified by a Category-I Merchant Banker or Chartered Accountant.

-

Reporting requirements under Form FC-GPR to RBI must be completed within 30 days of allotment.

C. Income Tax Act, 1961

-

Section 56(2)(viib) requires share premiums to be justified by fair market value to avoid angel tax implications.

D. SEBI (ICDR) Regulations, 2018

-

For listed startups or those planning a listing, preferential issues or rights issues must adhere to SEBI guidelines on pricing, disclosure, and lock-in.

By delaying large funding rounds, startups get time to institutionalize governance frameworks and ensure full compliance—reducing legal risks during investor due diligence.

5. Strategic and Financial Control

Prematurely onboarding large investors often results in loss of control through:

-

Investor board representation,

-

Protective covenants, or

-

Veto rights in the Shareholders’ Agreement (SHA).

When startups defer such rounds, they can build a stronger financial track record and negotiating power. This enables founders to secure:

-

Favorable valuation terms,

-

Balanced rights and obligations under the SHA, and

-

Long-term strategic alignment with investors.

In essence, delayed investment empowers startups to negotiate from strength rather than need.

6. Strengthening the Compliance & Audit Framework

Big investments trigger comprehensive legal and financial due diligence. Founders must ensure readiness under:

-

Statutory Audit (Section 143, Companies Act, 2013)

-

Secretarial Audit (Section 204, Companies Act, 2013)

-

GST and Income Tax Audits (based on turnover thresholds)

Startups that institutionalize internal control systems, accounting standards, and documentation before large investments demonstrate maturity and credibility—crucial for attracting sophisticated investors.

7. Investor Confidence and Market Signaling

Investors perceive startups that delay big funding rounds as financially disciplined and strategically patient. Such behavior signals:

-

A validated business model,

-

Efficient capital management, and

-

Strong governance principles.

Consequently, when large investments are finally raised, they come with higher valuations, better investor confidence, and stronger exit prospects—benefiting both founders and investors alike.

8. Conclusion

In the startup lifecycle, timing of investment is as critical as its amount. Raising large funds too early can dilute ownership, compromise control, and expose compliance gaps. Conversely, delaying major investments until operational, financial, and legal maturity ensures:

-

Higher founder equity retention,

-

Enhanced corporate governance,

-

Increased valuation, and

-

Long-term strategic sustainability.

In the contemporary Indian context—governed by the Companies Act, 2013, SEBI Regulations, and FEMA Rules—the principle is clear:

Startups grow faster when they grow smarter, and smarter growth often means waiting for the right time to raise big money.

Author: (LegalMantra.net Team)

Somil Gupta, BBA, MBA (Finance)

Bharati Vidyapeeth Deemed University

Unlock the Potential of Legal Expertise with LegalMantra.net - Your Trusted Legal Consultancy Partner”

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including Newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, Research Papers etc